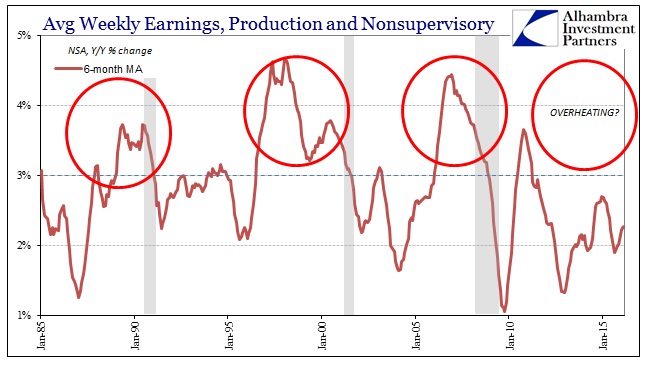

Having established the farcical nature of wage interpretations on the shortest time scale, a wider contextual framework leads in the same direction of doubt. The point of any interest rate hike for monetary policymakers is to head off “inflation” before it gets out of hand; the economy “overheating.” Having undertaken sufficient (it is assumed) stimulus to surpass whatever hysteresis calculations, putting the economy on course toward more “inflationary circumstances” (sustained growth), the monetary job turns to restraint in order to ensure that once inflation starts it doesn’t go past 2% (or if it does, not for long).

With the Phillips Curve remaining somehow as the basis for policy analyses, wages and the idea of “full employment” are the general guidelines. By the count of the unemployment rate alone, full employment seems indicated; all that is left is wage growth to corroborate. For economists believing in this kind of control and controlling variables, the emphasis on, and scrutiny of, wages particularly with all the other negativity is intense. They keep saying that they “see signs” that wages are accelerating but consumer spending and the manufacturing sector (perhaps now services, too) keep moving in the opposite.

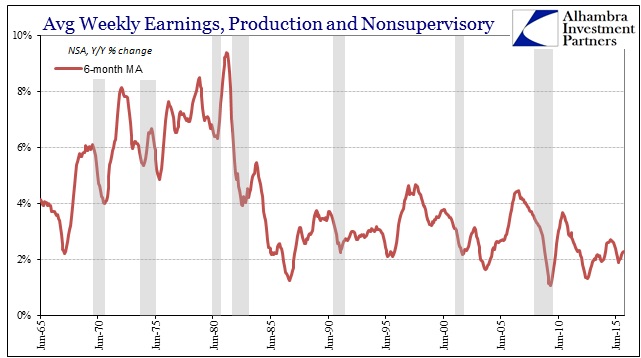

By any reasonable interpretation, earned income just isn’t there (and the above includes not just growth in wage rates but also hours to capture total earnings growth which should be quite robust at “full employment”). In fact, the longer historical perspective above downplays the dearth of income growth that we see right now.

At each of the last three cycle peaks, that is those where the unemployment rate suggested “full employment”, earnings growth was consistently better than 3.5%; we have not seen even 3% since the early days of the recovery right after the absolute bottom in job cutting (2010). February’s earnings growth was just 2.0%.

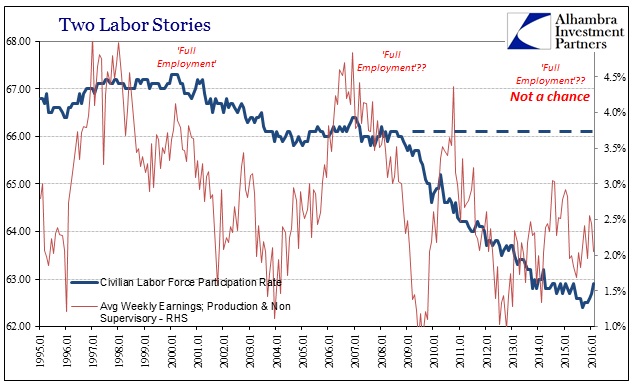

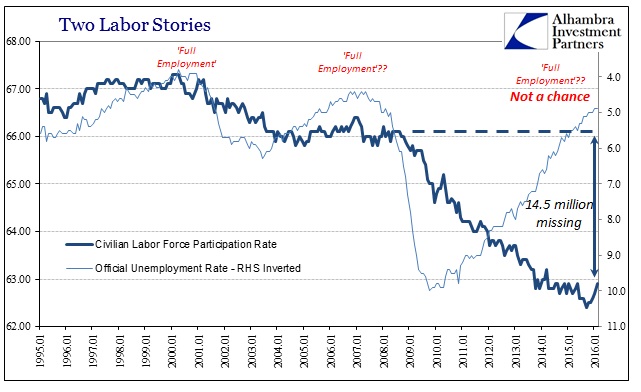

The concept of full employment as determined by the unemployment rate is historically appealing; there is no doubt about that. But as you can see plainly above, there is “something” drastically amiss in this relationship this time around. The unemployment rate has been at or below 5% for the past five months and earnings growth is instead stuck nowhere near even 3%, let alone the 4% and more received during the latter parts of the housing bubble’s adventure into full employment and overheating.

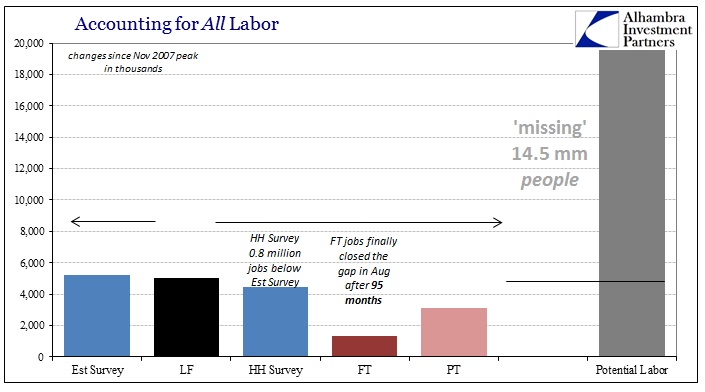

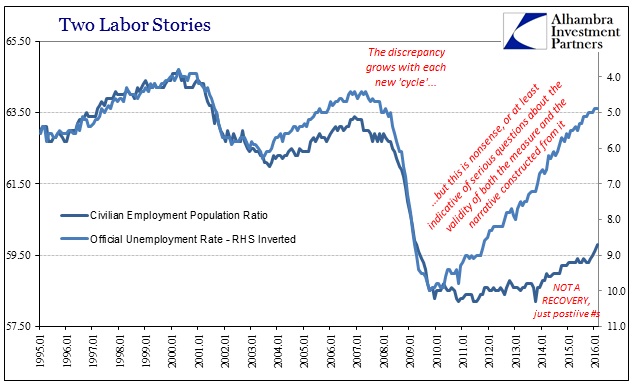

The lack of earnings growth does more closely resemble, however, the unemployment rate’s nemesis in the form of the participation rate. In other words, economic labor “slack” as defined by the real potential pool of labor outside the narrow view of the unemployment rate is corroborated by both the dangerously low participation rate as well as the lack of wage growth. Those “missing” millions in the population that have been abandoned by the official statistics do seem to actually matter.

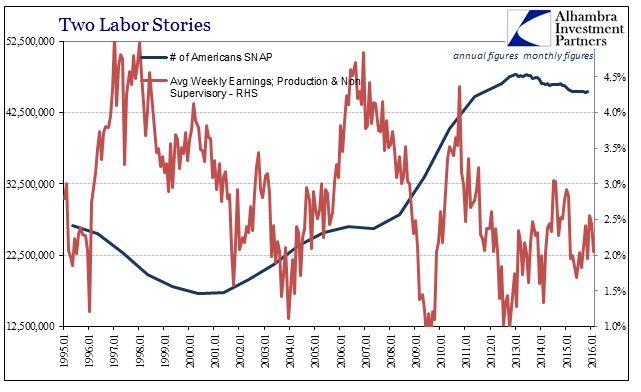

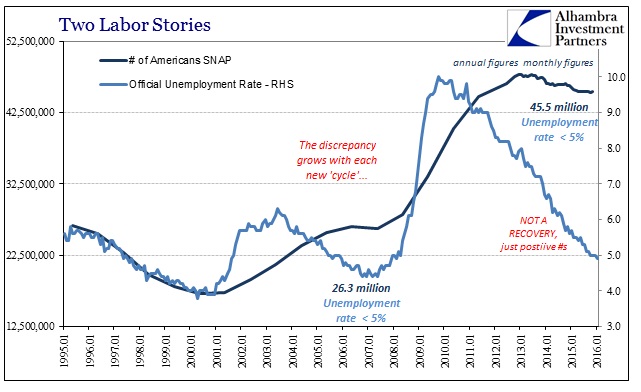

From there, the close fit of the participation rate with earnings and wages suggests that those left outside the unemployment rate are having some effects upon broad economic circumstances no matter how hard official and orthodox channels endeavor to ignore them. And if they matter as remaining “slack”, then this unfortunate probable labor supply continues to add to longer run (and likely now “cyclical”) economic attrition, leaving the economy suffering from a much reduced state as suggested by any number of ancillary reports (including SNAP).

In other words, there is no surprise to find wage and earnings growth historically low and at the same time continuous government safety net application historically high. These Americans on the outside of the “full employment” narrative are highly indicative of continuing rot upon true potential unrelated to the Phillips Curve and the 2% inflation target the Federal Reserve hasn’t met in almost four years (another clue).

Looking for signs that four QE’s actually provided enough economic boost comes up empty in wages and earnings (and so everything thereafter, too; wages to inflation to recovery). To expect otherwise is to deny reality, since robust wages and employment don’t ever accompany a manufacturing recession and relatively heightened economic uncertainty. A dearth of actual wage growth, however, is perfectly consistent with the overall economic picture that still shows such a massive proportion left on the outside; which can only suggest huge and unresolved economic imbalance. Such an economic drag especially in comparison to other “cycles” explains quite a lot about the past few years, as well as these more recent (and numerous) contradictions to full employment. In other words, even assuming QE was ever a boost, the drag of that overall structural imbalance appears to be “winning” – keeping wages and earnings down while other related negative forces erode what was left of the cyclical pieces.