Investing.com’s stocks of the week

The Fed put aside inflationary risks and instead focused on financial concerns and sluggish global growth to justify its decision not to raise rates and to reduce expectations regarding rate hikes in 2016. The central bank fears that roiling global markets are harming the U.S. economy and GDP and inflation forecasts for 2016 were therefore scaled back slightly.

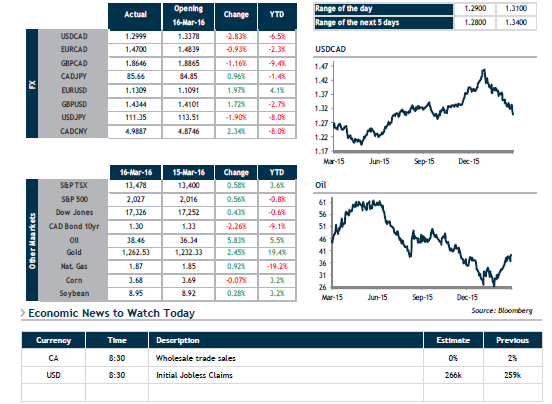

In short, the Fed’s expectations are now much more in line with those of the market, meaning one or two rate increases in 2016. This means the door is now open to a weaker greenback and more inflation. It is also important to keep in mind the expansionary monetary policies in the eurozone and Asia to see how we end up with the perfect recipe for a rally in commodities and emerging nations. Crude oil, for example, has gained 10% since Tuesday! Given this context, the loonie has a legitimate shot at nearing 0.78.

Today in Canada, we’ll be taking a look at Wholesale Sales, which had to partially wipe out the major gains of the two previous months. Retail Sales will be out tomorrow. Have a great day!