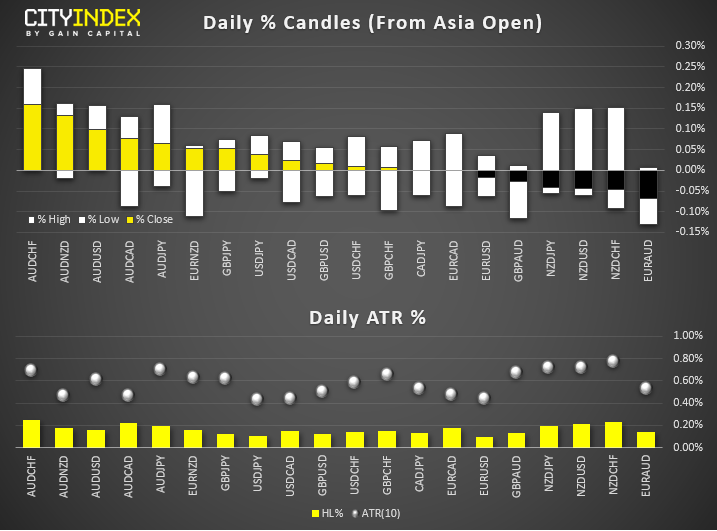

- Tiny ranges for FX markets with all pairs remaining well within typical daily ranges. But then that’s no major surprise, given the U.S. holiday yesterday and of course today’s Nonfarm payroll report just around the corner.

- Equities remain supported ahead of nonfarms, with the ASX extending its reach from 11-year highs after breaking out of bullish flag pattern. U.S. Index futures have also opened higher after the holiday break.

- Japan’s household spending rose at it fastest pace in four years, a metric BoJ will take note of as it’s a potential catalyst for their elusive inflation. Still, with an expected tax hike to 10% in October, such rebounds may be short lived.

- Australian construction PMI contracted for a tenth consecutive month, although managed to lift itself 2.6pts from its lows to sit around 43. Hardly a victory in the grand scheme of things, but AUD is today’s strongest major none the less.

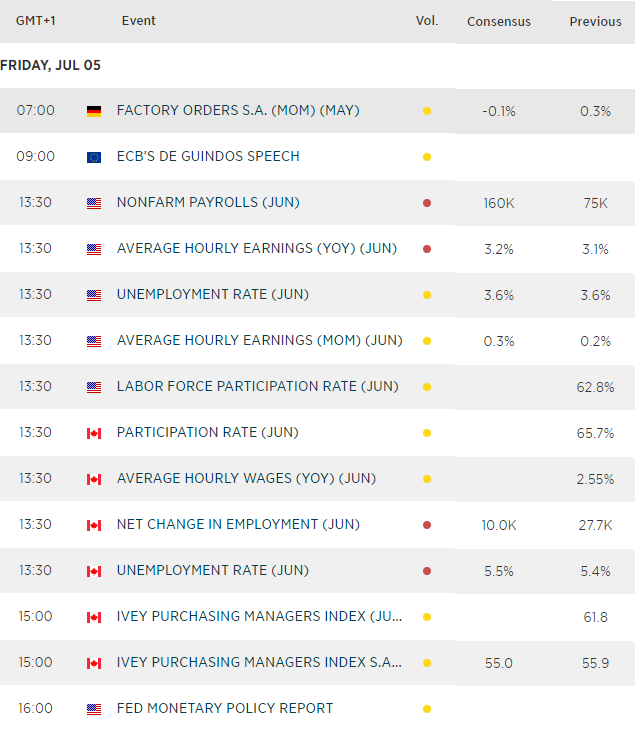

Up Next:

- Today’s NFP is the main game in town, with the added-bonus that Canada also release their employment data alongside the U.S.

- Canada’s PMI remains one of the firmer reads among FX majors, although that too has not as strong as it was late 2018. If it’s to follow the trend this month, it could be a miss and weigh on CAD, even more so if employment data misses the mark.

- Either way, USD/CAD, CAD/JPY, CAD/CHF, USD/JPY and USD/CHF will be the FX pairs to watch around these data points. Also keep an eye on EUR/CAD as its stalled on an important technical juncture.