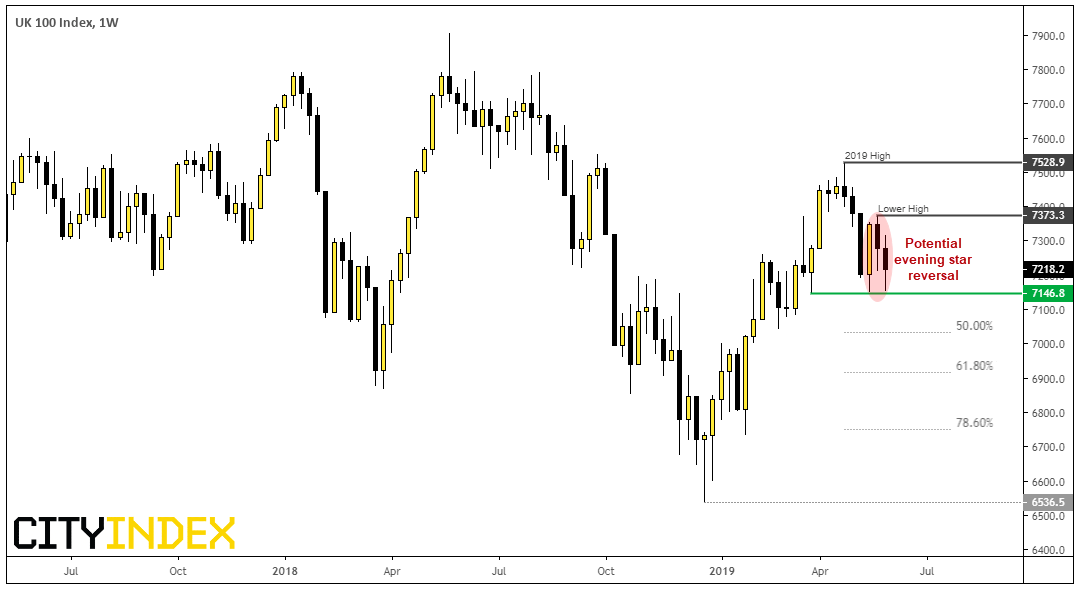

It’s the last day of the month and, barring a miraculous recovery into the close, the FTSE 100 is headed for a 3-week, bearish reversal pattern with seasonality working against it.

We can see on the weekly chart that an evening star reversal pattern is on the cusp of being confirmed. Moreover, last week’s high provides a lower-high beneath 7528 (YTD high) so bears are slowly relinquishing control. However, we’ve seen three tests of 7146.80 which is currently providing support, which makes 7146.80 is the line in the sand for bulls and bears. Whilst candlestick patterns do not project targets by themselves, we can combine them with other forms of analysis.

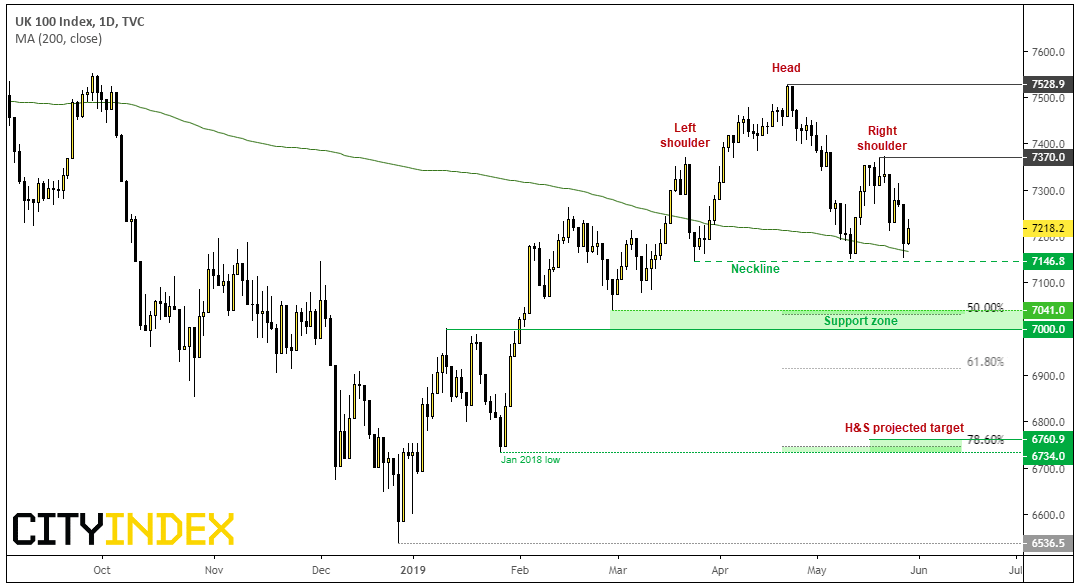

Switching to the daily chart shows a potential head and shoulders reversal chart which, if successful, projects an approximate target around 6760, and area which coincides with the 78.6% Fibonacci retracement level and January 2018 low.

Of course, it won’t be without its obstacles as the FTSE needs to clear the 200-day average, break below the 7146.80 neckline and of course the cluster of support around 7,000. But if it can break the neckline, there are targets around 7,000 and the January lows that bears will keep an eye on.

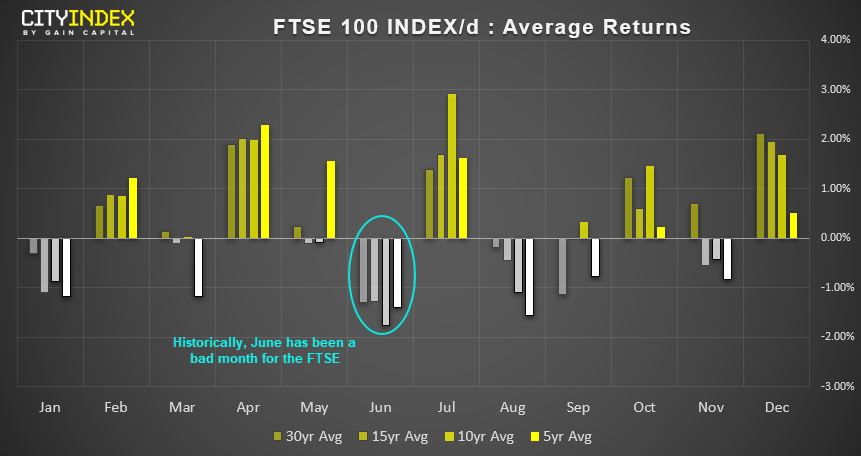

Obstacles aside, keep in mind that June has historically been a bad month for the FTSE100, so if its seasonal tendency is to play out this year, it adds another string to the bow of the bearish case.

FTSE 100: Over the past 30 years, in June:

-

70% have been negative months (the highest loss rate through the year)

-

Average return in -1.3% 9 (2nd most bearish month, behind August)

-

Average negative return of -2.8%

-

One of only three months in the year to see a negative average return, over 50% of the time (January and September are the other two)

Of course, in all the time 7146 holds as support, we could see a bounce higher. Yet the potential head and shoulders patterns remains as long as 7370 holds as resistance.