The Bi Polar equities are clearly off their medication. Actually, that's not correct. Today the "hawkish" Dallas Federal Reserve President Fisher indicated that the markets would continue to receive their high octane meth direct from the dealer for the indefinite futures.

"My personal opinion is that it's not in play," Fisher told Reuters on Tuesday. "This is just too tender a moment."

The Senate hammers out some patchwork deal that staves off the threat of default for another 90 days. Boehner and company cave, but the slip in confidence threatens the "recovery" so the Fed will maintain it's easing bias.

Last Wednesday the VIX term structure inverted and the markets were gripped with panic. Now the S&Ps, RUT, and Wilshire 5000 are at All Time highs. The US Dollar is getting decimated. Metals are rallying, with Gold up about 3% and $70 off the Friday lows.

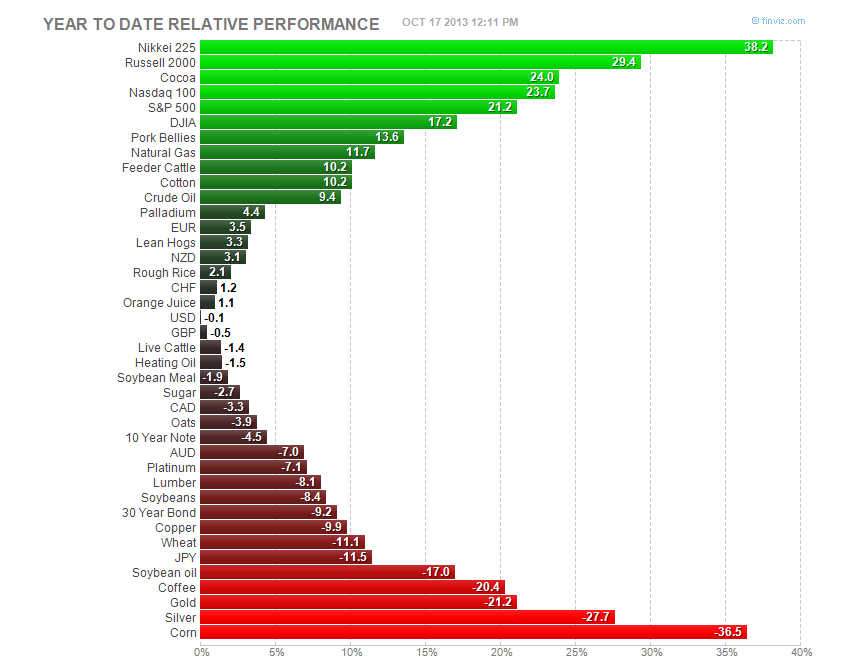

Year-To-Date Performance

The Dollar Index is unchanged. Right back to where we started the year. The Russell 2000 is up nearly 30% in 2013. The RUT is up 44% since the November 2012 (election/sequester) lows. The RUT is up 83% since the October 2011 (Eurozone, US debt downgrade) lows. The RUT is up 225% from the March 2009 lows.

Technology, as measured by the NQ 100 is up about 24% YTD. The S&Ps are up over 21% YTD and the Dow is lagging (not helped by IBM today) - up ONLY 17% since Jan 1.

The Grains, Metals, and Bonds have been under pressure most of the year. Corn was planted fencepost to fencepost after an historic drought in 2011.

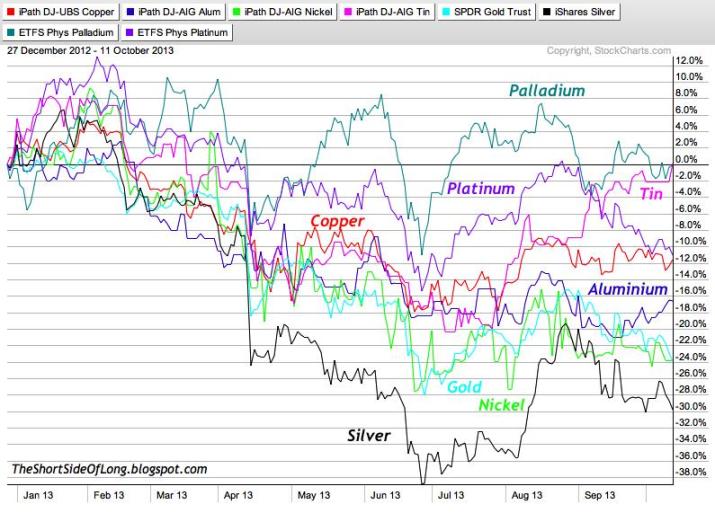

Take a look at Metals performance YTD:

Palladium is the relative star at roughly unchanged. The base metals are down between 3%-15%. Gold and Silver have lagged all year long (with the big break happening in mid April).

VIX Year to Date (spikes on Cyprus, Boston marathon bombing/Fake AP White House tweet, the threat of taper, and the recent debt ceiling drama).

- Big picture our political process and stop gap measures will work until they don't.

- Watching: The Dollar Index at "support".

- Watching: Crude Oil flirting with multi month lows (CLZ13 = 99.65 on August 8th) on options expiration day. See also: term structure plays and relationship spreads with Brent.

- Currencies: Euro flirting with multi year highs around 137. Pound has big move on good retail sales data. Swiss Franc moving in sympathy. Yen catches a bid too....can't seem to break Par with the Buck.

- Equity options expiration tomorrow. ALL TIME HIGHS.

- VIX compression, back to levels where hedges seem cheap.

- Considering: SHORT the EMini S&Ps, LONG the MiniDow for a compression trade.