Market Movers Today

Today's calendar is a blend of politics and data. First, the German Ifo will be closely monitored. Both the expectations and current situation components have been on a falling trend for the past year and we are very interested to see if it will follow the more upbeat Zew expectations from last week or reflect the weak PMIs we saw yesterday. In Sweden, the Parliamentary Committee on Finance will hold an open hearing on the current monetary policy at 09.30 CEST . Governor Stefan Ingves and Deputy Governor Per Jansson will participate.

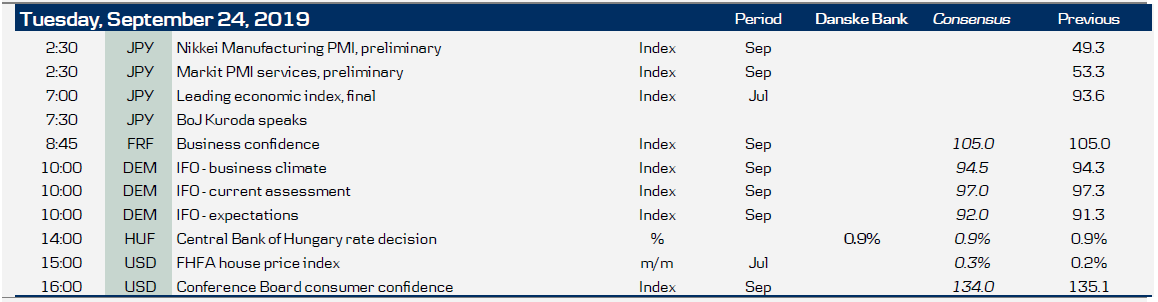

In the UK, the Supreme Court is expected to rule on Prime Minister Boris Johnson's suspension of Parliament at 11.30 CEST. The Hungarian central bank (the MNB) will hold its monetary policy meeting. In line with Bloomberg and Reuters consensus, we expect the key rate to remain unchanged at 0.90%. As the ECB has prolonged its dovishness, Hungarian inflation continues to decelerate and business confidence has slid dramatically, we expect the MNB will be dovish again, adding pressure on the HUF in the short and mid-term.

Selected Market News

Asian equity markets and US stock futures have remained in green territory, while shares climbed in Japan, where markets opened after a holiday. Previously, US stocks struggled to rise, ending slightly in the red, while oil and gold slid after Reuters reported that Saudi Arabia had restored more than 75% of the crude output lost after the recent attacks and could return to full volumes by early next week. However, the Wall Street Journal reported that repairs at the plants could take months longer.

The recent Middle East saga suddenly got more of a European flavour as Britain, France and Germany joined the US in accusing Iran of an attack on Saudi oil production. The European countries urged Iran to agree to new nuclear and missile talks. However, Tehran ruled out the possibility of negotiating a new deal, stating that the European powers had failed to fulfil the agreement under the 2015 nuclear pact.

Yesterday, preliminary PMIs from Europe surprised negatively as German manufacturing and services PMIs headed lower and manufacturing PMI hit its lowest level since 2009. In manufacturing, the picture is still one of a weakening order situation and deteriorating employment expectations. Probably more worrying is that the services sector is feeling the pinch as well, with incoming new business falling into contractionary territory for the first time since December 2014.

ECB President Draghi's hearing at the European Parliament did not reveal any new monetary policy directions. Draghi defended the September package, while also continuing to show trust in the Phillips curve, repeating the potential for further cuts if needed. Finally, he also mentioned that new ideas such as MMT (Modern Monetary Theory) could be discussed among the Governing Council, although is in no rush towards this.

Scandi Markets

In Sweden, the Parliamentary Committee on Finance will hold an open hearing on current monetary policy. Governor Stefan Ingves and Deputy Governor Per Jansson will participate.

Fixed Income Markets

There is significant focus on the repo market in the US after last week’s turmoil, where repo rates spiked to very high levels. The Federal Reserve continued its repo auctions on Monday and will continue these until 10 October, and this has stabilised the market. Yesterday, the weak European PMI data sent bond yields lower across Europe as it increased expectations for further ECB easing. Furthermore, comments from Italian officials regarding the target for the budget deficit for 2020 being between 2.0% and 2.1% added extra support for Italy, while Spain was supported by the upgrade on Friday. Hence, the 10Y spread between Italy and Germany tightened some 3bp to 144bp, but we are still some 10bp from the lows seen last week. We stick to the long position in 10Y Italy relative to Germany and 10Y Spain versus France.

The European yield curves continued to flatten from the long end, and despite the low levels for both 2Y-5Y, 5-10Y and 10Y-30Y, we expect the flattening to continue between 2Y and 10Y as the 10Y-15Y segment still offers the best carry and roll-down on most of the European government and EUR swap curves.

Today, the German IFO indicator will provide more insight into sentiment in the German economy and another low number is likely to send bond yields lower, together with a bullish flattening. Today could also give more headwind to the UK’s PM Johnson as the UK Supreme Court is expected to give its ruling on his suspension of Parliament. As the risk of a hard Brexit is declining, we have seen Irish government bonds perform relative to peers such as France and Belgium.

FX Markets

EUR/USD dropped below the 1.10 mark again yesterday after weak euro-zone PMIs but did not take a further dive despite a decent US. German IFO today could give further hints of activity but the bar for the ECB to do more at this stage is probably quite high.

Meanwhile, EUR/PLN continued to be bid yesterday as worries over Polish banks’ FX mortgages weigh and some contamination to other CEE currencies such as the HUF was seen; the move seemingly also had repercussions into EUR/CHF, which dropped below 1.08. More broadly, on average, G10 2Y swap rates – which can be taken as an indicator of monetary-policy prospects – have risen on average lately and the USD will, in our view, be superior in coping with this, see FX Essentials: 10 days, 8 central banks - lessons for FX autumn trading.

While the NOK gained somewhat on the modest oil and risk sentiment rebound in yesterday’s session, we think it’s still too early to position for sustained NOK strength. Indeed, the past weeks have showed how the global environment dominates moves in relative rates. As long as global growth decelerates, ‘bad’ USD strength persists, China deleverages and commodities underperform, we think NOK rallies will prove temporary. Instead, we recommend to play the NOK short term as a high-beta derivative of global risk appetite.

EUR/SEK edged slightly higher yesterday, trading close to our end of Q3 10.70 target and USD/SEK surged after the German PMI data release. We believe that European weakness is a sign that the Swedish economy will take a harder hit than the Riksbank is currently anticipating. That is partly why we think it will have to reconsider the planned hike around year-end and eventually cut instead – which would clearly be a headwind for the SEK going forward. Today, focus is on the Riksdag hearing of the two governors, Ingves and Jansson.

Key figures and events