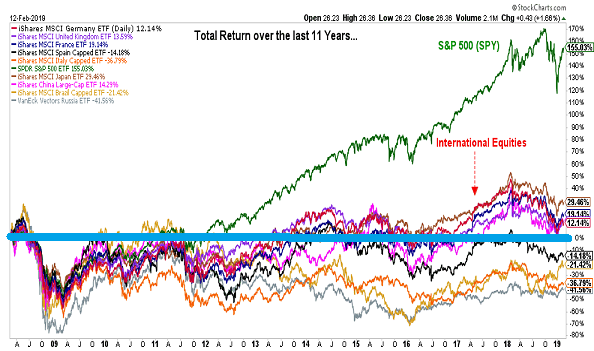

Leading into 2008, emerging market stocks and international stocks dominated financial shows. “Talking heads” agreed that investors should allocate as much as 50% overseas for a well-diversified portfolio.

The reasoning? One should be aligned with the world’s stock market pie. After all, half of the world’s market capitalization belonged to U.S. stocks and half belonged to stocks from elsewhere around the globe.

However, the real reason had little to do with market capitalization. In truth, foreign stocks were dramatically outperforming U.S. stocks. You had to be in the “euro-zone.” You had to be in “BRIC” (Brazil, Russia, India, China). In essence, you had to invest more in the winners.

Since 2008, however, allocating abroad has been an exercise in futility. Whereas the U.S. market has experienced admirable total return gains that have largely erased memories of its “lost decade” (2000-2009), non-U.S. equities have netted next to nothing for 11 years.

What do you hear these days about diversifying with non-U.S. stocks? Maybe you are coming across a 20th century heuristic such as 20%. You certainly don’t hear about placing 50% of your money in foreign equities because half of the world’s market capitalization belongs to non-U.S. public companies.

Ironically enough, there are quite a few advocates for allocating 0% to foreign equities. The rationale? Scores of U.S. corporations derive as much as half of their revenue and/or earnings from overseas operations. According to this shift in thinking, a U.S.-only stock investor is diversified already.

Sounds like yet another effort to back into the recent decade’s winner. 50% in 2008. 0% in 2019.

It is worth noting, of course, that any country/regional diversification since the financial crisis has hurt. What’s more, a fair-minded assessment of stocks as an asset class should account for the adverse effect of non-U.S. equity exposure.

For instance, did a global equity bear actually begin in 2018? Or do the eight consecutive weeks of recovery imply that flip-flopping central banks have placed a permanent floor underneath stock declines?

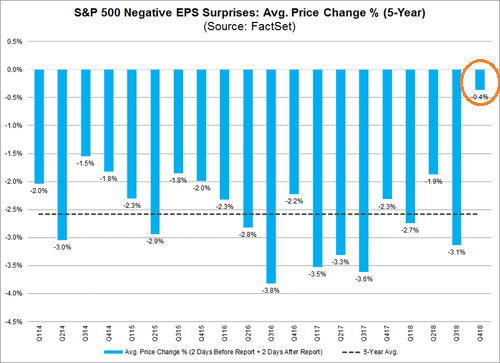

One thing is for certain: U.S. stocks are back in favor. So much so, in fact, that bad earnings news go unpunished.

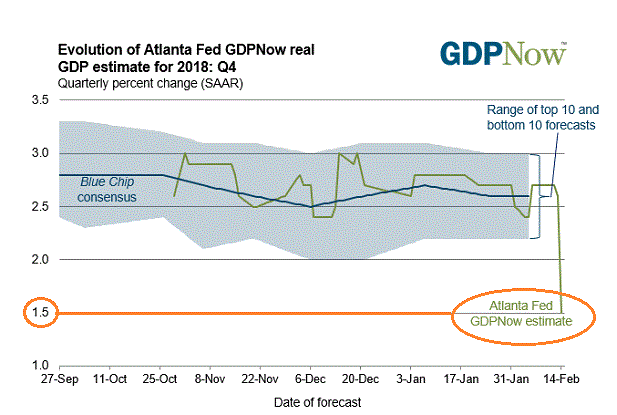

And bad economic news? Well that just means the Fed and other central banks will remain accommodating.

Bear in mind, the recent tax reform stimulus was supposed to bolster 2% economic growth up into the 3%-4% range. Nobody seems to be talking about 3% anymore.

In light of diminishing economic prospects, both in the U.S. and in influential economies abroad, many are crediting the Federal Reserve’s sensible retreat. Yet the full effects of on-the-fly decision making may not be felt for quite some time.

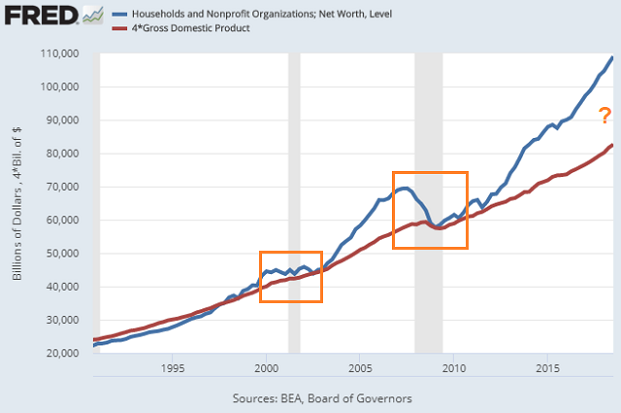

Consider what the Fed needed to do to lessen the impact of the three previous recessions. Committee members needed to bring the Fed Funds overnight lending rate down by an average of 500 basis points. And it still did not prevent two 50%-plus stock bears.

If a recession begins in 2019 or 2020, the Fed may have a paltry 225 basis points for lowering the overnight lending rate. (Unless negative interest-rate policy is introduced as well.) It is also unclear how many more trillions of electronic dollar credits would have to be created out of thin air to buy U.S. Treasuries and other struggling assets to promote liquidity as well as stimulate borrowing. The existing $4 trillion on the Fed books is already rather daunting.

What is largely forgotten with investor infatuation for central banks is that their actions are unlikely to prevent the next downturn nor eliminate bearish price depreciation. Are we not going to see household net worth that is largely comprised of stocks, bonds and real estate revert back to the economic trendline? If so, asset prices would move sideways for an extended period or, more likely, plummet.

It may be easy for some folks to exclaim that they relish the opportunity to buy the next big bearish dip. On the other hand, you cannot acquire stocks or real estate or any asset that has lost one-third or one-half of its value without cash on the sidelines.

Cash may be trash when the Fed makes it worth 0%. But today? Cash equivalents like SPDR 1-3 Month T Bil (NYSE:BIL), First Trust Enhanced Short Maturity (NASDAQ:FTSM) and JP Morgan Ultra Short Income (NYSE:JPST) are competitive with the 10-year Treasury Bond yield of 2.63%.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.