Oil all over the place

It has been a "phenomenal week" in the crude oil markets, says Saxo Bank head of commodities strategy Ole Hansen, with WTI crude prices travelling more than $22/barrel within a $10/b range as prices rallied, collapsed and rallied again yesterday. At the moment, volatilities are the highest they have been since 2009 and Hansen says that yesterday's finding of support around the 21-day moving average indicates that "bulls are in control".

Hansen adds that oil trading patterns show significant correlation to dollar levels, noting that continued strength in EUR/USD could add upside support. Though yesterday's trend was sharply higher, Hansen says that the market is still trying to find direction and will likely turn to today's US rig count data for further cues.

Looking at options, Hansen says that the biggest focus is on puts, where traders are gathering to play the downside. The question now, he adds, is whether we will seer the formation of new ranges around $55/b for Brent and $50/b for WTI, or whether the breaking of these key levels will see further extension.

The trouble with Twitter

Speaking live from Saxo Bank's trading floor in Copenhagen, equities head Peter Garnry reports on Twitter's earnings beat, saying that the company's strongly positive revenue and earnings-per-share growth hide a more troubling metric.

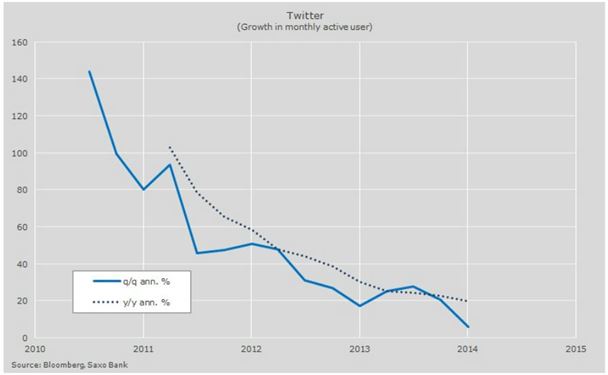

Although Twitter reported 20% user growth, says Garnry, it did so by simply comparing the fourth quarter of 2014 with that of 2013. Had they instead highlighted quarter-by-quarter growth, a significant downtrend would have been revealed. In real terms, Garnry adds, Twitter's user growth statistics are collapsing, pointing to poor long-term revenue potential. Ultimately, he concludes, Saxo's equities desk is negative on the US social media giant.

The quarter-over-quarter view shows the real trouble with Twitter's engagement profile. Source: Bloomberg, Saxo Bank

Aussie on watch

From our trading desk in Singapore, Saxo Bank's Christoffer Moltke-Leth said that the Asian session has been very quiet... with one very specific exception. According to Moltke-Leth, a less-dovish-than-expected monetary policy statement from Australia saw the Aussie dollar bounce 60 pips, with the AUDUSD rally only flagging at the $0.7860 level.

The statement also cut Australia's projected GDP growth to between 1.75% and 2.75% (from between 2% and 3% estimated in November) and may have led traders to anticipate a further rate cut on the horizon.

Mind the gap

Speaking from Saxo's Copenhagen trading floor, head of forex strategy John Hardy also notes the rally in AUDUSD, calling it a squeeze that he expects to fade. If USD is weaker after today's nonfarm payrolls report, however, he says that $0.80 represents "the final line in the sand" for shorts.

Similarly, the FX Options desk's Gustave Rieunier says that Aussie volatilities are "extremely bid", but adds that they did sell off significantly during the last spot price rally.

Still on the topic of lines in the sand, Hardy points to French president François Hollande and German chancellor Angela Merkel's visit to Moscow today, where the pair hope to rein in the escalating conflict in Ukraine.

The visit follow's yesterday's talks in Kiev, and the move by European leaders to contain the violence in Ukraine could present significant gap risks in terms of the ruble. This weekend, it will become known whether the pair return to Western Europe empty-handed or whether their talks with Russian president Vladimir Putin prove fruitful; either scenario, says Hardy, presents significant gap risks for Monday.

Strong numbers needed

Over at the fixed income desk, Saxo bond trader Michael Boye says that today's US nonfarm payolls data are the session's main focus, with treasury yields up (closing at 1.82 yesterday) from Monday's lows (1.65) as the print looms.

Boye adds that the earnings component of today's report is particularly import given its ties to inflation. Given that markets are still expecting a rate hike from the Federal Reserve this fall, he says that strong numbers are needed on this front if current expectations are to remain tenable.

Slow train comin'?

Saxo Bank head of macro strategy Mads Koefoed says that today's US nonfarm payrolls print is the elephant in the room as far as today's session is concerned, emphasising that there is certainly room for speculation on how strong January's job growth will prove to be.

As outlined in his NFP preview, Koefoed reiterates his view that today's print will come in shy of both December's figure and consensus estimates with Koefoed expecting the US economy to post 220,000 new jobs – shy of both December's 252,000 print and analyst estimates of 230,000.