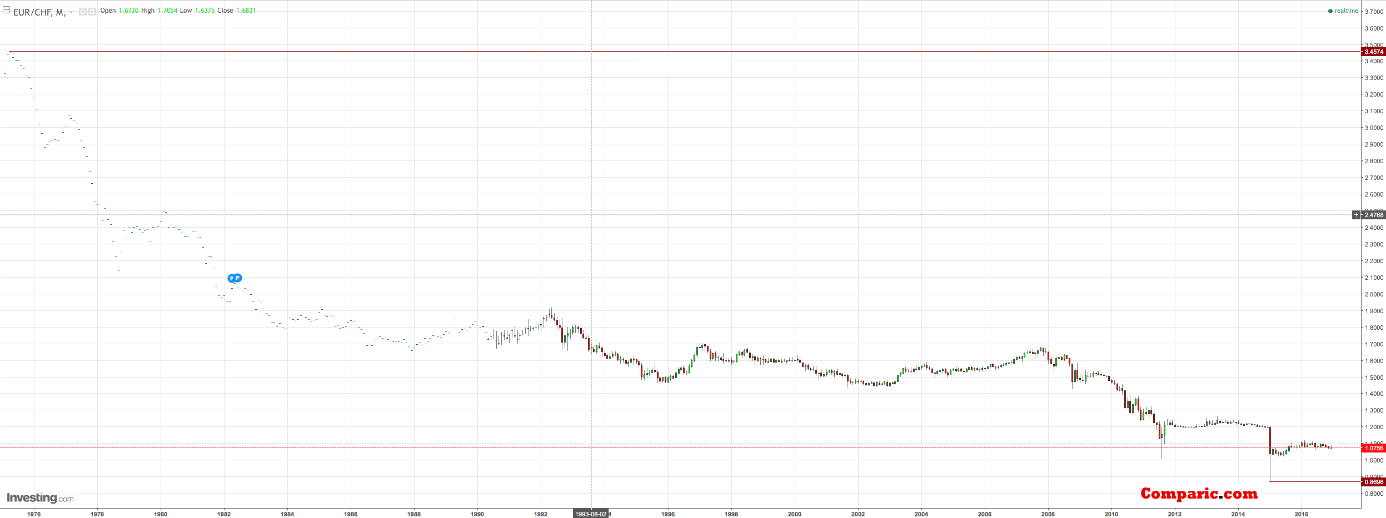

EUR/CHF almost from the beginning of quoting moves down. Historical highs which were established in April 1975 can be found at 3.4574 while the low happened during the “black Thursday” in January 2015 years and is at 0.8696.

Taking a closer look at the current situation on monthly chart we see that almost for two years market is moving in consolidation where the upper limit was defeated in the “black Thursday” support at 1.1150 (now resistance). Given that for a long time price oscillates in the area of upper limit of the box and the downtrend line in the near future we expect a decline for which potential support turns out to be 1.0210.

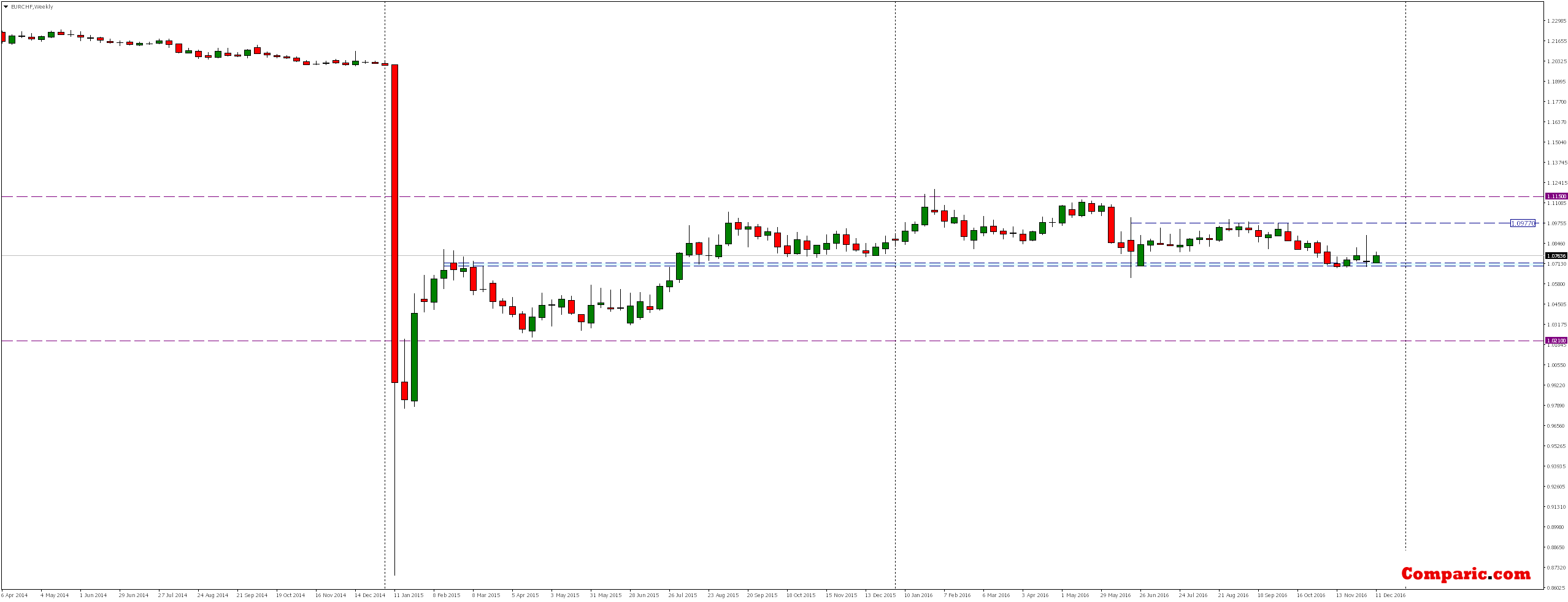

Looking on the weekly chart we see that market is currently oscillating around the support zone coinciding with the level of momentum 50% Fibonacci correction of the ongoing from April 2015 until January 2016 growth. The rejection of this zone could result in increases in the vicinity of the local resistance 1.0977.

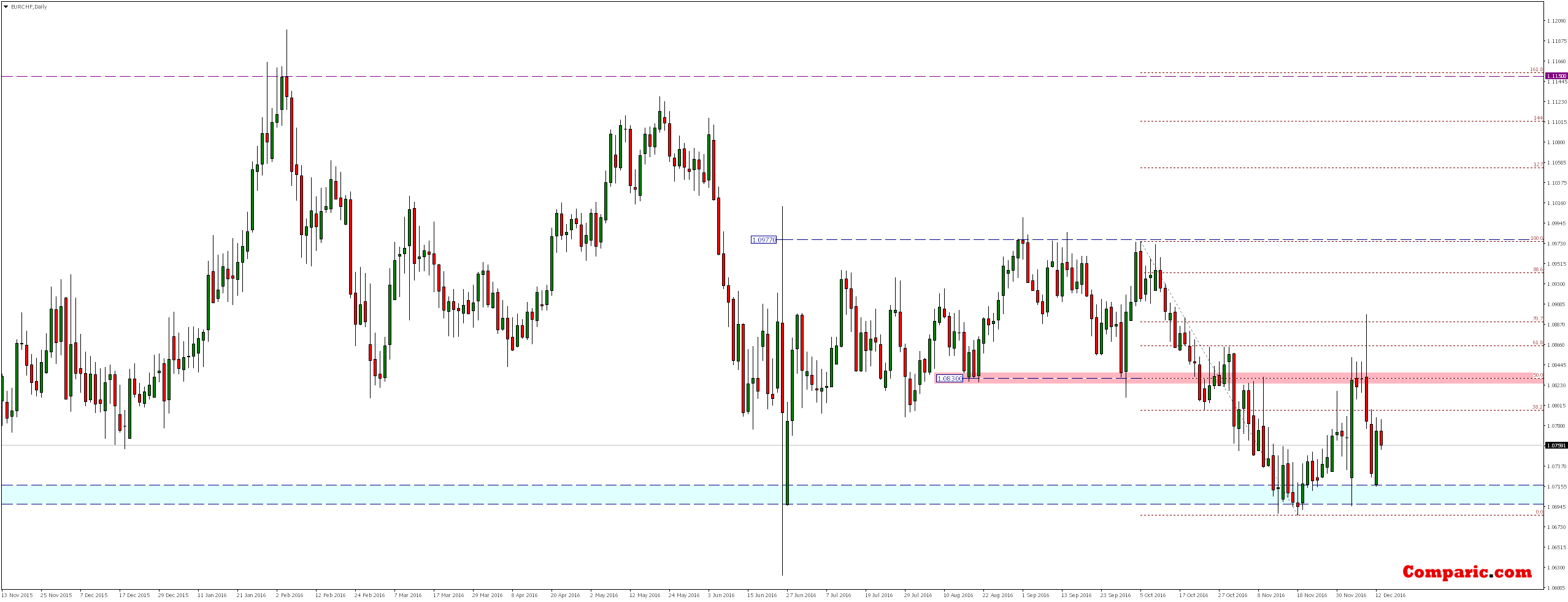

On daily chart we see that lasting from mid-November growth reached only the area of the local resistance coinciding with the momentum of 50% Fibo. According to the box theory, such a situation can predict impending defeat of support area, breaking the bottom and continuation of declines in close future.

Bearish scenario is also supported by present situation on the H1 chart where we see that increases lasting from beginning of the week have not reached even the zone of resistance and creating of double top pattern has already rejected the level of around 38.2% Fibonacci correction of last week’s declines.