Investing.com’s stocks of the week

One, two, three or four rate hikes?

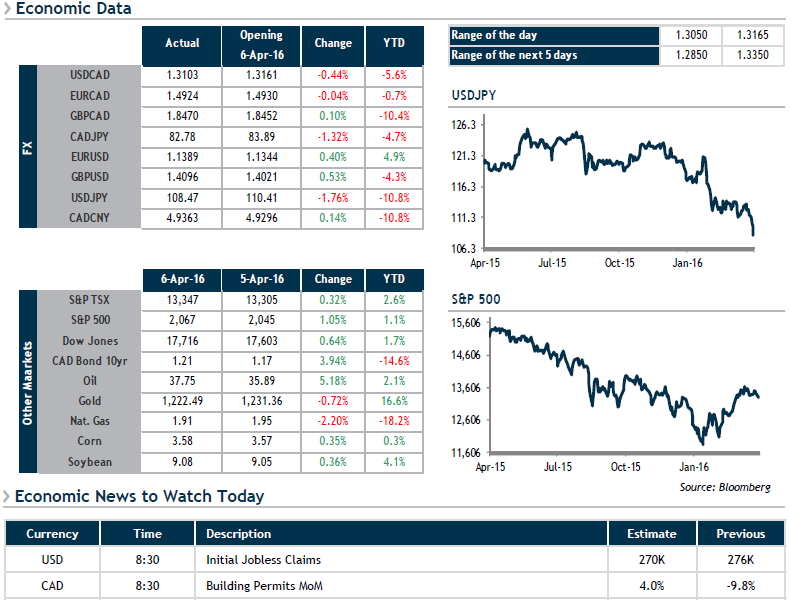

The minutes of March’s FOMC meeting were released yesterday, revealing that a divide exists within the committee. In concrete terms, Fed members always attempt to assess two factors before announcing new monetary tightening: the strength of the domestic economy and the risk of an international slowdown. In light of these minutes, the scenario of an April rate hike appears to be off the table, although our economists are stressing that the Fed could still announce increases in June and December. We’ll have to keep an eye on the greenback, which could remain volatile as this debate continues.

This morning’s big winner is the yen, so much so that Japanese authorities thought it wise to reiterate that they are prepared to take action should the country’s currency become too strong. Considering the yen’s status as a “safe haven” currency, this is further proof that many observers have doubts about the global economic outlook. Could this be yet another argument justifying the caution from the Fed?