As Easter Weekend continues for many, reaction to Friday’s announcement of better-than-expected U.S. growth in the final quarter of 2015 has been limited. The annualized reading of 1.4% compared to the expected 1.0% combined with a Consumer Spending reading up 2.4% (vs. 2.0%) on the same basis has nevertheless helped to fuel the debate over a potential interest rate hike by the Federal Reserve.

Cleverly, Fed Chair Janet Yellen was quick to remind markets that a key rate increase in April could not be ruled out. However, markets generally believe this scenario is unlikely, and are pricing it at only 6%. In contrast, a rate hike at the June Fed meeting is priced at a likelihood of 38%, a figure that could rise if economic data prove to justify an increase. On Friday, we’ll get a look at U.S. job data for March.

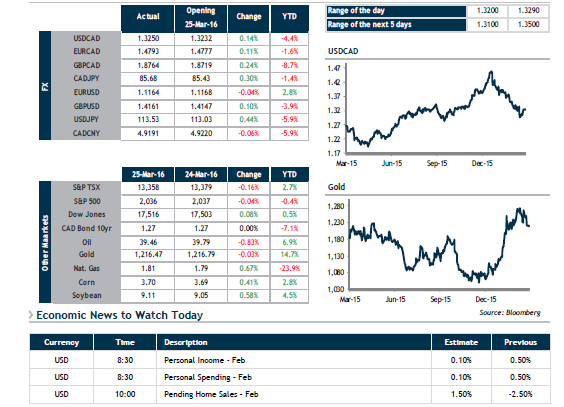

In the meantime, at 8:30 this morning a few U.S. indicators are on the menu, such as Personal Income and Personal Consumption Expenditures as well as Pending Home Sales. It’s a safe bet that many will be tracking these developments from the comfort of their home.