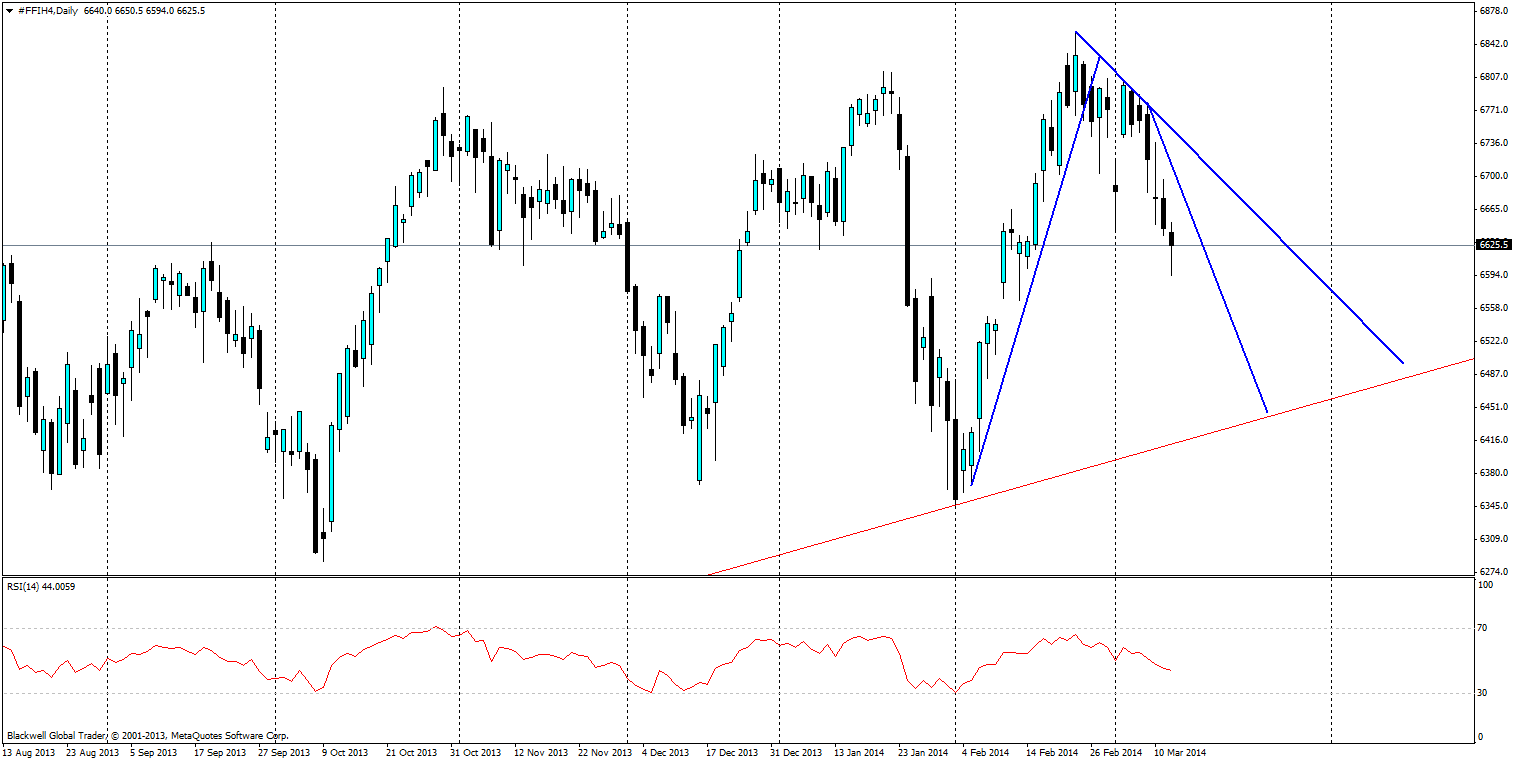

The FTSE 100 looks to be taking some heavy pressure as of late as markets look for further movements and have driven down the FTSE as markets fear it’s overbought, and that Russian problems in the east with Ukraine will spill over into neighbouring European economies.

Despite all of this happening, the FTSE is presenting some great trading opportunities and not just the usual short that is apparent in this forever ranging index.

It’s clear that the last bullish up trend had a big impact on the FTSE 100, as it looked to jump higher and certainly did. Touching the 6850 mark before pulling back just as sharply as its original jump. What is certainly clear for this pair is that highs lead to lows very quickly,with sustained downward waves.

While looking at the current downward trend in the market, it'sclear that it’s been a battle so far. Normally, the candles down are slow and trending or sharp with very small wicks. But in this case, what we see is a real battle between buyers and sellers and that’s not surprising, given recent economic events, especially with a more general positive view of the US and European economies.

Looking to catch momentum down certainly looks like the key to cashing in on the FTSE100. Nevertheless, it's important to note where support levels are in relation to the current price.

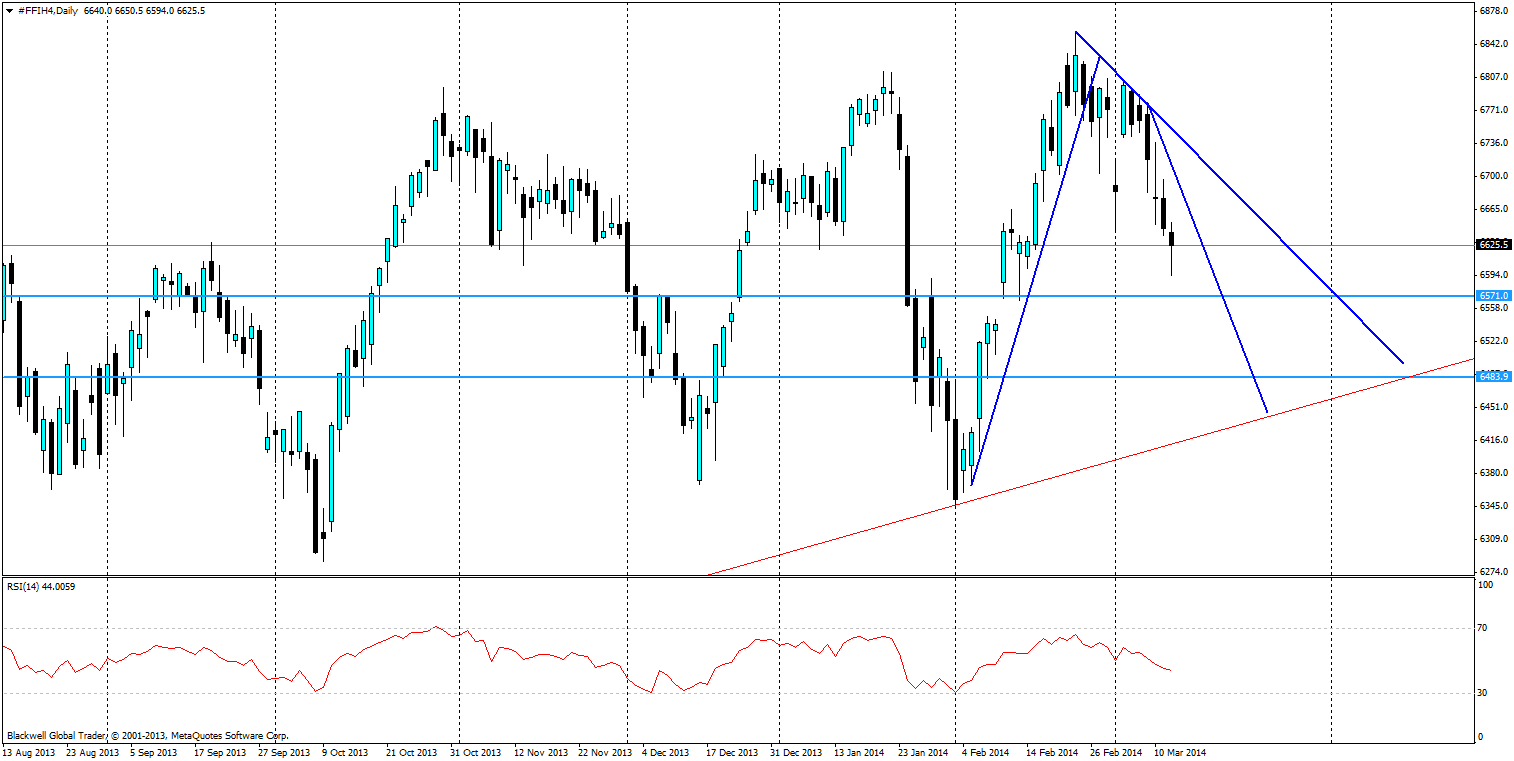

Current support levels can be found at 6571 and 6483, both of which have played previous roles in acting as solid support levels. It’s worth noting that currently, the FTSE is sitting on a support level. Lower support levels will be found at the long term bullish trend line that is in play, the one that the market is currently using as dynamic support and should be treated as an entry and exit point for bottoming out.

When looking at key resistance levels, the two downward trend lines are the obvious choices and are acting as dynamic resistance. The first and steepest can be easily broken in a massive upswing. However, the secondary downward sloping trend line is looking solid after being tested early on and market movements would certainly look to push off this key point.

While market movements for the FTSE seem to follow a pattern of a ranging motion, its i also worth noting the RSI which bottoms out at each turning point. Markets are not a fan of being oversold and it’s clear that technicals are a big driver for the FTSE.

Overall, there is still plenty of opportunity for movements lower as the RSI is still not near oversold and we have not touched on any significant resistance levels just yet. I certainly will be looking once again to capitalise on such movements and watch out for lower lows in the coming days.