• No directional move for EUR/USD although it has been leaning on local support again a bit today. The broad USD picture remains mixed, with USD/JPY stuck in a terminal range.

• AUD is on a runaway train higher almost across the board — much of the action is likely to be due to the massive break of the 1.5000 support in EUR/AUD. This may be getting overdone soon but the momentum is impressive. AUD/JPY is on the cusp of an interesting area (see chart section below for more details).

• Key CHF crosses suggest the CHF is weakening through a few key levels, particularly in EUR/CHF but EUR/CHF has weakened a bit late in the day. Its status should emerge in the next 24 hours.

• SEK weakened on data releases today and EUR/SEK is taking a stab at a critical local resistance area after the downside momentum of the previous sell-off lost all momentum lately.

USD/CAD is trying to make a stand at last-ditch support areas and must pivot one way or another over the next day or so.

Chart: EUR/AUD

EUR/AUD is coming absolutely unglued today on the break of the 1.5000 level and head and shoulders neckline. But will the 200-day moving average come in to support?

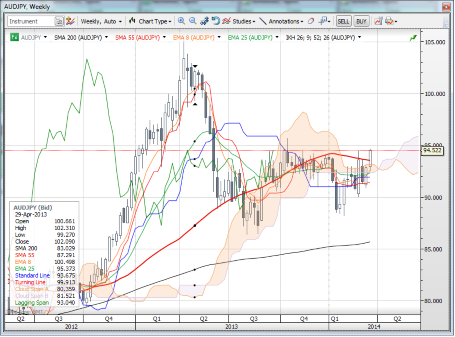

Chart: AUD/JPY

Most JPY crosses have been rangebound but AUD/JPY is pushing impressively higher — key flat-line resistance lies at 94.50/95.00 although it appears the pair has cleared the Ichimoku weekly cloud. Still, I would like to see some confirmation from other JPY crosses before looking higher here.

Chart: EUR/CHF

EUR/CHF made a stab today through the key 1.2200/25 area and is wilting a bit into US trading today. It’s a make or break area that tells us whether EUR/CHF is ever going to get interesting again.

Chart: USD/CHF

Again, USD/CHF is taking another step close to looking for an upside breakout after yesterday’s somewhat bearish reversal was ignored today. Still, we need to work through the 0.8850/75 area to get a new uptrend in higher gear.

Chart: EUR/GBP

EUR/GBP is pressing down on the interesting 0.8325 area, a close-through that could set up a test of the lows for the cycle.

Chart: USD/CAD

USD/CAD is barely hanging in there today as it has so far rejected an attempt below 1.1150 today — the bulls need 1.1200 again soon to help keep the bears at bay.

Chart: EUR/SEK

EUR/SEK is pushing up through the 8.900 area, which argues for a test of the very critical 9.00 level again in the days ahead.

Chart: USD/SEK

EUR/USD has yet to break down at the time of writing but with EUR/SEK looking higher, if it does, USDSEK could rocket up to the 6.55/6.60 area in a hurry. Today’s candlestick looks impressive if it can close up here or higher.

To Read the Entire Report Please Click on the pdf File Below