On Wednesday at 1000GMT the European Central Bank’s second Long-Term Refinancing Operation (LTRO) will begin. The Bank is auctioning unlimited 3-year funds to Europe’s financial sector at incredibly cheap rates of interest.

The last time the Bank held one of these auctions, Europe’s baking sector, especially in the sovereign debt ravaged periphery, sucked up EUR 500bn of funds, which set the markets on fire and triggered a rally that saw global stock markets rise some 20% on average since December.

So what can we expect from this auction:

• The market expects a similar take-up of approx. EUR 500bn of funds.

• Italian and Spanish banks borrowed more than half of all funds at the first auction; we expect them to get the most funds this time too.

• The largest take-up of the debt is by mid-cap banks. Larger blue –chips in the periphery may actually scale back some of their purchase as they concentrate on recovery and weaning themselves off cheap funding supplied by the central bank.

• Banks in Northern Europe, especially Germany, have actually cut their reliance on ECB funds and are unlikely to partake of the latest LTRO auction.

What is the LTRO expected to achieve:

• The ECB’s primary objective is to avert a credit crunch and to ensure enough liquidity is pumping through the heart of Europe’s financial system.

• It was also designed to help banks fund themselves for the medium-term and thus not have to rely on a dwindling pool of funds available in the inter-bank lending market.

• Some including French President Nicholas Sarkozy argued that LTRO funds could be used by banks to purchase sovereign debt.

What did LTRO 1 achieve?

• It helped banks to raise funds. France gas already raised 22% of 2012 funding and their cost of funding so far has dropped to 2.4% for 2012 from 2.8% in 2011. Overall, banks in Europe have raised EUR 93bn YTD from the markets, which is more than in the last six months of 2011.

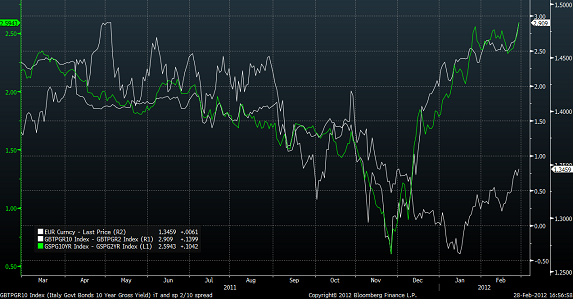

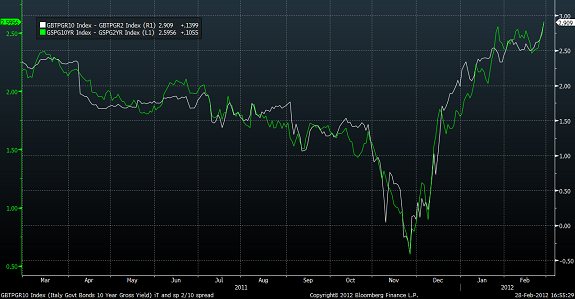

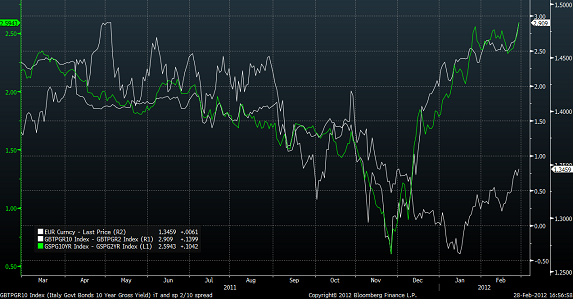

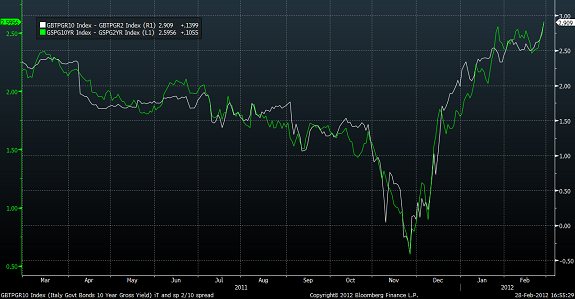

• It has certainly helped to relieve pressure in the sovereign space, especially for Spain and Italy. The chart below shows Italian (white line) and Spanish (green line) 10-year - 2-year yield spreads. The 10-year-2-year yield spread is a good way to gauge credit market tensions as in a “normal” environment 10-year yields should be rising faster than 2-years and so the spread should be widening. Prior to the first LTRO auction the spread for both Italy and Spain had been narrowing, it reached a nadir at the end of November 2011, as you can see in the chart below.

• Stocks also recovered along with other risky assets.

• Stocks also recovered along with other risky assets.

So what should we expect from LTRO 2?

• A strong result: Banks take up at least EUR 500bn (possibly more), which eases fears of a credit crunch for the banks and helps to reduce sovereign yields for Italy and Spain thus lowering the overall credit profile of the currency bloc. This would be a bullish sign and may cause high beta currencies like the Aussie, Cad and NZD along with copper and stocks to rise strongly in the short to medium term. The euro may also benefit in this scenario versus the dollar as safe havens are ditched.

• An okay result: Banks take up between EUR 350-450bn, this may cause sentiment to dip as there is less liquidity sloshing around the system.

• A bad result: EUR 300BN or less: this causes a flight to safety as investors fear that credit markets may get stuck and that, in the absence of the ECB embarking on full-blown QE, it is out of bullets to fight this crisis.

LTRO: limited economic impact

• While markets love liquidity there is no sign as yet of the LTRO helping to lift the Eurozone’s growth prospects. In fact, since LTRO 1 the EU has revised down its growth forecast for the currency bloc to a dismal 0.3% contraction. Essentially the ECB can only help with preventing a credit crunch it won’t make the Eurozone more solvent, thus it won’t solve the credit crisis. If growth fares badly in the coming months then the positive impact of LTRO on the markets could wear off and the ECB may come under pressure to embark on full-blown official QE.

• Cash borrowed by banks from the ECB isn’t t trickling through to the rest of the economy, which remains credit constrained. The ECB has argued that funds will take a while to feed into the real economy, and indeed M3 money supply data rose in January, although from a very low level. However, it doesn’t take away from the fact that Europe’s banks are in de-leveraging mode. They want to re-build their balance sheets which means constraining credit from the public. Thus, the ECB has to do more LTRO than the banks do de-leveraging. However, after tomorrow’s auction we still don’t know if there will be more cheap money coming from the ECB…

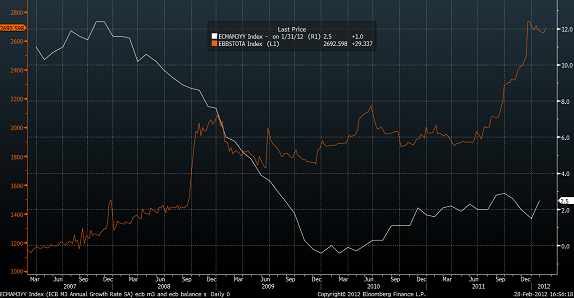

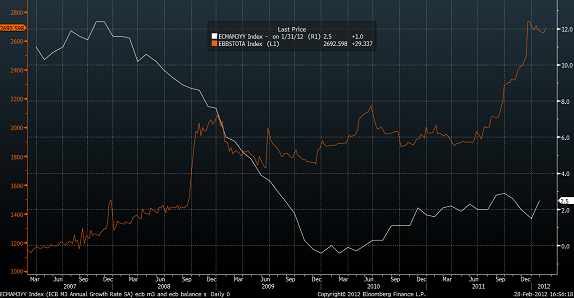

Eurozone M3 money supply (white line) and ECB balance sheet (orange line). Although the ECB’s balance sheet has ballooned to EUR 2.6 trillion, the amount of money in the economy has barely budged and is well below its long-term average.

LTRO 2: market impact:

The euro: EUR/USD has risen by 6% since the first LTRO auction and is comfortably above 1.30. However, on a trade-weighted basis the euro is up by around 4.5%, as it has underperformed the commodity currencies, which tend to perform very strongly when central banks inject liquidity into the global economy. Thus, a good up-take at the auction may boost EUR/USD but may see the EUR/AUD and EUR/CAD underperform.

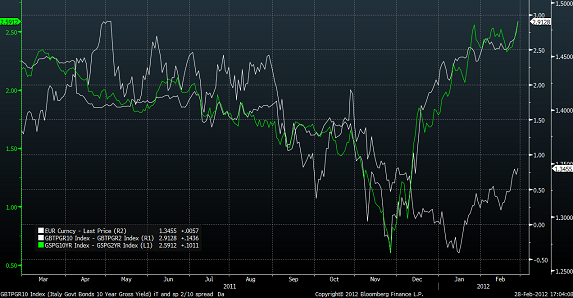

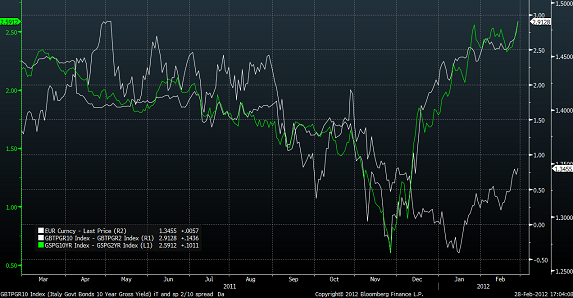

Although the ECB is expanding its balance sheet this may not hurt the euro if credit risk continues to recede, hence EUR/USD has moved in line with the recovery in Spanish and Italian bond markets: it fell as 2-year yields started to rise sharply, and recovered as the 10-yr-2-yr spread started to normalise, as you can see below.

Thus, if the LTRO doesn’t help peripheral bond markets then the euro could tumble sharply and reverse the gains made sine LTRO 1.

Stocks: Markets have been boosted by a global wave of liquidity including the ECB’s LTRO, thus stock markets in both developed and developing markets have done well. We are slightly concerned about the outlook for European equities. The rally since the start of the year was driven by the banks in Europe; however, they have started to flat-line of late as the wider market has continued to move higher. This suggests to us that some nervousness is entering the markets and the investor reaction to LTRO 2 may not be as jubilant as to LTRO 1.

Eurostoxx 50 (orange line) and Eurostoxx banks sector (white line)

The last time the Bank held one of these auctions, Europe’s baking sector, especially in the sovereign debt ravaged periphery, sucked up EUR 500bn of funds, which set the markets on fire and triggered a rally that saw global stock markets rise some 20% on average since December.

So what can we expect from this auction:

• The market expects a similar take-up of approx. EUR 500bn of funds.

• Italian and Spanish banks borrowed more than half of all funds at the first auction; we expect them to get the most funds this time too.

• The largest take-up of the debt is by mid-cap banks. Larger blue –chips in the periphery may actually scale back some of their purchase as they concentrate on recovery and weaning themselves off cheap funding supplied by the central bank.

• Banks in Northern Europe, especially Germany, have actually cut their reliance on ECB funds and are unlikely to partake of the latest LTRO auction.

What is the LTRO expected to achieve:

• The ECB’s primary objective is to avert a credit crunch and to ensure enough liquidity is pumping through the heart of Europe’s financial system.

• It was also designed to help banks fund themselves for the medium-term and thus not have to rely on a dwindling pool of funds available in the inter-bank lending market.

• Some including French President Nicholas Sarkozy argued that LTRO funds could be used by banks to purchase sovereign debt.

What did LTRO 1 achieve?

• It helped banks to raise funds. France gas already raised 22% of 2012 funding and their cost of funding so far has dropped to 2.4% for 2012 from 2.8% in 2011. Overall, banks in Europe have raised EUR 93bn YTD from the markets, which is more than in the last six months of 2011.

• It has certainly helped to relieve pressure in the sovereign space, especially for Spain and Italy. The chart below shows Italian (white line) and Spanish (green line) 10-year - 2-year yield spreads. The 10-year-2-year yield spread is a good way to gauge credit market tensions as in a “normal” environment 10-year yields should be rising faster than 2-years and so the spread should be widening. Prior to the first LTRO auction the spread for both Italy and Spain had been narrowing, it reached a nadir at the end of November 2011, as you can see in the chart below.

• Stocks also recovered along with other risky assets.

• Stocks also recovered along with other risky assets.So what should we expect from LTRO 2?

• A strong result: Banks take up at least EUR 500bn (possibly more), which eases fears of a credit crunch for the banks and helps to reduce sovereign yields for Italy and Spain thus lowering the overall credit profile of the currency bloc. This would be a bullish sign and may cause high beta currencies like the Aussie, Cad and NZD along with copper and stocks to rise strongly in the short to medium term. The euro may also benefit in this scenario versus the dollar as safe havens are ditched.

• An okay result: Banks take up between EUR 350-450bn, this may cause sentiment to dip as there is less liquidity sloshing around the system.

• A bad result: EUR 300BN or less: this causes a flight to safety as investors fear that credit markets may get stuck and that, in the absence of the ECB embarking on full-blown QE, it is out of bullets to fight this crisis.

LTRO: limited economic impact

• While markets love liquidity there is no sign as yet of the LTRO helping to lift the Eurozone’s growth prospects. In fact, since LTRO 1 the EU has revised down its growth forecast for the currency bloc to a dismal 0.3% contraction. Essentially the ECB can only help with preventing a credit crunch it won’t make the Eurozone more solvent, thus it won’t solve the credit crisis. If growth fares badly in the coming months then the positive impact of LTRO on the markets could wear off and the ECB may come under pressure to embark on full-blown official QE.

• Cash borrowed by banks from the ECB isn’t t trickling through to the rest of the economy, which remains credit constrained. The ECB has argued that funds will take a while to feed into the real economy, and indeed M3 money supply data rose in January, although from a very low level. However, it doesn’t take away from the fact that Europe’s banks are in de-leveraging mode. They want to re-build their balance sheets which means constraining credit from the public. Thus, the ECB has to do more LTRO than the banks do de-leveraging. However, after tomorrow’s auction we still don’t know if there will be more cheap money coming from the ECB…

Eurozone M3 money supply (white line) and ECB balance sheet (orange line). Although the ECB’s balance sheet has ballooned to EUR 2.6 trillion, the amount of money in the economy has barely budged and is well below its long-term average.

LTRO 2: market impact:

The euro: EUR/USD has risen by 6% since the first LTRO auction and is comfortably above 1.30. However, on a trade-weighted basis the euro is up by around 4.5%, as it has underperformed the commodity currencies, which tend to perform very strongly when central banks inject liquidity into the global economy. Thus, a good up-take at the auction may boost EUR/USD but may see the EUR/AUD and EUR/CAD underperform.

Although the ECB is expanding its balance sheet this may not hurt the euro if credit risk continues to recede, hence EUR/USD has moved in line with the recovery in Spanish and Italian bond markets: it fell as 2-year yields started to rise sharply, and recovered as the 10-yr-2-yr spread started to normalise, as you can see below.

Thus, if the LTRO doesn’t help peripheral bond markets then the euro could tumble sharply and reverse the gains made sine LTRO 1.

Stocks: Markets have been boosted by a global wave of liquidity including the ECB’s LTRO, thus stock markets in both developed and developing markets have done well. We are slightly concerned about the outlook for European equities. The rally since the start of the year was driven by the banks in Europe; however, they have started to flat-line of late as the wider market has continued to move higher. This suggests to us that some nervousness is entering the markets and the investor reaction to LTRO 2 may not be as jubilant as to LTRO 1.

Eurostoxx 50 (orange line) and Eurostoxx banks sector (white line)