Market Commentary

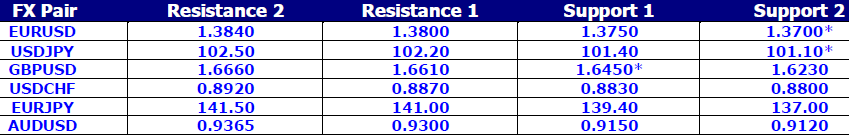

The Dollar Index (DX) is trading flat at 80.20 ranges after finding support at the medium term support of 79.00 ranges last week with 80.60 ranges acting as intermediate resistance; Dollar weakness may extend only on daily close below 78.70 ranges. Most of the FX majors traded mixed bag wherein the Euro and the Swiss France traded weak but the Cable and the Aussie traded strong though the Cable is still trading in supply zone.

The benchmark equity index of Dow Jones Industrial Average (DJIA) is ended weak after making high of 16460 ranges with 16500-16550 ranges still posting resistance; further rally may reinitiate only on daily close above 16650. Historic correlation between DX Vs DJIA suggests Dollar weakness till DX is not closing above 84.50 ranges on weekly basis though the historic correlation between DX Vs DJIA is have become less significant since past couple of years.

Disclaimer: This report contains the views of GFM Research Private Limited. This report should not be construed as investment/trading advice. Due care is taken when gathering the data/information and the data sources are believed to be reliable, though GFM Research Private Limited nor its Group Companies guarantee for the same. Trading/investing in financial markets may result in financial and/or emotional stress, a trader/investor is advised to weigh pros and cons of trading/investing. Further disclaimer will be produced on request.