Investing.com’s stocks of the week

Exports fall flat

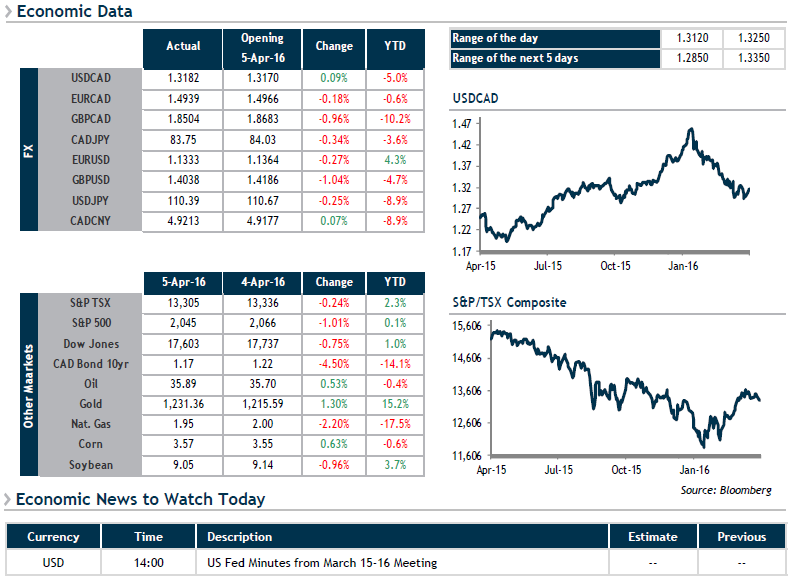

In a rare development, the Canadian dollar ended the day in the red while crude oil gained ground, likely due to the release of Canadian Trade Balance figures that came in substantially more negative than expected. In concrete terms, this means that our exports are lagging compared to our imports, which is troubling given the weakness of the loonie. At least not everything is bleak, as the same data south of the border showed that the U.S. continues to import, confirming that domestic demand remains solid.

In other news, Bank of Canada Senior Deputy Governor Carolyn Wilkins gave a speech stressing the risks of an economic slowdown in China, our second largest trading partner. Despite troubling signs, she also stated that the BoC believes that the impact on the Canadian economy should be relatively limited. In short, a speech that does not necessarily hint at a possible easing of Canadian monetary conditions in the short term.

Today, we’ll be keeping an eye on the minutes of the Fed’s last FOMC meeting.