Investing.com’s stocks of the week

You have to wonder whether Fed members deliberately try to confuse markets. In contrast to other Fed officials, Chair Janet Yellen threw cold water on anticipations of new tightening in U.S. monetary policy. In her opinion, the Fed should proceed cautiously, even pointing out that if need be, she has substantial leeway to stimulate the nation’s economy. Market observers quickly took note, downgrading the likelihood of a key rate increase at the next Fed meetings between 3% and 4%. At this point, an April rate hike is for all intents and purposes off the table.

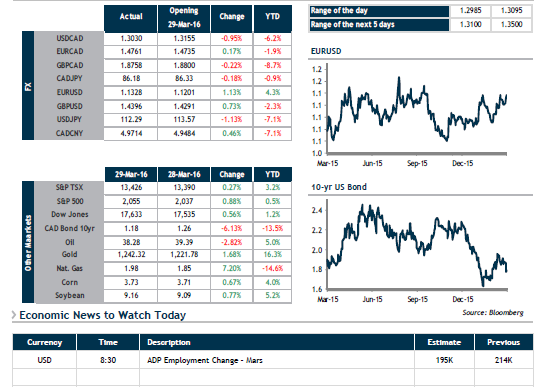

In the wake of Ms. Yellen’s speech, the greenback took a beating against all of its peers, as did U.S. bond yields. In contrast, gold is rising along with stock markets, which were bolstered by the idea that a low-interestrate environment will continue.

It remains to be seen how long it will take officials from troubled economies to complain about an overly strong currency if the USD continues to slide. Japan and Europe come quickly to mind as possibilities as well as potentially Canada, as the country has committed to giving its exporters a friendlier environment.