Currency moves have been relatively subdued so far this week as we have seen no major developments in financial markets; though Russia was kicked out of the G8 on Monday after political leaders took a vote.

Looking at the COT, (Commitment of Traders) reports, and open position statistics for this week, there looks to be possible opportunities for GBP/USD and USD/JPY traders.

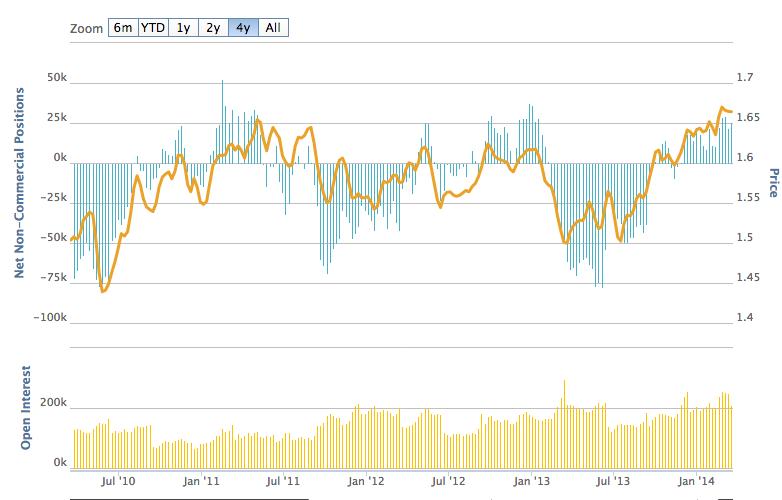

GBP/USD

As you can see from the chart, GBP/USD still trades near a 5 year high, although the currency is currently off that mark by around 300 pips at 1.6530. Even so, the chart shows that it is unusual for cable to be trading at these heights and the currency has moved past 1.65 on only a handful of occasions over the past 4 years.

Non-commercial traders are currently long here by about 25,000 contracts and this is also a relatively rare occurrence for the pair. The recent drop in price has yet to convince speculators to give up on their longs but this is the most likely possibility and we could see GBP/USD move back to 1.64 before too long.

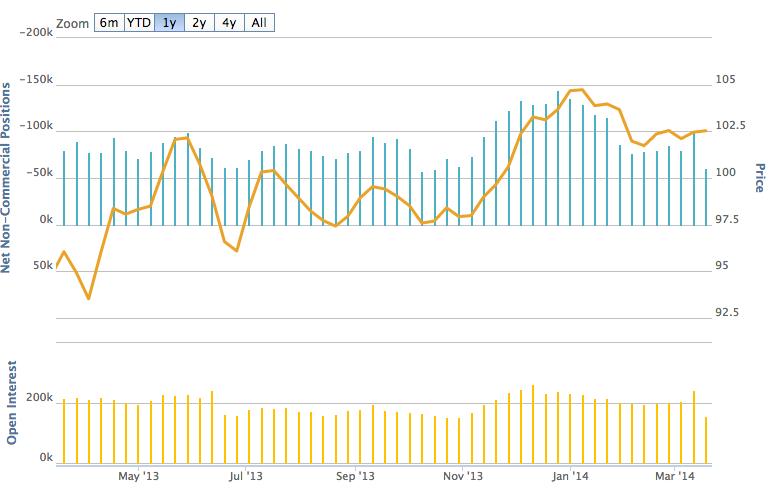

USD/JPY

Looking at the COT chart for USD/JPY and we can see that net non-commercial positions dropped back to -61,099 contracts last week while the market price consolidated around 102.

Over the past year, non-commercial positions have fallen back to the -50k to -60k area just a couple of times and on both occasions it has been a good opportunity to rejoin the upward trend.

It happened in June and October last year and it has happened here so the indication is that this is a bullish signal. This is also supported by the fact that USD/JPY has remained resilient despite the increase in net long positions. In fact, USD/JPY has ticked up, despite the big drop in net short positions. This could spell a nice period for USD/JPY as non-commercial traders re-enter the trend.