- Weak export numbers from Japan weighed on sentiment, with manufacturing confidence hitting a 3-year low. Treasuries and equity markets are lower, although contained remains contained overall.

- Australian employment failed to light another match under rate-cut calls, supporting AUD during a slightly risk-off session. Unemployment remained steady at 5.2%, although RBA will need to see this lower over the coming months to justify recent cuts. Participation rate remained at record highs, although the headline employment figure missed the mark, coming in at 0.5k versus 10k expected down from -9.5k prior.

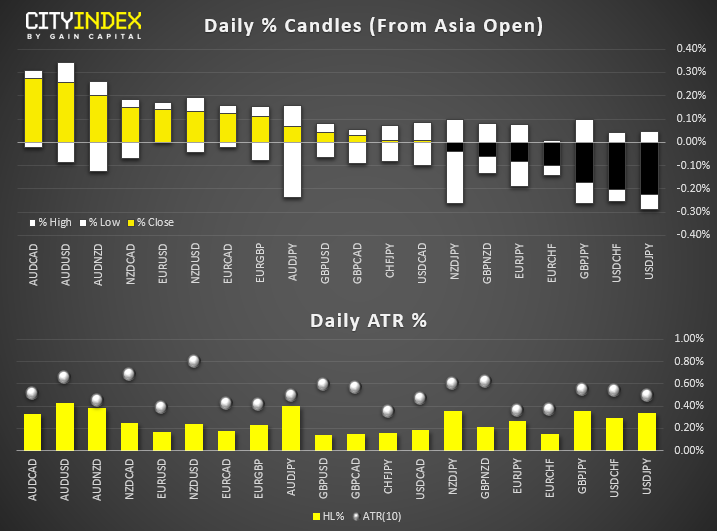

- AUD, CHF and JPY are the strongest majors, USD and CAD are the weakest. AUD/CAD is the biggest gainer, with AUD receiving a tailwind with okay employment data and CAD pressured from trade concerns. USD/JPY is the biggest loser of the session, all pairs remain within their typical daily ranges although AUD/JPY is the closest to breaching it.

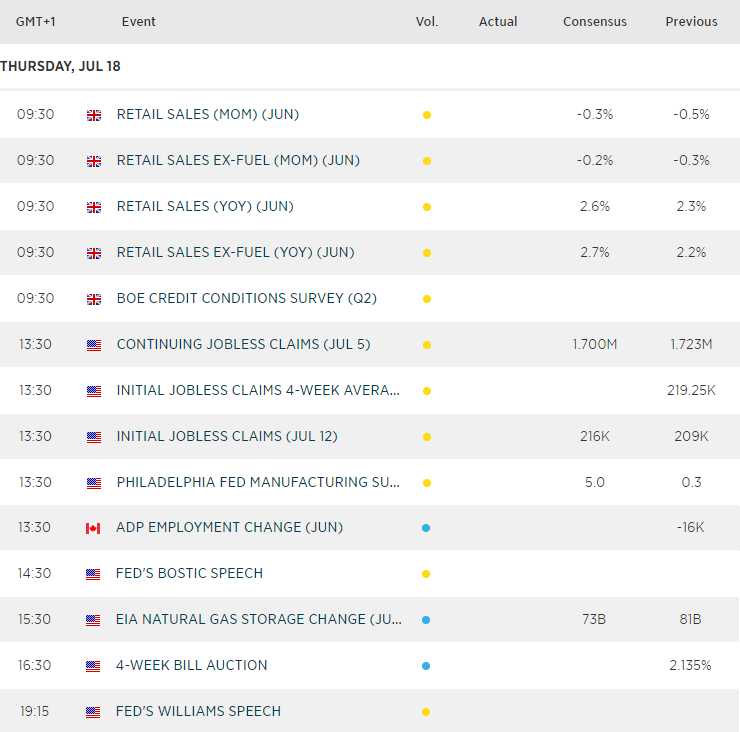

Up next:

- UK retail sales is a volatile number at the best of times, and May’s figures were no exception with the YoY rate plummeting -2.8% with cool weather to blame. Shorting GBP is not a new idea and, given GBP/USD’s minor up day yesterday, perhaps it’s approaching a time for a contrarian move and may not take a huge beat to if GBP/USD further. Still GBP/USD is hovering just below key resistance around 1.244/78, so it could be reaching a pivotal moment.

- US Initial jobless claims hit a 50-year low last month, but it may not be a main driver for the USD with markets expecting further easing from the Fed. USD is receiving safe haven flows and, whilst data overall isn’t great, it’s performing better than the rest of the world on a relative basis. Still, keep USD/JPY in focus as it is approaching 107.54 support.