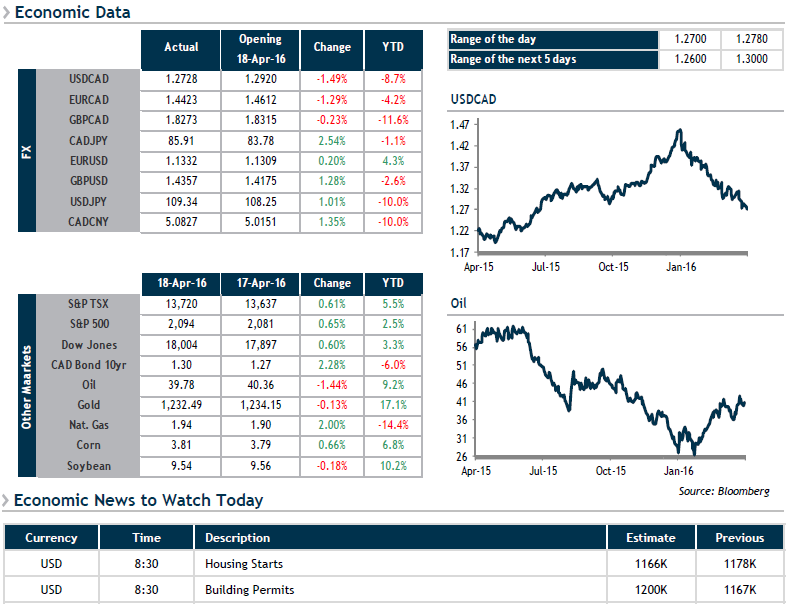

Back to square one if you look at the closing levels for crude oil (WTI) and the USD/CAD pair, you could think that the Doha conference never took place: A rise in the currency of 200 points, followed by a drop of another 200 points and a $2 decline followed by a virtually identical gain for oil.

The Doha summit nevertheless ended with a genuine breakdown in negotiations. The idea has been put forward that this failure was offset by the strike in Kuwait, which has deprived the country of 60% of its petroleum output. Logic is sometimes nowhere to be found on markets. What’s your take?

Are we on the verge of a correction toward 1.3400 or will the USD/CAD pair keep falling toward 1.2500 considering these few (non-exhaustive) elements?

-The USD/CAD pair has returned to October 2015 levels when oil was trading above $45

-Monetary policy is neutral in Canada and slightly expansionary south of the border

-There has been a slight uptick in Canadian economic indicators and a slight dip in indicators south of the border

-The strike in Kuwait should be temporary

Feel free to share your thoughts with your contacts at National Bank (trader, MIT, AM, etc.) while remaining cautious regarding these highly volatile markets and paying careful attention to safeguarding your bottom line.