Market Commentary

The Dollar Index (DX) closed flat after testing interim resistance zone of 80.70-80.75 ranges. DX is finding support at the medium term support of 79.00 ranges with 80.75 ranges acting as intermediate resistance; Dollar weakness may extend only on daily close below 78.70 ranges else breakout above 80.80 would retest the medium term resistance of 81.60/ 81.70 ranges.

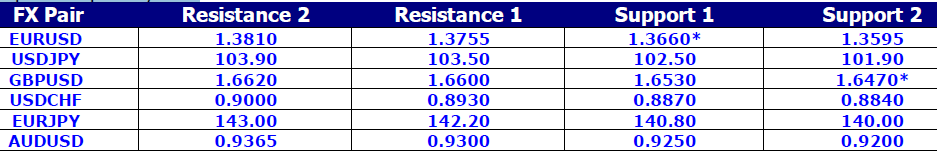

The Common currency finds support at important support of 1.3700 ranges; the medium term trend is still sideways with 1.3680 ranges acting as support and 1.3840 ranges acting as supply zone.

The benchmark equity index of Dow Jones Industrial Average (DJIA) slips again from the major resistance zone of 16500-16600 ranges to currently trade weak at 16370 ranges; further rally may reinitiate only on daily close above 16650. Historic correlation between DX Vs DJIA suggests Dollar weakness till DX is not closing above 84.50 ranges on weekly basis though the historic correlation between DX Vs DJIA is have become less significant since past couple of years.

Disclaimer: This report contains the views of GFM Research Private Limited. This report should not be construed as investment/trading advice. Due care is taken when gathering the data/information and the data sources are believed to be reliable, though GFM Research Private Limited nor its Group Companies guarantee for the same. Trading/investing in financial markets may result in financial and/or emotional stress, a trader/investor is advised to weigh pros and cons of trading/investing. Further disclaimer will be produced on request.