A Canadian dollar at 75c

• 242,000 jobs created in February (190,000 expected)

• Unemployment rate at 4.9%

• Labor force participation rate (often used to criticize an unhealthy job market) at a 2-year high of 62.9%

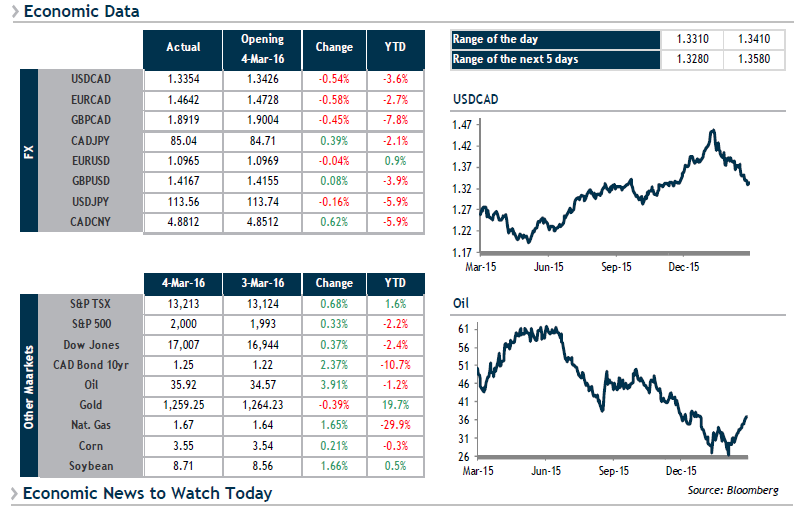

Who would have thought that with the release of these U.S. data, there would have been a widespread move to sell the USD. And yet that is what happened on Friday because of focus on one detail in the report: wages had not increased as expected and hopes of seeing inflation climb back up were shattered. If you add oil at 35$, you get a Canadian dollar at 75 cents.

The Federal Reserve’s dilemma now is whether to increase its key rate once again this year because things are heating up on the job market or leave it unchanged because inflation is low: we may get some answers further to the March 16 meeting.

Back at home, we can expect the Bank of Canada’s reaction to the USD/CAD pair that went from 1.4700 to 1.3300 in less than 2 months on March 9.

In the meantime, we believe that the move was too quick and pessimism about wages (which were still up by 2.2% annually) was exaggerated. Corrections are possible around 1.3500 this week.