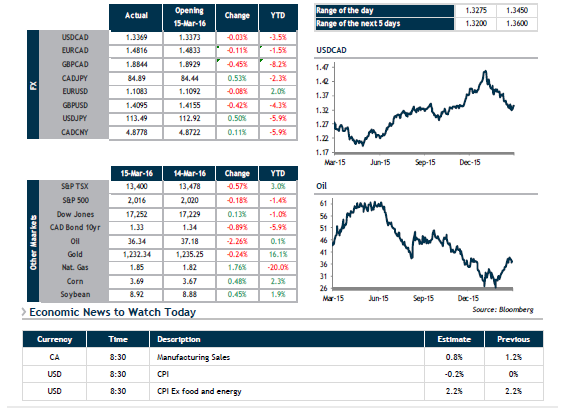

The loonie started to show hints of weakness Tuesday as crude oil nosedived for the second straight day. Our dollar slipped back below 75 cents and the trend could continue if the Fed shows signs of tightening interest rates later today.

U.S. consumers, who drive the economy, curbed their spending in February, as seen in the 0.1% dip in Retail Sales announced yesterday. Inflation data south of the border will be posted today and no doubt will show a setback due to declining energy prices. The Consumer Price Index excluding energy should reach an annualized 2.2%, slightly above the Fed’s 2% target.

This week’s main market event, the Fed’s meeting today, will no doubt be free of surprises. We believe the Fed will opt for caution and hold off on a rate hike until June, given the uncertain global economic context. The Fed will present revised forecasts, which should point to more ambitious rate increases than the single one markets anticipate as job creation remains robust and financial conditions have stabilized recently. Have a great day!