Investing.com’s stocks of the week

What came at the end of our discussion yesterday will be the first item we discuss this morning, namely a currency war! Yesterday, currencies were the main focus of Donald Trump’s statements. It started with the EUR (“grossly undervalued,” see yesterday’s text) then later in the morning, the new U.S. President continued along the same lines stating that all countries were devaluing their currencies, pointing specifically to Japan and China. Was he hinting that the United States was also planning to devalue the dollar? The mere fact of uttering these words resulted in a sharp drop in the greenback against the other global currencies. The CAD was no exception, as it also took advantage of better-than-expected economic data (November GDP). The USD did rally at the end of the trading day, however.

If campaign promises are taken into consideration (promises that the new administration appears to be keeping up to now), Mr. Trump should soon be talking about the two subjects that drove the USD upward last month: corporate tax cuts and massive public investments.

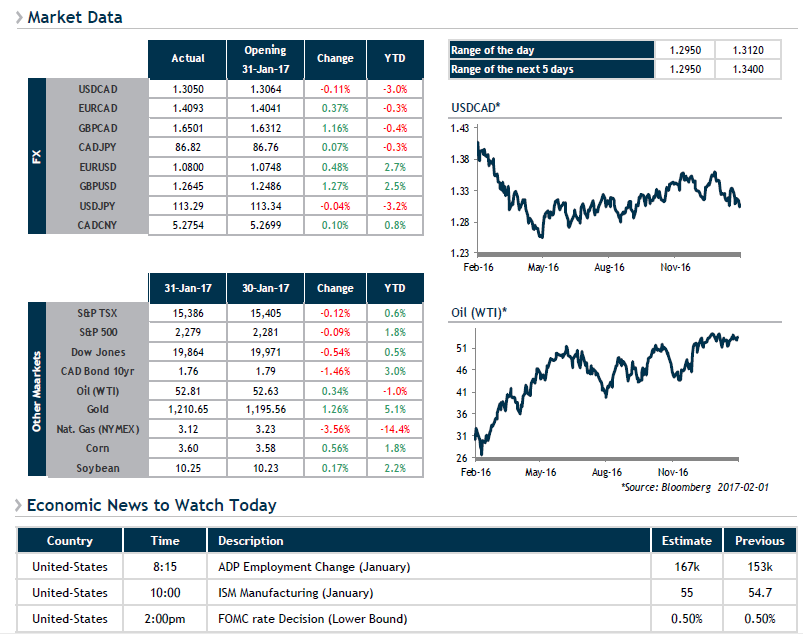

These are also two topics that could make the Federal Reserve nervous, as they are drivers of inflation. Their monetary policy decision will be announced today at 2 p.m.