Investing.com’s stocks of the week

Calm before the storm?

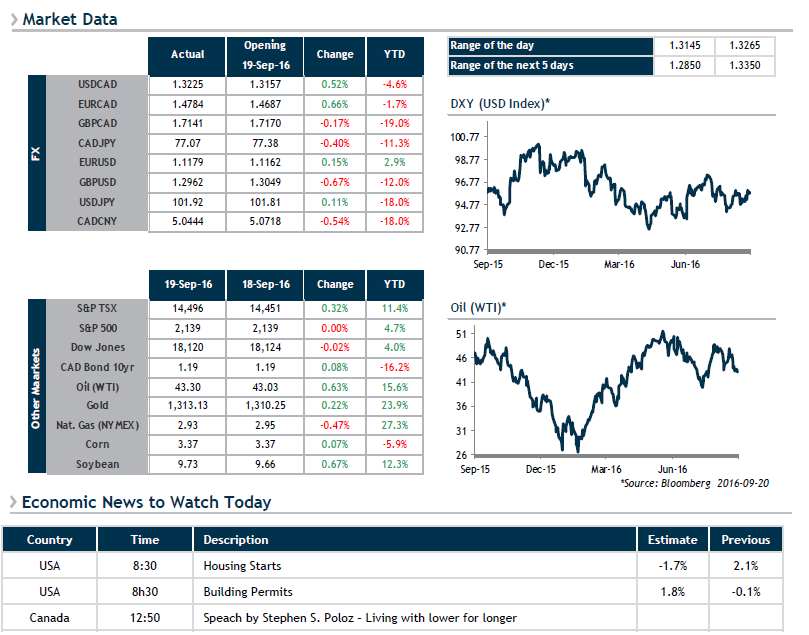

There is little to report this morning with a relative lull prevailing on markets as we await the U.S. Federal Reserve’s key rate decision tomorrow. The only noteworthy story is the price of oil (WTI), which has resumed its slide further to renewed output in Libya, which will add some 3,500 barrels a day to the current supply. However, despite a loonie at similar levels to yesterday, the price at the pump this morning reflects an entirely different reality.

The minutes of the most recent Reserve Bank of Australia meeting released earlier appear to herald the end of easing in that country’s monetary policy, stating that the economy is showing some growth despite reduced private sector investments. It should be noted that for some time now, Australia has been attempting an economic shift to reduce its dependence on the mining sector.

In the meantime, we will have an opportunity to take the pulse of the U.S. real estate sector at 8:30 this morning, when monthly Building Permits and Housing Starts data are released.