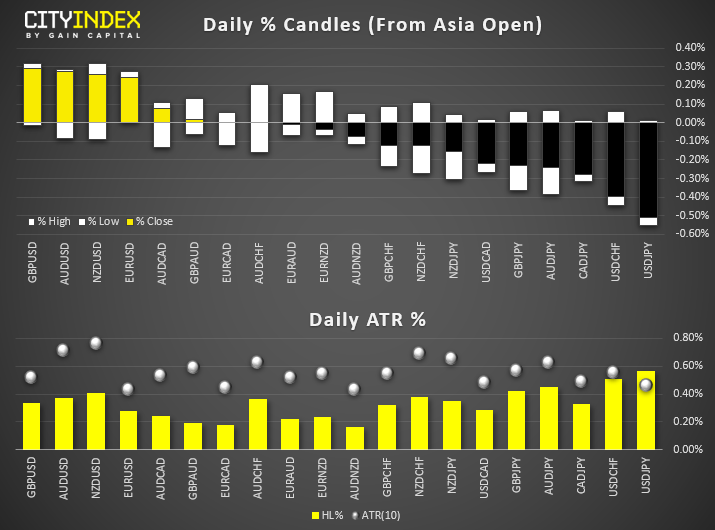

- USD is the weakest major again following a dovish testimony from Powell. Now he has set the stage for a rate cut this month, the Greenback is paring gains made after Powell walked back earlier dovish comments.

- USD/JPY is the weakest pair we track, hitting a 4-day low and shedding a further -0.43% after closing -0.41% lower yesterday. USD/CHF has also rolled over after hitting key resistance levels and has extended its decline to a 5-day low. Even GBP/USD has managed to lift itself to a 3-day high although we’re closely watching a key resistance level. Elsewhere for GBP, several crosses appear set to break to new lows.

- With S&P500 hitting 3k, Asian equities tracked Wall Street higher with Chinese stocks taking the lead and index futures also in the black.

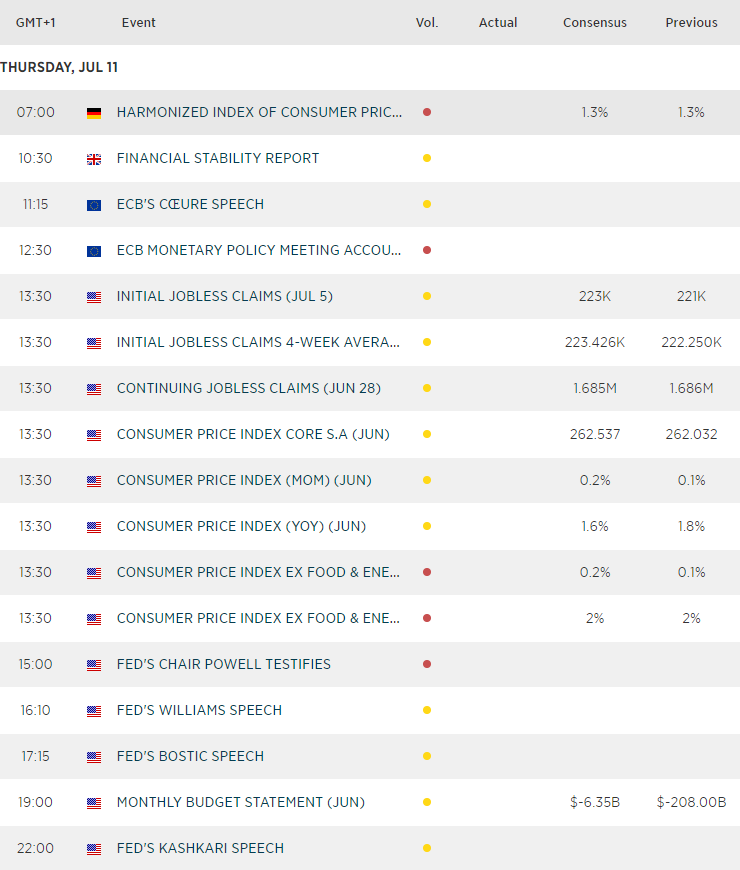

Up Next:

- Final readings for German and French CPI are not expected to deviate too much form the prior releases, but you never know. Both reads disappointed last month so unless there’s a notable upwards revision, it may not prove to be a huge driver.

- However, US CPI is the main event for traders today. Given we’ve effectively had the green light for a Fed cut this month (and calls for further cuts this year now piling up) then we’d expect a weak print from US CPI to weigh down on USD, in the current ‘chuck your dollars away’ environment.