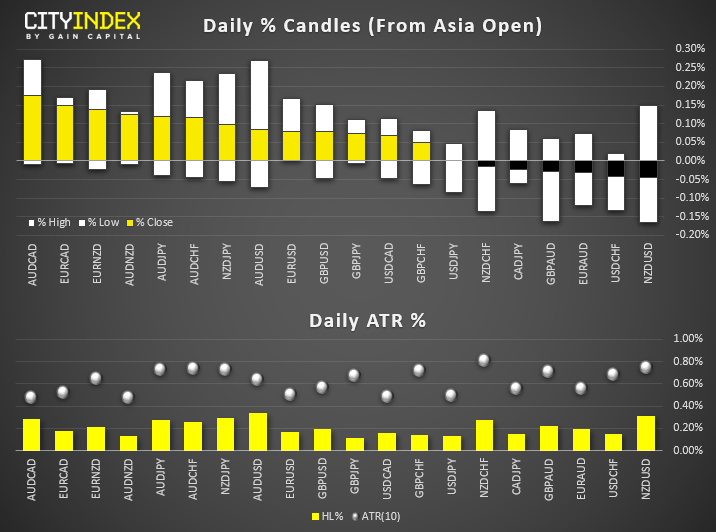

- A quiet day for FX markets with all majors and crosses staying well within their typical daily ranges. AUD and GBP are currently the strongest majors, CAD is the weakest.

- AUD/USD briefly touched a 2-month high, USD/CAD appears set to extend its decline, WTI’s minor rebound has stalled below $58 and gold appears steady around $1420 after a minor bearish day yesterday.

- Bitcoin surged early Asia, putting up for debate as to whether the corrective low is truly in.

- U.S.-China trade talks are to resume next week, according to U.S. officials.

- Equities moves higher after a strong lead from Wall Street which saw all three major indices close to record highs. The ASX200 broke out of a bullish flag pattern and above 6,700.

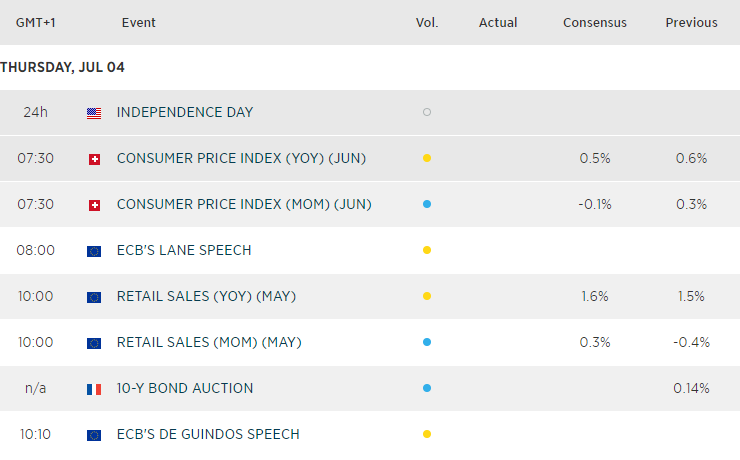

Up Next:

- It’s mostly second and third tier data, although ECB’s chief economist Philip Lane speaks at 7 am GMT, and ECB vice president at 09:10 GMT.

- Volumes are expected to be much lighter in the U.S. session due to Independence day. However, volatility can pick up in lower liquidity environments if something major were to occur (whether it be news driven or a bot-driven flash-crash).