Key Points:

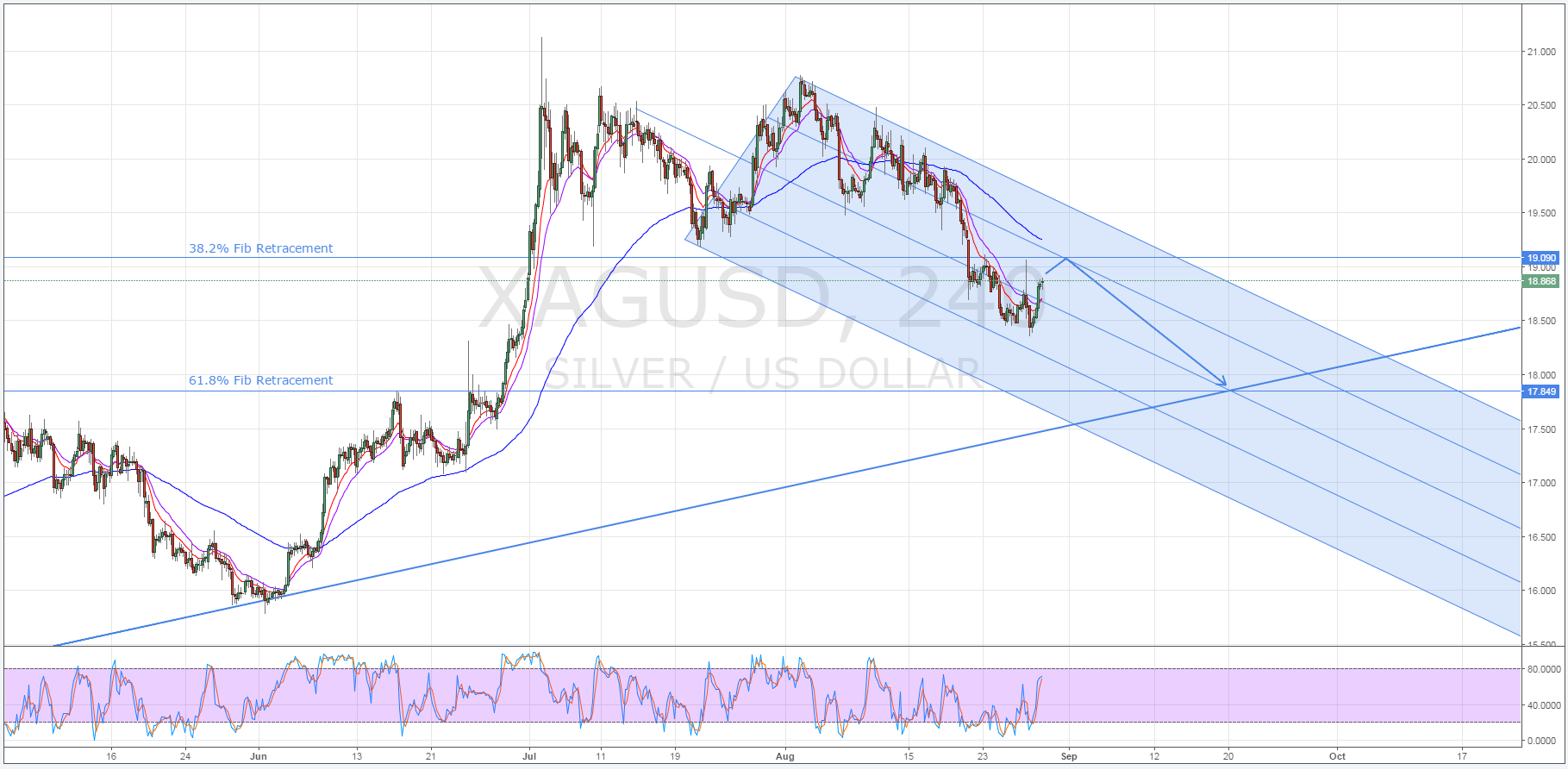

- Following a Schiff Pitchfork lower.

- EMA bias is bearish.

- Should decline as low as the 17.849 mark.

Silver could be setting up for another near-term slip prior to resuming its long-term bullish trend as this week progresses. Specifically, the metal is fast approaching a probable point of infection around the 19.090 level which could subsequently see silver descend to the 17.849 mark.

However, keep an eye on the US Employment data as any unexpected weakness in the figures could see bullishness resume earlier than anticipated.

As shown below, silver has remained within the confines of a Schiff pitchfork throughout August and this structure should remain intact for some time yet. As a result, it is expected that the metal trends lower in the near-term.

This being said, exactly when it reverses is less obvious. Fortunately, there are a number of technical indicators which are singling that the 19.090 mark should prove itself to be a point of infection.

Firstly, at its current trajectory, the metal should encounter resistance from an intersection of one of the Schiff Pitchfork levels and the 38.2% Fibonacci retracement level.

This intersection occurs at the 19.090 level and, consequently, it is expected that resistance will remain unbroken here. Additionally, at this point the 100 period EMA on the H4 chart will be exerting some downward pressure which should likewise encourage a reversal.

After making a reversal, silver should remain in decline and follow the pitchfork down to around the 17.849 level. Much like the 19.090 level, the reason that this price should prove to be a reversal point is twofold.

Primarily, it represents the intersection of both the long-term bullish trend line and the central tendency of the pitchfork structure. Secondly, this price represents the 61.8% Fibonacci retracement which should intensify support around the 17.849 mark.

From a fundamental perspective, there is significant scope for some major interference courtesy of the bevy of US employment data due this week. Much like gold, silver enjoys the benefits of being a safe-haven investment, meaning its price generally spikes alongside market fear.

Therefore, should the impending US Employment data fall short of forecasts, we could see silver push through the 19.090 price despite the technical bias.

Ultimately, keep an eye on these fundamentals this week, especially the US Unemployment Rate, as they could upset this technical manoeuvre. However, in the absence of any significant shortcomings in the US data, silver should have some substantial downside potential in the coming weeks.

This being said, the long-term bias remains bullish so don’t expect to see the metal stray far below the 17.849 mark.