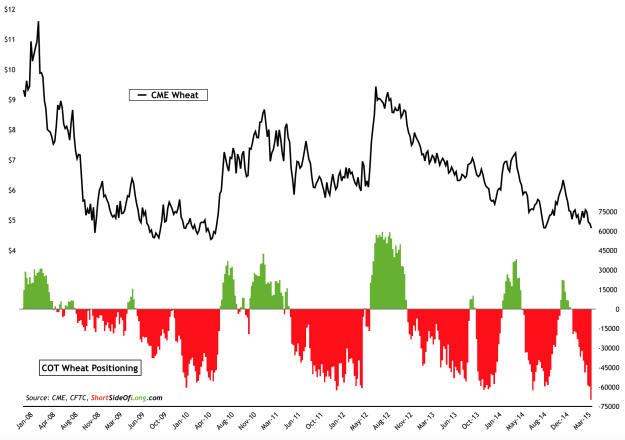

Sticking with my commodity theme, today's second chart of the day focuses on the sentiment in the agricultural sector and especially looks at Wheat. This grain originally made a new high all the way back in early 2008, just shy of $12.

A powerful bear market followed, where Wheat lost over two thirds of its value, bottoming out in summer of 2010. Interestingly, this was just around the time hedge funds and other speculators held very large net short bets against the grain. Therefore, it shouldn't be a surprise that over the following year, prices doubled.

Chart Of The Day: Speculators are currently at record short vs Wheat

A similar type of an event occurred once again in the summer of 2012. Recently, prices have been trending downward, with short term strong rallies working off oversold conditions. Wheat is now once again resetting the bottom we saw during the 2009 - 2010 period, while hedge funds and other speculators pushed the net short count to a new record high. In other words, just about every man and his grandmother dislike agriculture right now.