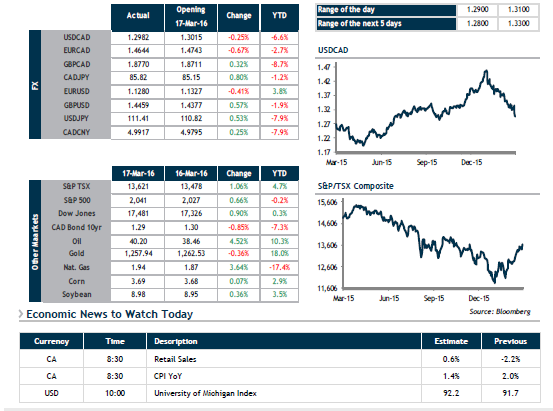

Stocks stayed in the green and the U.S. dollar lost ground yesterday in the wake of the Fed’s announcement on Wednesday that it would ease off its rate hike plans. The S&P briefly moved into positive territory and crude oil climbed above the critical $40 level. The U.S. Dollar Index (DXY), which measures the greenback against six major currencies, dropped to levels not seen since last October.

Meanwhile, the loonie has taken full advantage of the general weakness of the U.S. dollar, trading around 1.3000. We nevertheless see solid support at 1.2850 and believe this is a good time to buy for USD purchasers.

Today, we’ll be keeping an eye on Canadian economic indicators. Retail Sales for January should show an improvement over the substantial setback in December. Despite declining fuel prices, inflation could prove resilient for February due to the slumping loonie and the increasing cost of imported goods. A reading in line with the Bank of Canada’s 2% target could provide further support to the CAD. Have a great day.