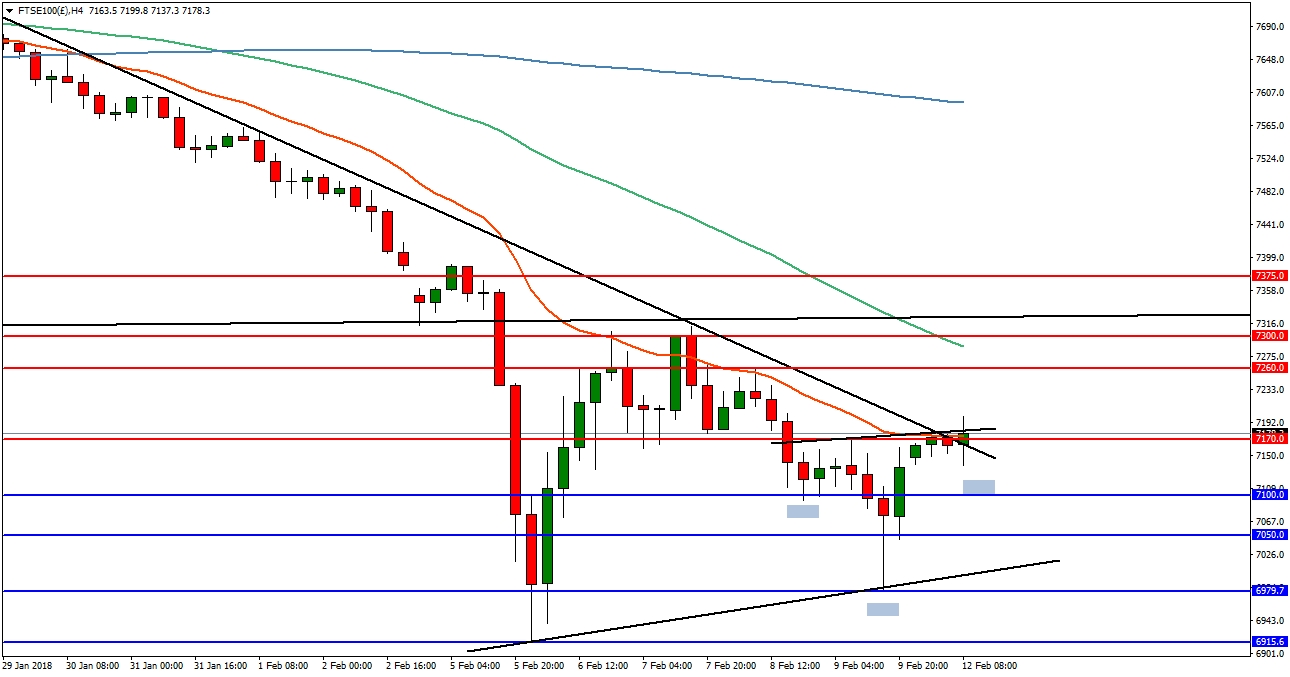

The FTSE 100 index managed to rebound without visiting the lows of 6915 after a volatile session on Friday. This morning, global equity markets have opened with bullish sentiment. In the 4-hourly timeframe, FTSE 100 is attempting to break above the falling resistance trend line, with a potential inverted head and shoulders pattern forming with a measured target of 7375. A close above 7170 is needed to provide greater confidence that a bottom is in place. Any upside move will find resistance at 7260 and then 7300. Conversely, a move below 7100 would negate the positive outlook and target support at 7050 and then 7679.

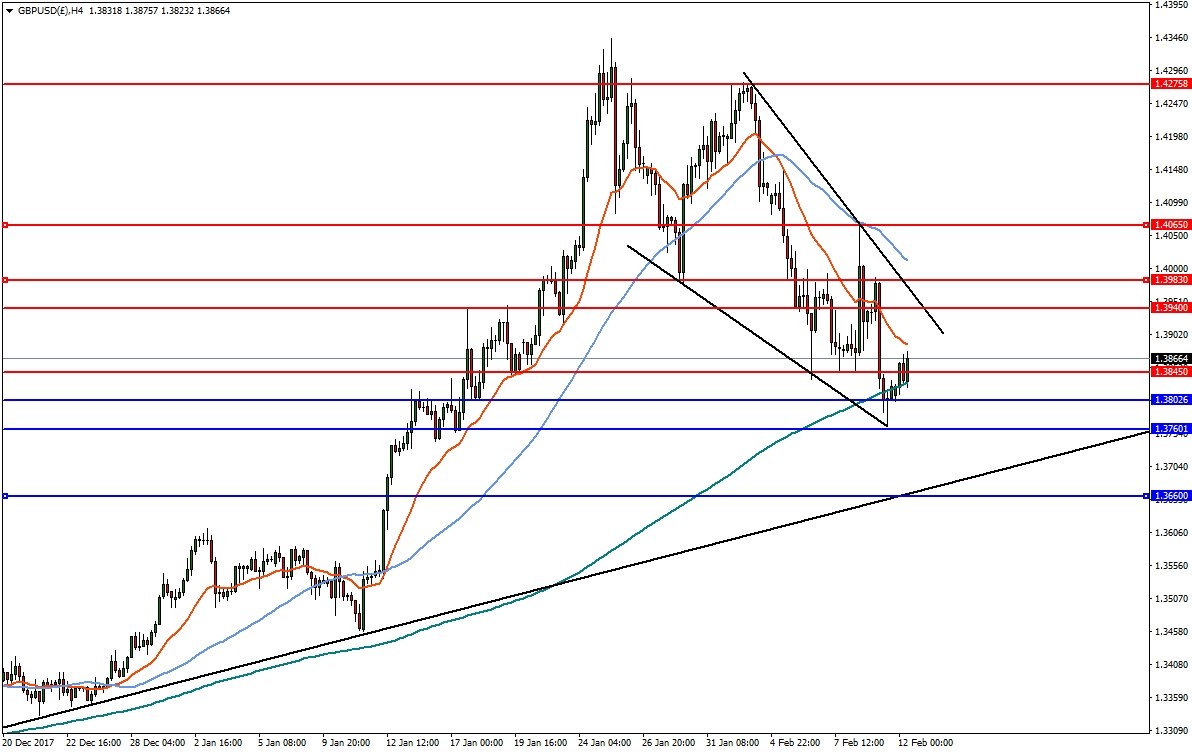

The GBP/USD currency pair suffered a sharp reversal last week from the 1.43 region. Today, the pair continues to be driven by Brexit related news and comments by Bank of England policymaker Vlieghe, who commented that a further rise in British interest rates was likely to be appropriate if a strong global economy and a labour market pick-up continued to offset Brexit issues. In the 4-hourly timeframe, GBP/USD found support near 1.3760 and has moved to trade back above the 200MA. Provided the 1.3845 level holds, a bullish move will find resistance on the trend line near 1.3940, followed by 1.3983 and 1.4065. On the flip-side, a close below 1.3845 would put the sellers in control and target 1.3800, followed by 1.3760, and then target the October trend line.