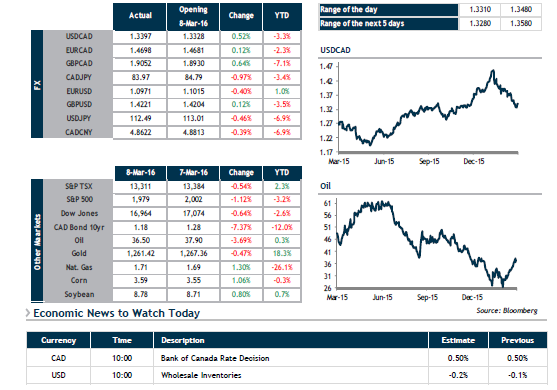

The USD/CAD pair rebounded along with dropping oil prices yesterday. This timid rebound has been in place since the 200-day moving average (1.3280) was tested on Monday. This same 200-day moving average was tested many times on the EUR/USD pair in March (at 1.1050). These two currency pairs also both have related announcements being made by central banks this week: the Bank of Canada will release its statement at 10 this morning and the European Central Bank will announce its monetary policy decision at 7:45 a.m. on Thursday.

For the USD/CAD pair, moving below 1.3280 would mark a significant change in sentiment that could be confirmed by employment data on Friday. Low levels would then be 1.3150, 1.3080 and even 1.2825. Otherwise, optimistic exporters will see the rebound continue up to 1.3810, then 1.4085. The situation is the same for the EUR/USD pair. Even if ECB President Mario Draghi wows pundits with his economic stimulus measures, the EUR/USD could plummet toward 1.0900, then 1.0810 while disappointing news (a meeting similar to the one on December 3) would send the pair toward 1.1080, then 1.1110.