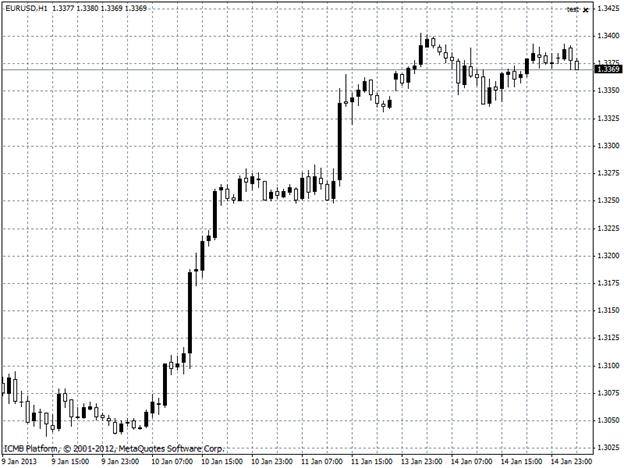

European leaders declaring they’ve gained the upper hand in the three-year-old debt crisis are sharpening efforts to channel a rebound in financial markets to an economic recovery to chip away at soaring unemployment. Even as euro-area chiefs call for more time to lock in a bailout package for Cyprus and elections loom next month in Italy, German Finance Minister Wolfgang Schaeuble said Jan. 11 that the single currency is over the worst of the crisis. Financial markets are starting to appear normal again; the euro-area economy will climb out of recession this year. Draghi’s six-month-old pledge to do whatever it takes to deliver the 17-member currency out of the crisis has been credited for declining yields and an easing in market turmoil. That’s given leaders more room to grapple with issues such as unemployment in Europe, which climbed to a record 11.8% in November, with every other Spanish youth out of work. The euro climbed 0.3% to $1.3380 after reaching $1.3404, an 11-month high. EUR/USD" title="EUR/USD" width="800" height="482">

EUR/USD" title="EUR/USD" width="800" height="482">

GBP/USD

U.K. government bonds rose for a second day as euro-area industrial production unexpectedly declined in November, underpinning demand for safer assets. Two-year yields dropped to the lowest level in more than a week amid concern U.S. lawmakers will struggle to reach agreement to increase the nation’s debt limit, potentially slowing growth in the world’s largest economy. U.K. 10-year yields have fallen around 10 basis points since climbing to the highest since April this month. The pound weakened against all except one of its 16 major counterparts before the government releases inflation data for December tomorrow. The pound dropped the most in a week against the dollar as economists forecast data tomorrow will show retail price inflation held at 3% last month, while consumer prices inflation was at the quickest since May for a third month. The U.K. currency declined 0.4% to $1.6072 after falling as much as 0.6%, the biggest decline since Jan. 3.  GBP/USD" title="GBP/USD" width="800" height="482">

GBP/USD" title="GBP/USD" width="800" height="482">

USD/JPY

The yen rose against its major peers after comments by Japan’s economy minister stoked speculation the nation won’t try to spur further weakness in its currency. The yen ended four days of declines against the dollar after Akira Amari said an excessively weak currency has negative effects on livelihoods. The world has gone massively short yen on the idea that Japan is going to be more aggressive with its stimulus under the new Prime Minister, Comments like Amari’s are likely to spook those holding yen shorts. A short position is a bet a currency will decline in value. The yen rallied 0.7% to 88.96 per dollar after yesterday reaching 89.67, the weakest since June 2010. USD/JPY" title="USD/JPY" width="800" height="482">

USD/JPY" title="USD/JPY" width="800" height="482">

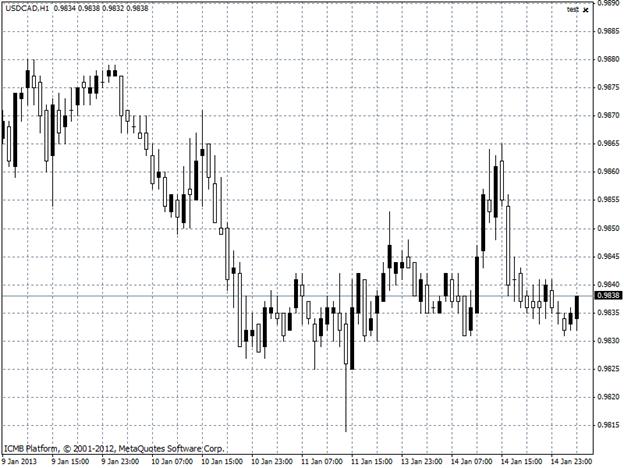

USD/CAD

The Canadian dollar fell against its Australian and New Zealand counterparts as comments from the Chinese securities regulator indicated the possibility of more foreign investment in Chinese firms. The Canadian currency declined versus a majority of its 16 most-traded peers as Chinese stocks rose the most in a month after Guo Shuqing, Chairman of the China Securities Regulatory Commission, said China can raise quotas to allow foreigners as well as offshore Yuan holders in Hong Kong to buy stocks and bonds in the mainland. You’d look at Canada as a bystander in terms of the flow that leads Asia over North America at the moment, the loonie rose 0.1% to 98.37 cents per U.S. dollar.  USD/CAD" title="USD/CAD" width="800" height="482">

USD/CAD" title="USD/CAD" width="800" height="482">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Analysis: Tuesday's Major Pairs

Published 01/15/2013, 09:45 AM

Updated 04/25/2018, 04:40 AM

FX Analysis: Tuesday's Major Pairs

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.