Key Points:

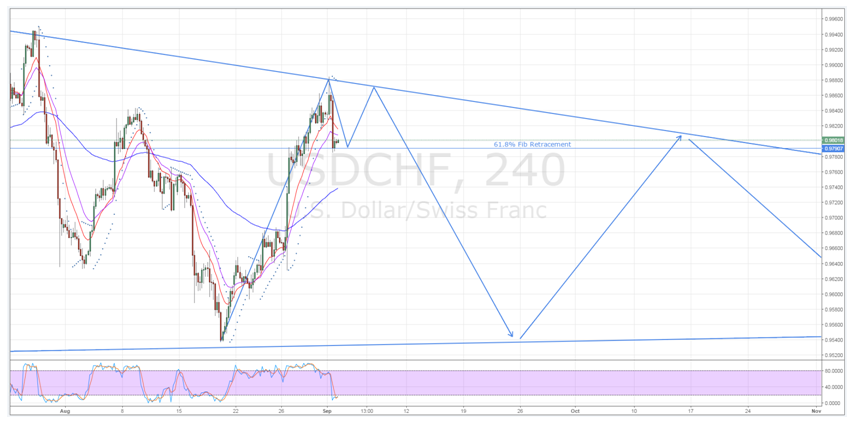

- Retreating from the upside constraint of the pennant structure.

- Testing a strong support around the 61.8% Fibonacci level.

- US fundamentals remain vital moving forward.

After recently re-confirming the upside constraint of the long-term pennant formation, the USD/CHF is looking set to make another move back to the downside. However, the pair is currently testing a rather robust support which could see a second attempt at breaching the upside constraint going forward.

As a result of this, we could see some further bullishness as the week begins to wind down, even in the absence of some stronger US employment results.

As shown on the daily chart, whilst the swissie’s price action is beginning to tighten somewhat, a breakout from the consolidation phase is still a relatively distant prospect. As a result, it is expected that the pair continues to move between the upper and lower boundaries of the structure over the proceeding weeks.

However, the coming decline could be stalled or even temporarily reversed by the rather strong support around the 0.9790 level. Additionally, this could mean that another attempt at breaching the upside boundary is seen by week’s end.

Support around the 0.9790 level is particularly strong for a range of reasons which become clearer on a shorter timeframe. Specifically, looking at the H4 chart reveals a number of key factors which are signalling that the current support may hold firm this week.

Firstly, this price coincides with the 61.8% Fibonacci level and a long term zone of support. Moreover, the H4 stochastic oscillator is now in oversold territory, the opposite of the daily reading.

Finally, the shorter timeframe’s EMA activity shows an even more bullish bias than the daily averages which should limit downside potential in the short-term.

As a result of the robust support, we could see a number of different outcomes by the end of the week. Firstly, the pair could continue to perform much as it has done during the early stages of the session and trend horizontally until the bulls finally abandon their defence of the 61.8% Fibonacci level.

Alternatively, the bears could lose interest as the week closes and the USD/CHF could begin to trend higher once again. If this occurred, it would result in a double top formation which would ultimately end in a plunge back to the downside constraint.

In either scenario, the effect of the remaining US employment data releases could prove to be a vital factor in determining the swissie’s movements. Stronger outcomes would basically ensure that the double top forms or could actually result in a disruption of the long-term pennant formation.

On the other hand, significantly weaker results could see the current support crumble and the pair track lower. As a result, keep an eye on impending data such as the US Unemployment Rate as it could prove to be rather disruptive.

Ultimately, the medium-term bias for the swissie remains bearish but some near-term bullishness is also highly likely. As a result, keep an eye on any sudden shifts in momentum amid the increased volatility that is likely to be seen as the week comes to an end.

However, don’t expect to see the pair move far beyond the upside constraint of the pennant and watch out for any subsequent corrections to the downside if the USD/CHF does climb higher.