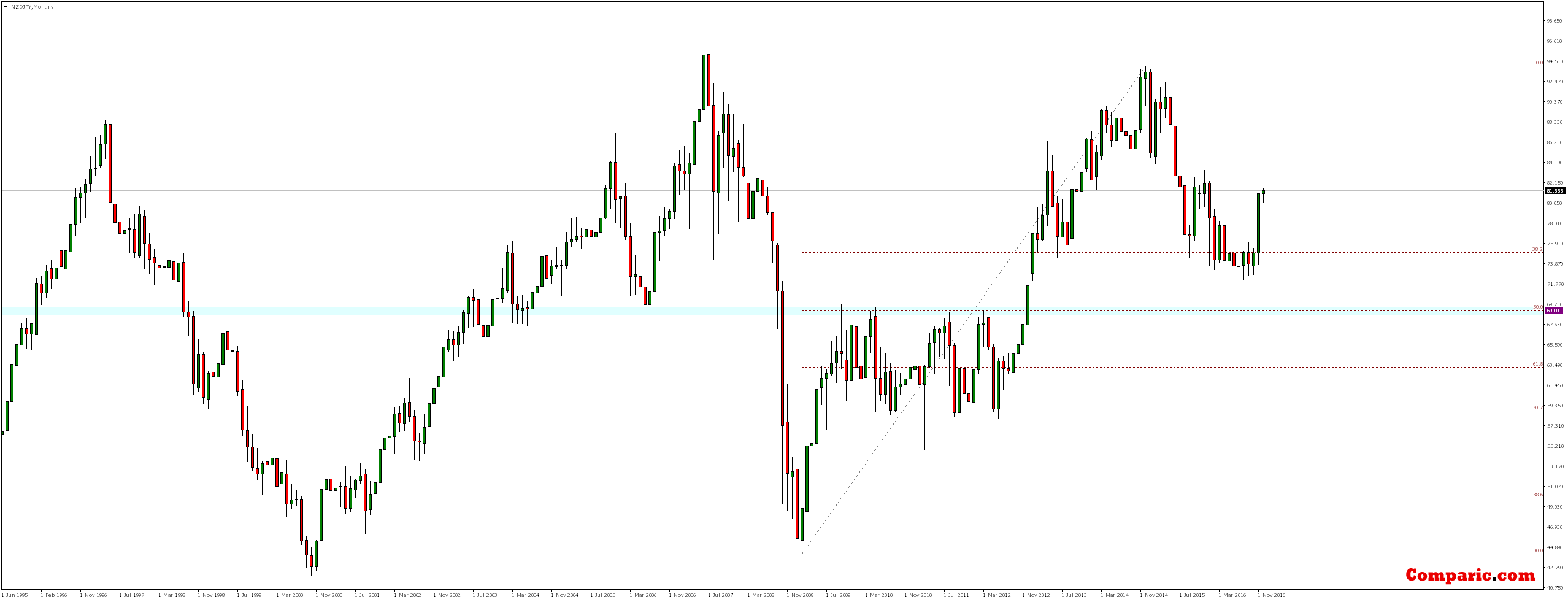

After declines lasting since January 2015 in June reached very important support around level 69.00, coinciding with 50% Fibonacci correction of the earlier over six-year increases. The rejection of this level resulted in gains, which increased in November.

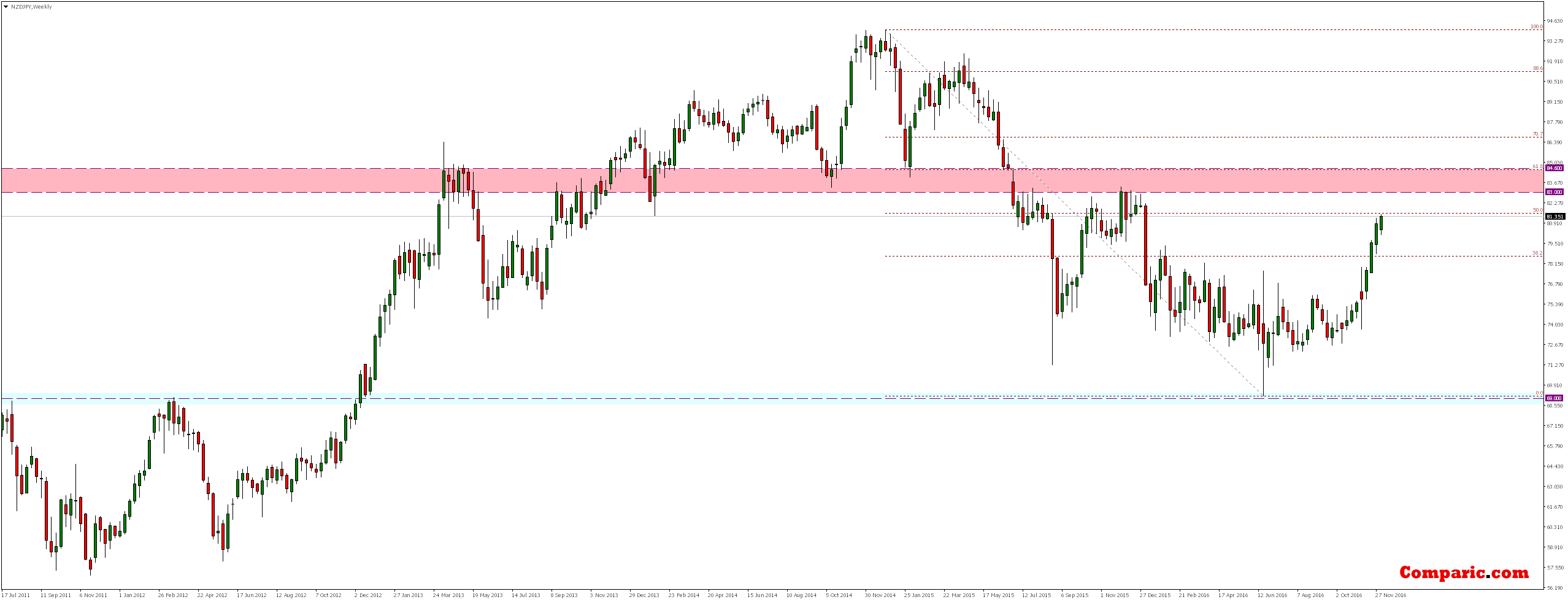

On the weekly chart, we see that market is currently around 50% of the momentum of these declines. From a technical point of view, gain could continue to around a level of 83.00 or 84.60 coinciding with 61.8% Fibonacci level.

Looking on the daily chart, we see that even if in the near future there will be a reaction of bears, a potential drop could be only a correction re-testing defeated on November 24th this year at the level of 79.15.

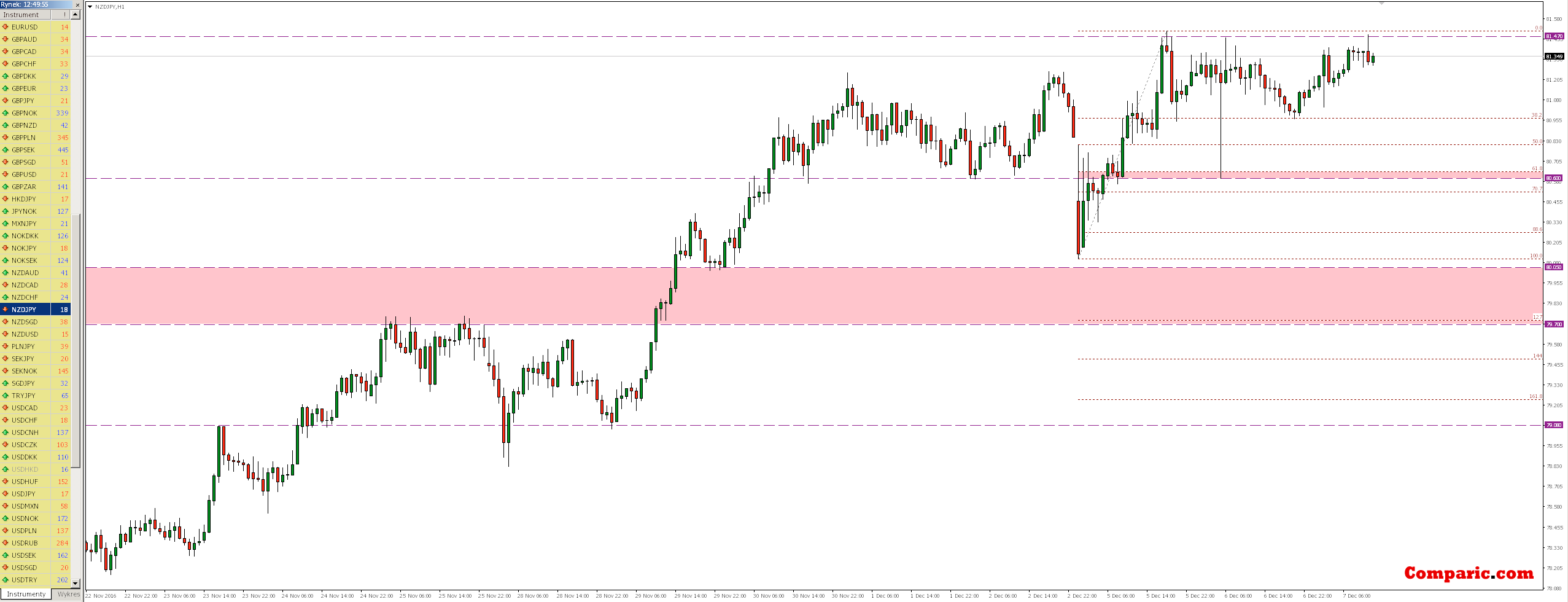

On the H1 chart we see that the market since Monday evening is oscillating around the level of 81.47. Defeat of it could pave the way for further gain. However, if this resistance will be rejected, the nearest support turns out to be 38.2% Fibonacci correction coinciding with yesterday’s lows and further support zone around 80.60.