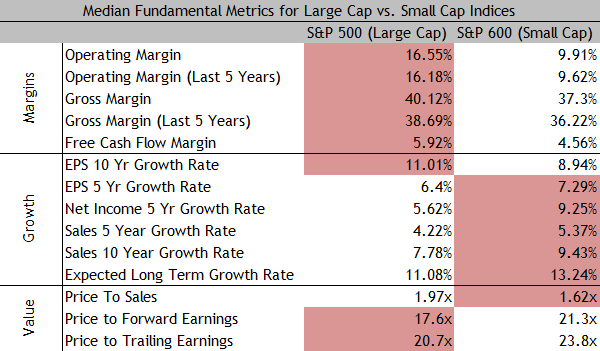

The S&P 500 may be up 26.5% this year, but that huge gain pales in comparison to the S&P 600 small cap index, which is up 35.9% in 2013. Like its large cap cousin, the small cap index’s rise has been driven by multiple expansion. In fact, looking at the earnings multiple, the Small Cap index trades at a significant premium to the Large cap index. Below is some fundamental data to help break down why that’s the case.

Perhaps not too surprisingly, Large Cap companies tend to generate higher margins than small cap companies, but generally at a lower growth rate. The exception in this data is that over the last 10 years, the median large cap company has grown earnings faster than the median small cap company.

In terms of valuation, the P/E multiple may overstate the small cap premium somewhat since the median large cap company has a higher P/S multiple than the median small cap company. One could argue that this is justified though, since equity shareholders are paying for earnings, not sales.

Although it probably shouldn’t have, I’ll admit that the data below surprised me a little. The classic argument for owning small cap ETFs is that the companies grow faster than large caps. This is definitely the case for some small caps, but for some reason I didn’t expect it (and still don’t really believe) that it’s the case on average.

Qualitatively, based on my research, I’d say the average small cap company is of much, much worse quality than the average large cap company, so to me, small cap trading at a premium to large cap is a little like a high yield bond trading at a premium to an investment grade bond.

Source: Compustat Data, Avondale

Note that these are median metrics for the indexes, not market cap weighted (as the published index data would be). That’s why the valuation metrics may be different than what you’ve seen elsewhere. The median P/E ratio of the S&P 500 may be worth its own post.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post