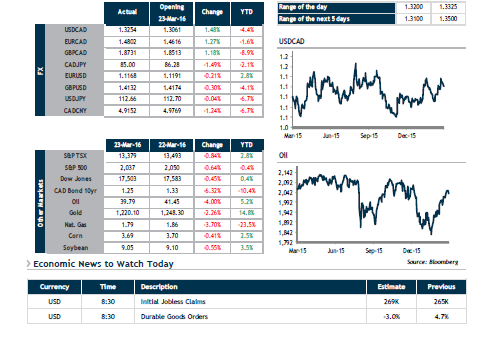

After rebounding 58% since February 11, crude oil had a rough ride yesterday, when stockpile levels came in above analysts’ expectations. U.S. crude oil inventories reached a record high, up 9.4 million barrels over last week and 60% above the average for the past 30 years. Not surprisingly, the loonie has been hard-hit, shedding 300 bps since last weekend.

Meanwhile, the greenback is being bolstered by upbeat commentary from Fed officials, who have hinted at the possibility of tighter monetary policy. The futures market is pricing the likelihood of at least one rate hike at 6% for April and 38% for the June meeting.

Today, we’ll be keeping an eye on Initial Jobless Claims and Durable Goods Orders south of the border. Crude oil, stocks and the loonie are all down this morning. Please note that our trading desk will be closed tomorrow but open on Easter Monday. Have a great day!