- The Pentagon claim a “recent” missile launch by China in the South China Sea was “disturbing”. AUD/JPY hit a 5-day low and is the weakest major cross this session.

- Later is was reported that US government staff have been told to treat Huawei as blacklisted.

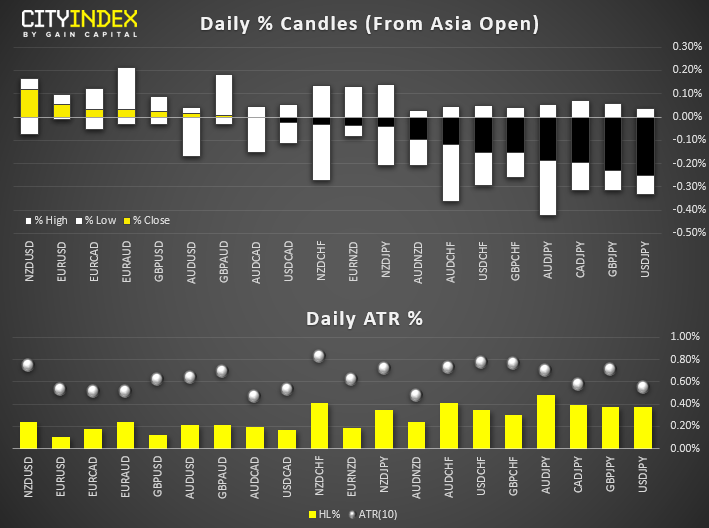

- JPY and CHF are the strongest majors, USD and GBP are the weakest.

- Gold is sitting comfortably back above $1400 after its Tuesday turnaround, where Monday’s most bullish session in a year was reversed with yesterday’s most bullish session in 3.

- Service PMI appear to be having a slightly better start to the month than their manufacturing counterparts. China’s Caixin Service PMI expanded at 52, its slowest pace since February. Australian Service PMI expanded for a 2nd month, although at a slightly slower pace. Japan’s composite PMI ticked higher, thanks to a better than expected Service PMI.

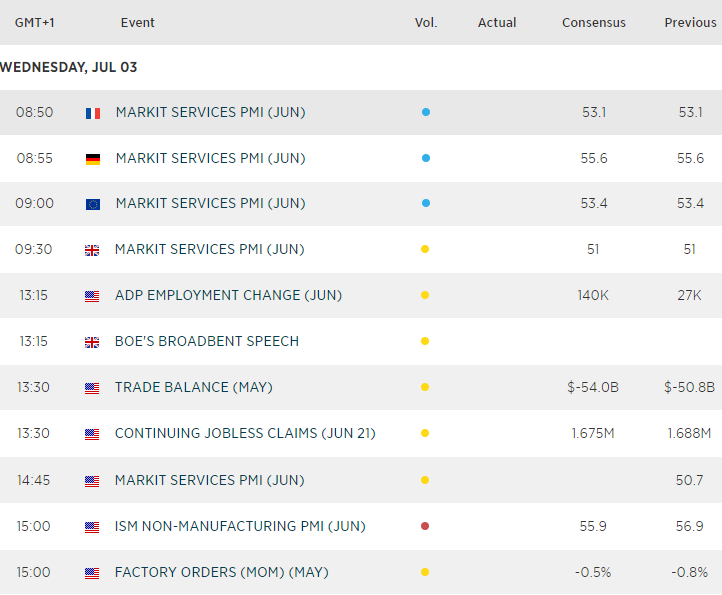

Up Next:

- Service PMI’s for France, Germany, Eurozone, UK and US are released later. Whilst not generally ‘top tier’ data sets, they could help soften the blow, or turn the screw on manufacturing PMI’s which have seen concerns for global growth resurface. This could put EUR/USD, GBP/USD and EUR/GBP onto the radar later today if we see numbers deviate away from expectations enough and weigh on composite PMI indicators.

- ADP employment is often seen as a precursor for Friday’s NFP, so any wilds swings here will could impact the dollar. Remember, Jerome Powell walked back some of the Fed’s dovishness, so employment data exceeding or falling short of expectations could have a material impact on USD as expectations for a July cut change.