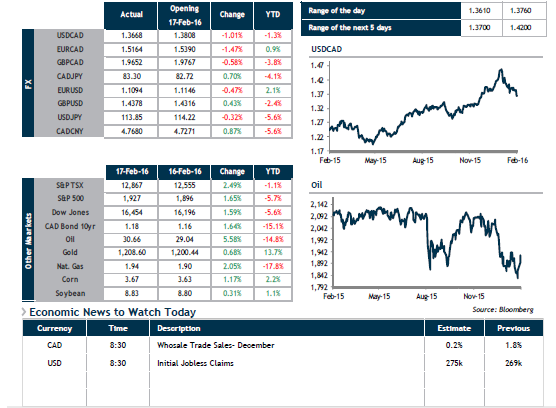

Hardly a day goes by of late without mention of oil prices and this morning is no exception. The gains posted in the various asset classes since crude prices rebounded seem to indicate that we are far from the 70s pipe dream of becoming independent from oil. The price per barrel rose by more than 5% spurred by Iran’s support for a production freeze, although the country itself would not commit to freezing output, which boosted yields, a few of the major currencies (including the loonie) and markets. The strong performance of the financial sector also bears mentioning. As for Saudi Arabia, Standard & Poor’s seems to be believe that the fallout from tumbling oil prices will have lasting consequences, cutting the country’s credit rating by two notches, from A+ to A-.

The publication of the minutes of the last Fed meeting yesterday seem to reveal a division within its ranks with regard to economic outlook. Though all members appear to agree on the fact that recent market turbulence is a matter of concern, long-term consequences are not as clear. Regardless, the market seems to be maintaining its vision that the Fed will opt for the status quo this year.