Investing.com’s stocks of the week

Risk-taking favoured

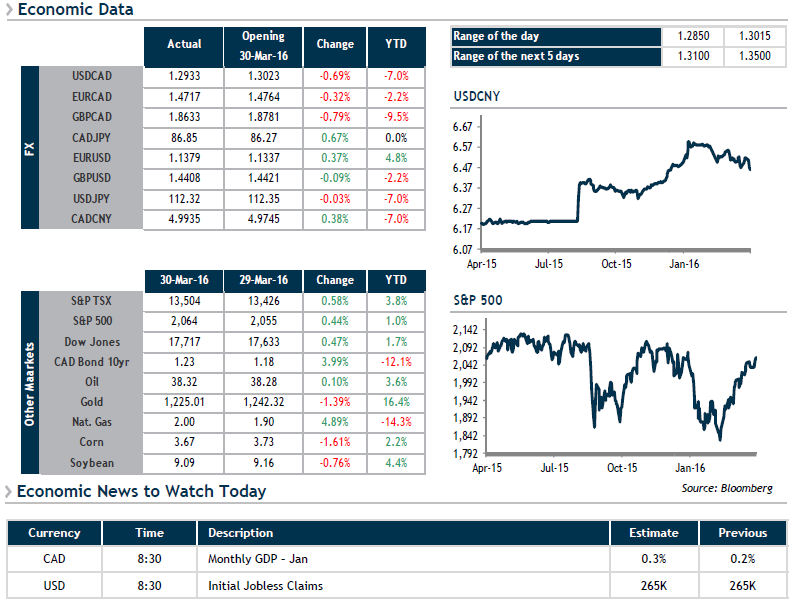

The greenback is once again under pressure against its peers this morning, with the euro reaching a 5-month high and the CAD racking up gains of more than 12% since bottoming out in January.

Although the loonie’s performance is often associated with investors’ appetite for risk, its recent decoupling from crude price movements says a lot about the state of affairs on markets at present. As proof, despite stable U.S. crude oil inventories and rising OPEC production (32.52 million barrels/day in March vs. 32.44 in February) bringing oil prices down, the loonie is holding strong. We’ll have to see whether Canadian GDP data for January moves the needle when it is released at 8:30 this morning.

Meanwhile, China’s credit rating outlook has been downgraded by S&P from stable to negative. The yuan nevertheless reached its highest level since December. In short, the current context leads us to wonder whether the forecast for fewer rate hikes from the Federal Reserve is really that worrying compared with the rest of the world.