Results have yet again beaten our forecasts and the management has now delivered the fourth consecutive year of earnings above expectations. The share price is up 41% over the last three months, and Treatt PLC (LON:TET) is steadily moving from commoditised sales to more value-added products. Its strategy of deep customer relationships is paying off, giving it a real competitive advantage and improving margins. The year finished strongly and momentum is due to continue in the traditionally seasonally weaker Q117. Our P&L forecasts are broadly maintained, but our fair value moves to 272p (from 240p) as a result of stronger cash flow.

From strength to strength

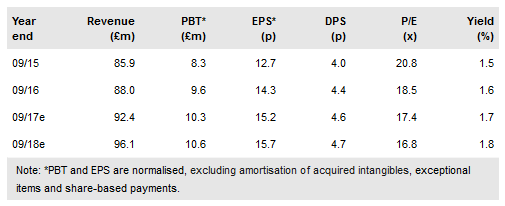

FY16 sales were in line and operating profit was 3% above our forecasts, but this was despite a net FX loss during the year. We expect the strong momentum from Q4 to continue into Q1 (which is usually seasonally weaker) and contribute towards further margin improvement. We leave our forecasts broadly unchanged, but see potential for upside given management’s conservative track record.

To read the entire report Please click on the pdf File Below