Daisy Maxey is a talented financial columnist for WSJ.com. Ms. Maxey also follows me on Twitter. Not surprisingly, then, I may be slightly hesitant to question the timing of her recent feature, “Frontier Market Funds Offer Promise, Risk.”

By the percentages, Ms Maxey cites data that is supposed to represent opportunity in the least developed countries and regions. Yet the risk-adjusted returns over a 10-year rolling period are lower for frontier markets than for other investment areas. Even if one ignores measures of risk like beta and standard deviation, the returns themselves are less palatable than those of the emerging markets, developed international markets and the United States.

Will the Next 10 years Be Better For The Frontier?

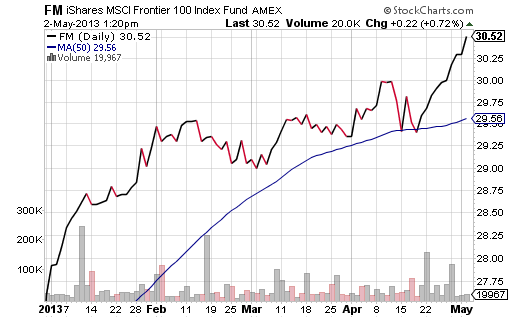

Naturally, I am curious why Ms. Maxey decided to focus on the worst 10-year annualized performer. One possibility may be the analysts in the article itself. Many seem to feel that the next 10 years will reward countries with the greatest potential for growth — countries with greater gross domestic product possibilities than that of traditional emergers like China and Brazil. Conversely, the near-term performance of a relative newcomer, iShares MSCI Frontier 100 Index Fund (FM), may have been the impetus behind discussing investments from unpaved roads less traveled.

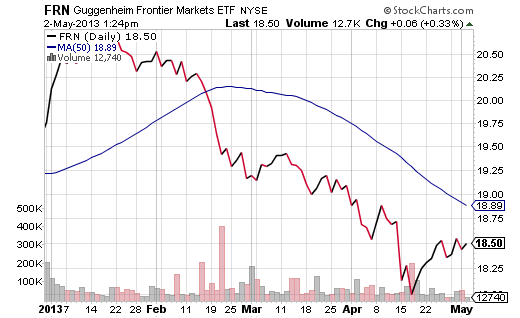

On the other hand, it is hard to dismiss the reality that frontier market performance is all over the proverbial map. Guggenheim’s long-standing Frontier Market ETF (FRN) has journeyed in the opposite direction, leaving its investors to ponder their frustrating allegiance to riskier regional assets.

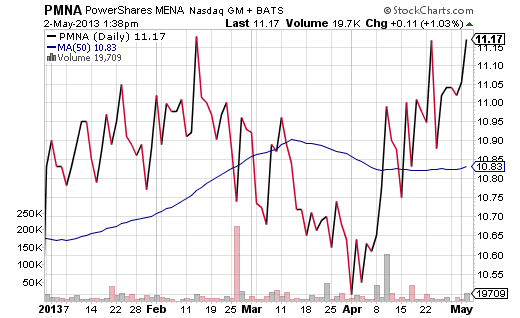

Menawhile, PowerShares Middle East North Africa Frontier (PMNA) has also been a disappointing underperformer.

So where does that leave the discussion? Wander as deep into the investment jungle as one can possibly go? Or stick with emerging markets where the risks may not be quite as great (or as exotic) as Vietnam or Peru?

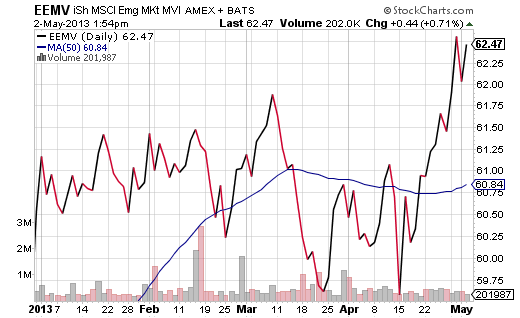

At this moment, the best risk-adjusted rewards are likely to come from less volatile non-cyclicals in the emerging markets. I like iShares MSCI Emerging Market Minimum Volatility (EEMV). There is less guesswork with respect to the breakout country ETF from the frontier or the emerging realm; moreover, there is less reliance on energy and materials to carry the day.

The net expense for the time being is a paltry 0.25%, the 30-day SEC yield is 2.75%, and the beta is 0.87 with the S&P 500. While EEMV started slow out of the 2013 gate, it has broken solidly above a 50-day moving average.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Frontier Market ETFs Or Emerging Market ETFs?

Published 05/03/2013, 02:12 AM

Frontier Market ETFs Or Emerging Market ETFs?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.