Every month, we review the latest BAML survey of global fund managers. Among the various ways of measuring investor sentiment, this is one of the better ones as the results reflect how managers are allocated in various asset classes. These managers oversee a combined $700b in assets.

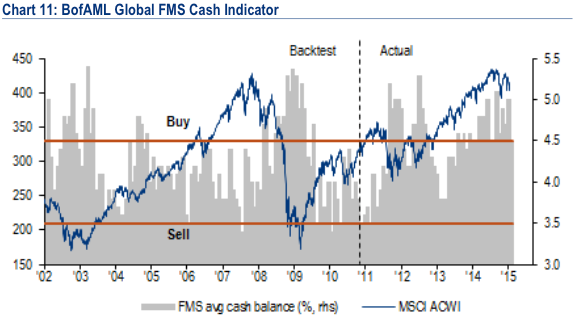

The data should be viewed mostly from a contrarian perspective; that is, when equities fall in price, allocations to cash go higher and allocations to equities go lower as investors become bearish, setting up a buy signal. When prices rise, the opposite occurs, setting up a sell signal.

To this end, fund managers became very bullish in July, September, November and December, and stocks have subsequently sold off each time. Contrariwise, there were some relative bearish extremes reached in August and October to set up new rallies. We did a recap of this pattern last month (post).

Let's review the highlights from January.

Fund managers dropped their cash levels to 4.5%. While this is relatively high on a historical basis, note that cash levels haven't been much below 4.5% since 2013. We consider current levels to be neutral.

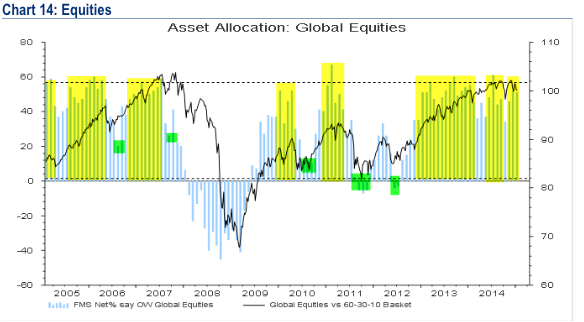

Fund managers are +51% overweight equities, unchanged from last month. The only other time equity allocations have been this great in the past year was in July; equities fell later that month. We consider current levels to be bearish.

As we have continually noted, what has been remarkable is how long managers have been highly overweight equities (virtually since the start of 2013). This is longer than any period during the 2003-07 bull market (yellow shading). In the past, after overexposure like that seen in the past 2 years, a washout low would be marked by an equity weighting under +15-20% (green shading).

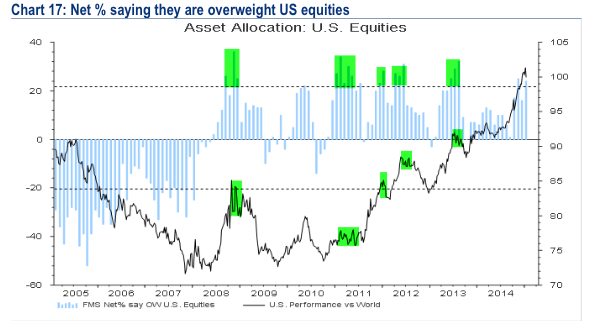

US exposure jumped to +24% overweight. Over +20% has been over-owned in the past (green shading). This is where the US equities underperform ex-US markets.

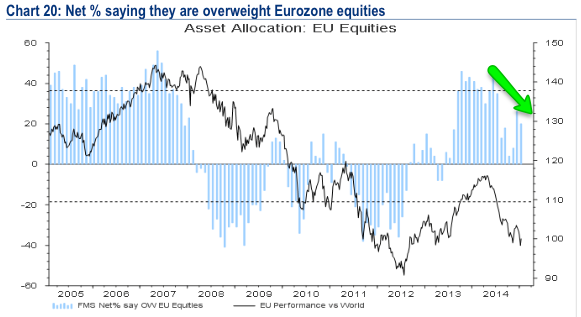

Until July, Europe had been the consensus long for 11 months in a row. Since then, the region has strongly underperformed (line in chart) and allocations fell as a result. In January, exposure was +20% overweight, which is neutral.

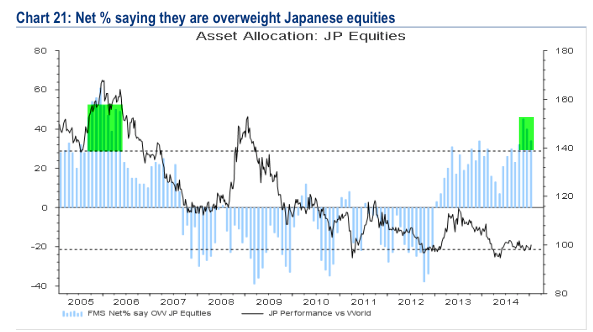

Managers have their largest equity exposure in Japan. Allocations the past three months haven't been this high since April 2006. It looks extreme. Managers expect Japan to benefit from central bank liquidity.

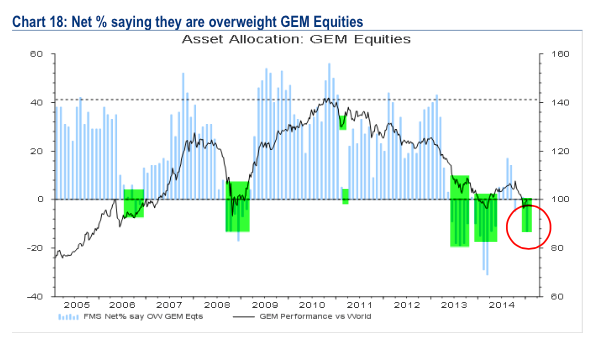

Managers were -31% underweight EEM in March 2014. This was a strong contrarian buy. In the ensuing months, the region strongly outperformed. In August, allocations increased to +17% overweight, the highest in 17 months. As we noted then, the fat pitch had passed. Exposure is now -15% underweight. This is where bottoms form, but, in the past, it has often (but not always) taken more than one month for a solid low to be put in.

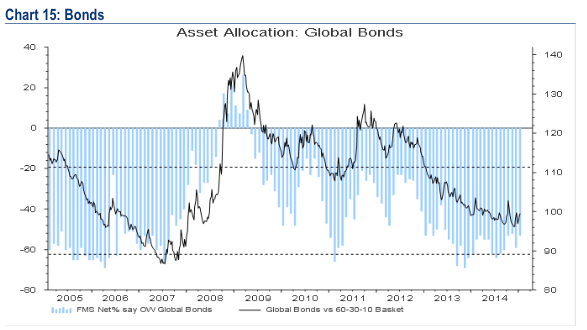

Remarkably, although US bonds outperformed SPX throughout 2014, fund managers are -53% underweight. Bonds continue to be the most hated asset class and this, in large part, explains why cash balances have not been lower that 4.5% in more than a year. For comparison, managers were -38% underweight in May 2013 before the large fall in bond prices. There is a lot of room for bond exposure to rise.

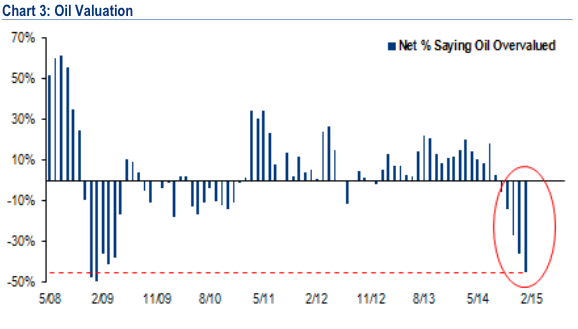

Fund managers remain -24% underweight commodities, near a 12-month low. Managers view oil as more undervalued than at any time since early 2009. This corresponded with the low in oil, from which prices rose threefold over the following two years.

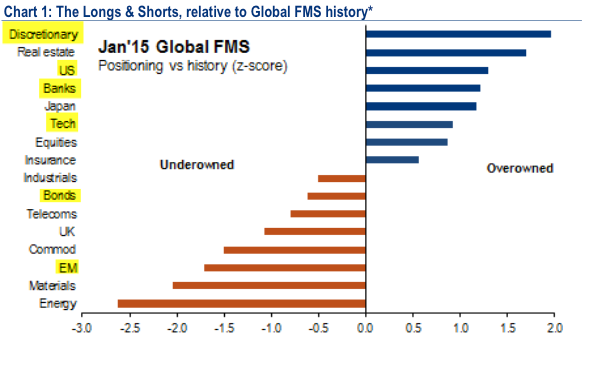

Globally, managers are not just overweight equity and underweight bonds, they are overweight the highest beta equities (technology, discretionary, banks) and underweight defensives (telecom, staples). The largest underweight is energy.

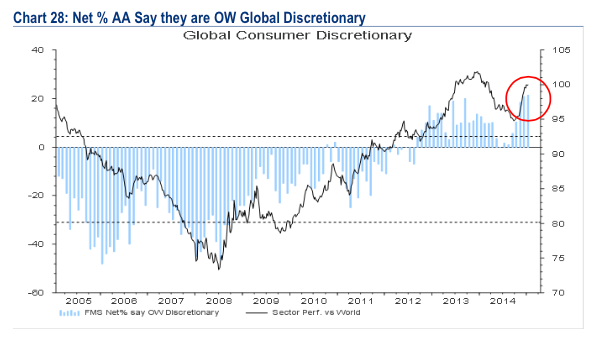

The global overweight in discretionary stocks is the highest since the survey began.

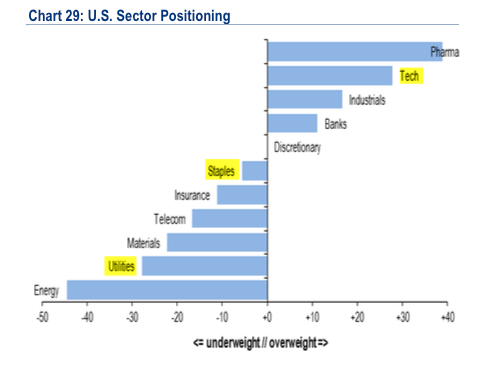

In the US, pharma (biotech) is the most favored sector, followed by tech, industrials and banks. This has been the case for many months. Utilities, staples, telecoms (defensives) and energy remain underweighted.

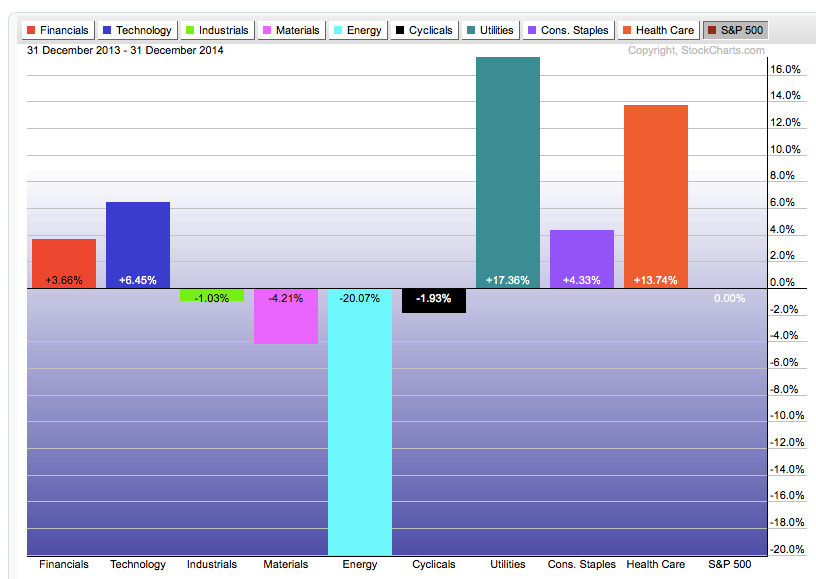

In 2014, utilities and staples, two of the least liked sectors, strongly outperformed in the US, along with health care (all defensives). Among cyclicals, only tech and financials outperformed. Energy has been the obvious loser.

Survey details are below.

- Cash (+4.5%): Cash balances sank to 4.5% from 5.0% in December. Typical range is 3.5-5%. BAML has a 4.5% contrarian buy level but we consider over 5% to be a better signal. More on this indicator here.

- Equities (+51%): A net +51% are overweight global equities, unchanged from last month. In July it was +61%, the second highest since the survey began in 2001. Over +50% is bearish. A washout low (bullish) would be under +15-20%. More on this indicator here.

- Bonds (-53%): A net -53% are now underweight bonds, a small rise from -59% in December. For comparison, they were -38% underweight in May 2013 before the large fall in bond prices.

- Regions:

- US (+24%): Exposure to the US jumped to +24% overweight from +16% in December. This is close to highest since August 2013.

- Europe (+20%): Exposure to Europe fell slightly to +20% from +26% overweight. Before August 2014, Europe had been investors' most most preferred region for 11 months in a row.

- Japan (+34%): Managers are +34% overweight Japan, down from +46% in November which was highest since April 2006. Funds were -20% underweight in December 2012 when the Japanese rally began.

- EEM (-13%): Managers dropped their EEM exposure to -13% underweight from+1% overweight in December.

5. Commodities (-24%): Managers commodity exposure remained -24% underweight, nearly the lowest in one year. With the exception of August, it has been less than -15% since early 2013. Low commodity exposure goes in hand with low sentiment towards EEM.

6. Macro: 51% expect a stronger global economy over the next 12 months, a drop from 60% in December. January 2014 was 75%, the highest reading in 3 years. This compares to a net -20% in mid-2012, at the start of the current rally.