Gold, mining stocks, and the USD Index have not been doing much recently. However, yesterday, this “inactivity” took quite a decisive shape, and unfortunately, things are not looking good for gold.

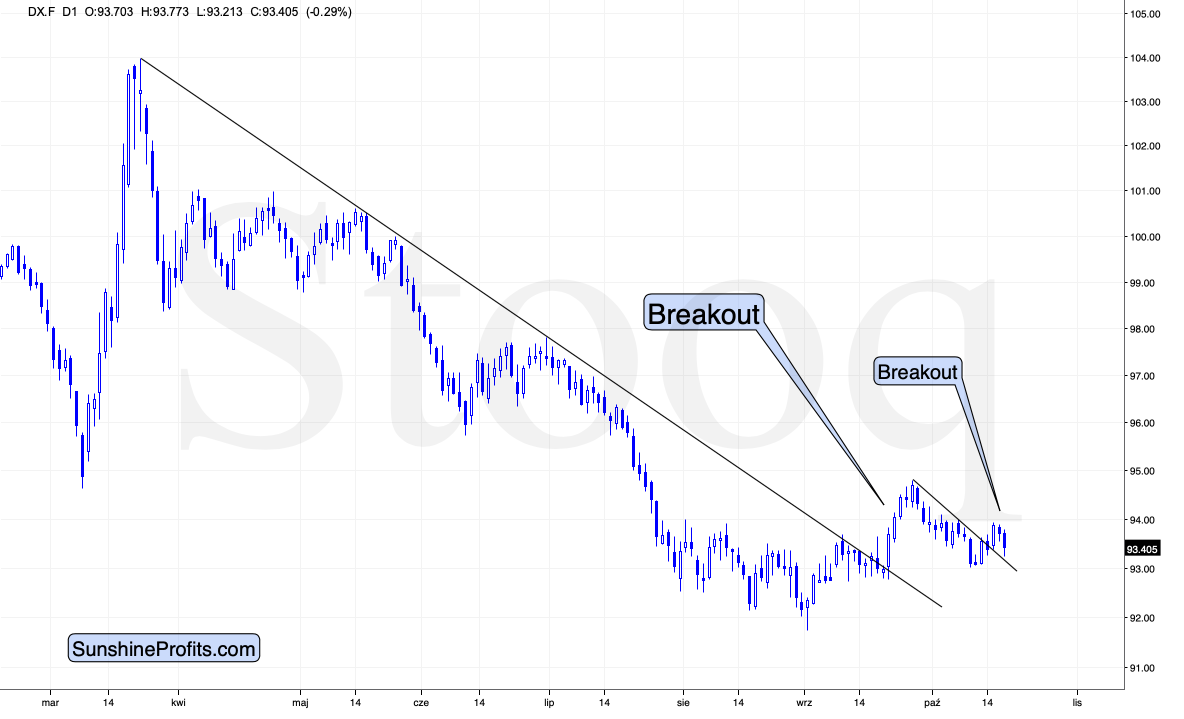

As you are all aware, gold tends to move conversely to the USD Index. Therefore, it’s useful to focus on the latter for signs that would influence the former. So, what does the current USDX outlook look like?

Well, it looks like the USDX is about to rally. It broke above its medium-term resistance line and verified this breakout. This verification took the form of a decline based on a more recent short-term breakout, which seems to have ended.

From a medium-term point of view, since the market had to correct before moving higher again, it’s no wonder that it had to do the same from a short-term perspective as well.

Based on the chart above, the outlook for the USD Index is bullish.

But, before we move to gold, please pay attention to the shape of the last candlestick. The USDX moved relatively lower, almost touching the declining support line.

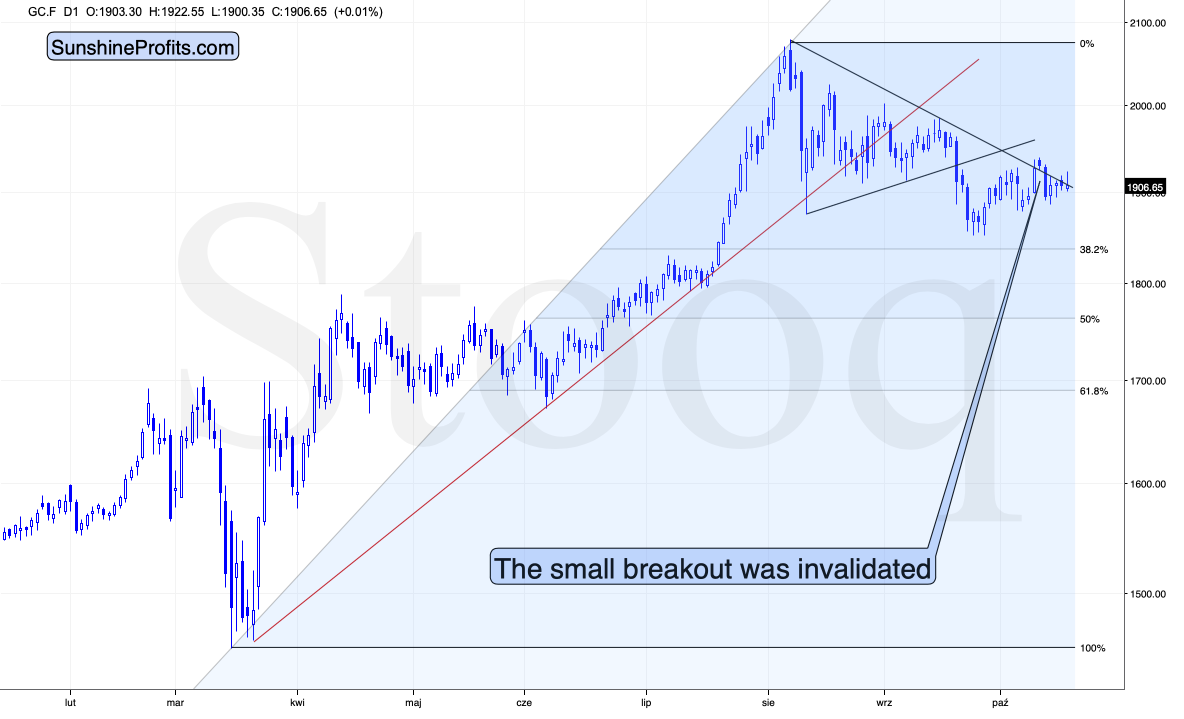

Considering the above, one might have expected to see a visible daily gain in gold – maybe with a small correction, but again, with a substantial gain in terms of daily closing prices. So, did we witness something like that?

Not really.

Gold was marginally up, which is a notable bearish indication. The bearish confirmation comes from the fact that gold tried and failed to break above the declining resistance line.

Above the resistance line, gold took only a small comeback from the USD Index that made gold invalidate its intraday breakout. It is a clear sign of weakness.

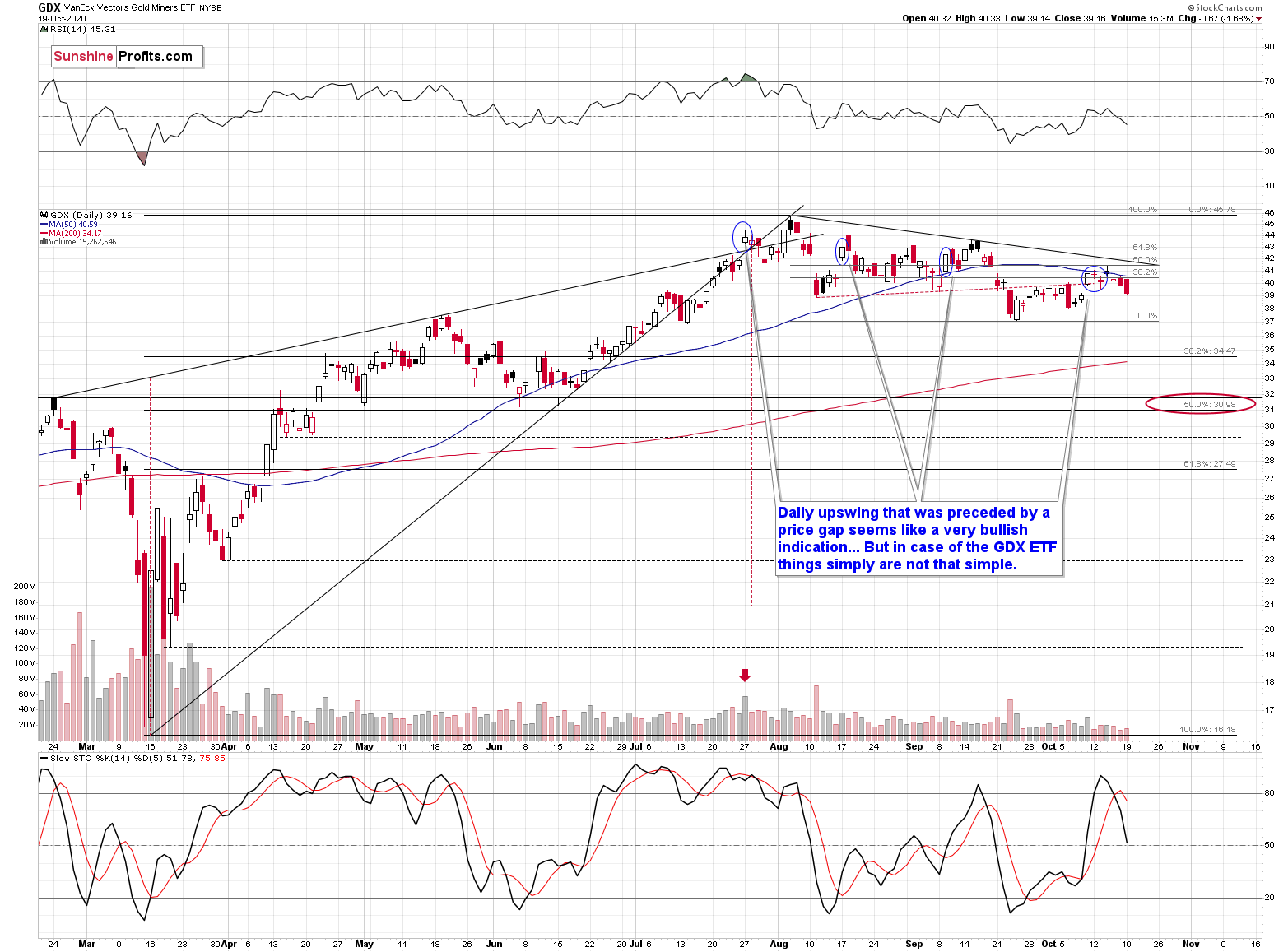

And you know what precious metals sector sign of weakness is even more visible? It’s yesterday’s action in gold and silver mining stocks.

Namely, miners have declined adamantly– much more visibly than gold. This type of underperformance is what precedes the decline. Or, more precisely, it is often the very initial part of a more significant decline.

That is a perfect cherry on the bearish analytical cake that we’ve “baked” in our previous analyses. Over a week ago, we wrote that the situation was reminiscent of the earlier cases, marked with blue ellipses. Namely, the GDX (NYSE:GDX) ETF moved only a tad higher, which was the final top for at least some time. We argued that the strong daily rally that started with a bullish price gap was not so bullish after all. Indeed, over a week later, once again, miners are visibly lower.

Of course, based i.a. in the USDX situation, most probably, this is not the end of the miners’ decline, but rather, it is just the beginning. The situation relative to the 50-day moving average (marked with blue) confirms it. After all, back in March, miners moved slightly above their 50-day moving average only to plunge shortly after that, and the current situation is the only similar case to the above. There were no other cases when the miners broke below this MA and then moved back up slightly above it, declining once again afterward.

And due to the above, if the situation wasn’t bearish enough, the Stochastic indicator based on the GDX ETF has just flashed a clear sell signal.

All in all, currently, the outlook for the precious metals market remains bearish.