Two weeks of central bank news!

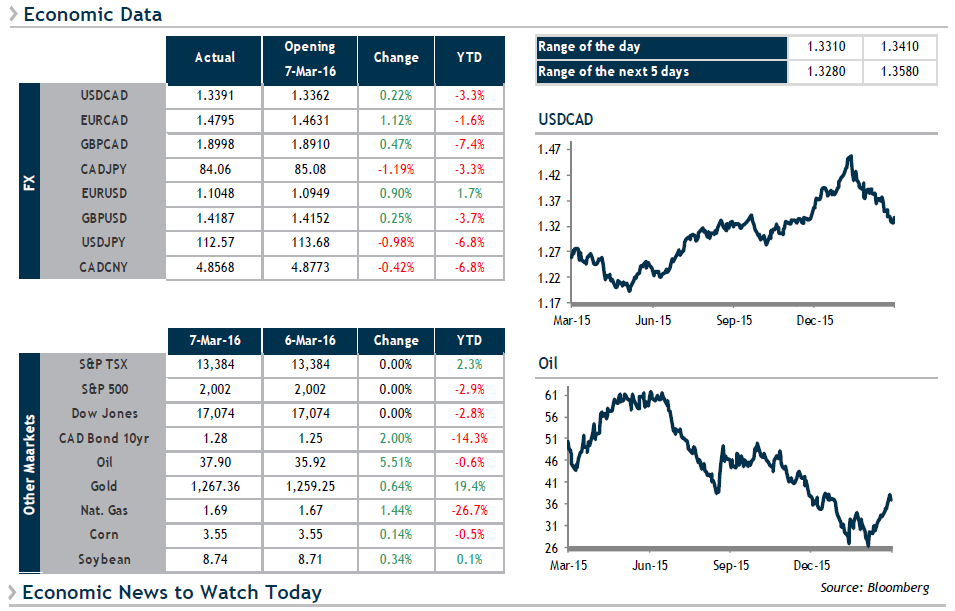

Oil prices continued to climb on Monday. WTI crude oil reached $38 a barrel, mainly due to three factors:

• The production freeze (not reduction) proposed in February by several countries including Saudi Arabia and Russia seems to have been accepted by other oil-producing countries

• The confirmation of the decrease in U.S. production

• A potential meeting of a few OPEC members in late March (possibly on March 20)

The rebound of the USD/CAD pair at the beginning of the day was quickly squashed (a temporary setback?). Two central banks are making monetary policy announcements this week.

• The Bank of Canada will start things off on March 9 at 10 a.m. We may see a change in tone further to the radical rise of the CAD or a neutral position while waiting for fiscal measures on March 22.

• The European Central Bank is expected to react to deteriorating economic figures (no inflation) on March 10 at 7:45 a.m. by dropping its rate and implementing additional quantitative easing measures, the combination of which would have negative impacts on the euro.

We will be keeping a close eye on Canadian employment figures on Friday. Any disappointing news could result in massive selling of the CAD.

Next week, we can expect news from the Federal Reserve, the Bank of Japan and the Bank of England.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.