Right now, the consensus seems to be that nothing in the economy or the markets can go wrong. Optimism abounds, even though history shows that boom-and-bust cycles are a permanent fixture.

What’s more, there’s a classic boom-bust cycle going on at this very moment – and it’s easy to see if you look closely.

That’s because every cycle has similar elements… and that should make the oil and natural gas industries very, very nervous.

The boom starts with optimism, and confidence in higher prices spurs investment. Speculators then stoke that optimism by pushing prices higher, leading to even greater spending.

Meanwhile, debt accumulates, and after a period of time, supply begins to overwhelm demand.

Excess supply drives prices down, leading to the bust. Debt becomes unserviceable for the overleveraged, and the default cycle begins.

The bigger the excesses and debt levels, the bigger the bust… and today’s energy sector could be heading for a very big bust.

The U.S. Energy Boom

It’s no secret that the United States has undergone an energy renaissance, driven primarily by the shale boom.

In fact, America became the world’s largest natural gas producer in 2010 and has now eclipsed Saudi Arabia as the biggest oil producer, as well.

Despite the increased difficulty of fossil fuel extraction, supply has swelled. Elevated oil prices have made expensive extraction techniques, such as hydraulic fracturing (fracking) and deep sea drilling, economically viable.

However, these techniques require significant capital expenditures (capex). According to Ernst & Young, there are 365 global oil and gas mega-projects (those with a proposed capital investment greater than $1 billion).

These projects total $2.6 trillion across the exploration and production (upstream), liquefied natural gas (LNG), pipeline, and refining segments. The U.S. share of this investment is $482 billion.

But how can the U.S. energy sector afford nearly half a trillion dollars in mega-projects?

For starters, we can thank the Federal Reserve!

The low-interest-rate environment and continued central bank stimulus have helped energy companies ramp their capex via cheap, ubiquitous financing. Consequently, debt levels in the energy sector have soared.

For example, Linn Energy, LLC (NASDAQ:LINE), a favorite stock for yield hogs due to its 10%-plus yield, has increased its long-term debt levels from $2.7 billion at the end of 2010 to $9.6 billion currently.

The Energy Information Administration (EIA) estimates that, in the last year alone, major oil and natural gas companies added over $100 billion in net debt.

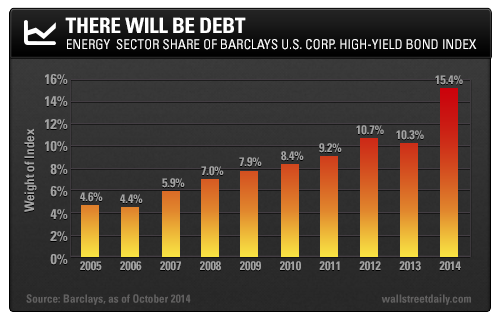

In fact, aggregate debt levels in the energy sector are rising so rapidly that they’ve transformed the composition of the Barclays U.S. High Yield Bond Index:

Similarly, the popular iShares iBoxx High Yield Corp Bond ETF (ARCA:HYG) is now more exposed to oil and gas, at 14.5%, than any other single sector.

Unfortunately, I don’t think many high-yield debt investors realize just how exposed they are to declining oil prices. Even institutional fixed-income investors typically don’t think on a macro level like this, let alone retail investors in high-yield ETFs.

The Coming Bust

Today, slowing global economic growth, increasing supply, a stronger US dollar, and a decrease in bullish speculative bets are all putting downward pressure on the price of oil.

The price of West Texas Intermediate (WTI), for example, has fallen 15% this year and is currently under $80 per barrel. The price of Brent crude has declined over 20% year to date.

Yet Douglas-Westwood, an energy advisory firm, estimates that nearly half of the oil projects under development need oil prices greater than $120 per barrel to achieve positive cash flow.

Thus, while lower oil prices may be welcomed by consumers, they’re a nightmare for debt-laden oil producers.

And worst of all, costs (capex per barrel) have been rising at a 10%-plus compound annual growth rate since 1999, according to the IEA and Barclays Research.

There Will Be Blood

Now, don’t get me wrong… The shale boom is great in the sense that it’s creating tens of thousands of jobs and leading to further U.S. energy independence.

However, the buildup of leverage will ultimately hurt many unsuspecting equity and debt investors.

Martin S. Fridson, a prominent figure in the high-yield bond market, sees as much as $1.6 trillion in high-yield defaults coming in a surge that he expects to begin shortly.

If the price of oil remains depressed, the energy sector (and the broader commodity complex) could be what sets the default cycle in motion.

So even though there are many cheap energy stocks, the companies need to have reasonable debt levels to be investable.

Finally, stay alert, because we’re going to start to see a deluge of dividend and master limited partnership distribution cuts, and then… there will be defaults.

Safe (and high-yield) investing,

BY Alan Gula, CFA