FTI Consulting (NYSE:FCN), Inc. FCN yesterday announced that Cedric Burgher has joined the company as a senior managing director in its Transactions practice within the Corporate Finance & Restructuring segment, in Houston, TX.

Burgher comes with more than 30 years of experience in the energy and financial services sectors, which includes working as a chief financial officer (“CFO”) for public and private companies. He has worked as an executive at companies like Occidental Petroleum (NYSE:OXY), EOG Resources (NYSE:EOG), Quantum (NASDAQ:QMCO) Energy Partners, KBR (NYSE:KBR) and Halliburton (NYSE:HAL), where he led IPOs, spinoffs, mergers and acquisitions, and capital market transactions.

He also has expertise in areas related to carbon management, renewable natural gas and renewable biomass. At present, he serves on the board of Renewable Biomass Group, LLC and has participated in the Oil & Gas Climate Initiative in Geneva, Switzerland.

The appointment of Cedric Burgher complements FTI Consulting’s prior hiring initiatives in order to strengthen its transactions expertise. Some latest appointments include Katy Quintanilla joining as a managing director in the Merger Integration and Carve-outs practice in December, and Guillermo Garau joining as a senior managing director in July.

Scott Bingham, co-leader of the Global Transactions practice at FTI Consulting, stated, “Cedric joins us with unique perspectives and experience, especially in the energy sector. He has overseen breakthroughs in the oil and gas industry, and his wealth of experience as a CFO enhances our ability to help clients navigate complex challenges and opportunities.”

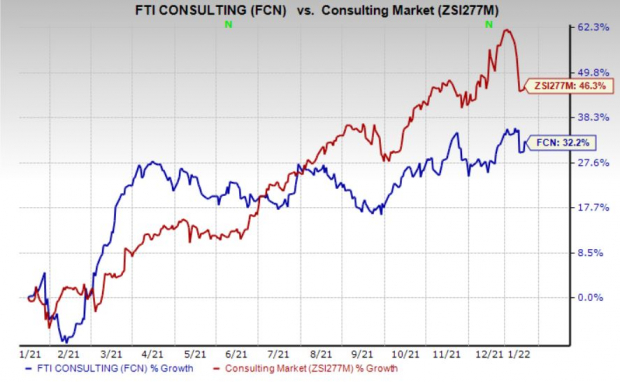

Over the past year, shares of FTI Consulting have gained 32.2%, outperforming the 46.3% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

FTI Consulting currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Business Services sector are Avis Budget (NASDAQ:CAR) CAR, Cross Country Healthcare (NASDAQ:CCRN) (CCRN) and Accenture (NYSE:ACN) (ACN), each sporting a Zacks Rank #1.

Avis Budget has an expected earnings growth rate of 420.6% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 744.3% in the past year. The company has a long-term earnings growth of 19.4%.

Cross Country Healthcare has an expected earnings growth rate of 447.8% for the current year. The company has a trailing four-quarter earnings surprise of 75%, on average.

Cross Country Healthcare’s shares have surged 201% in the past year. The company has a long-term earnings growth of 21.5%.

Accenture has an expected earnings growth rate of 19.7% for the current year. The company has a trailing four-quarter earnings surprise of 5.3%, on average.

Accenture’s shares have surged 43.2% in the past year. The company has a long-term earnings growth of 10%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN): Free Stock Analysis Report

Avis Budget Group, Inc. (CAR): Free Stock Analysis Report

FTI Consulting, Inc. (FCN): Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research