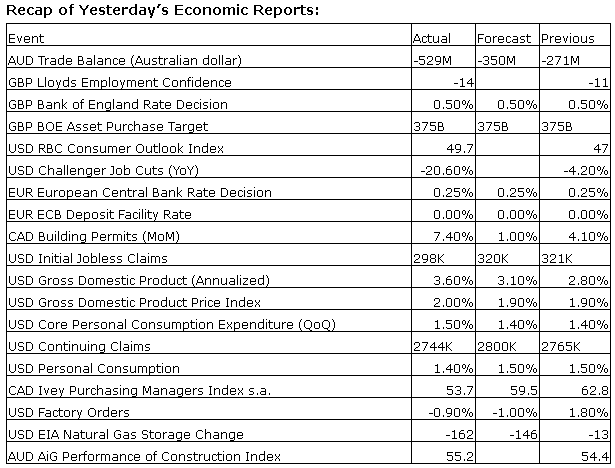

Upcoming US Events for Today:

- Employment Situation for November will be released at 8:30am. The market expects Nonfarm Payrolls to increase by 180,000 versus 204,000 previous. Private Payrolls are expected to increase by 173,000 versus 212,000 previous. The Unemployment Rate is expected to tick lower to 7.2% from 7.3% previous.

- Personal Income and Outlays for October will be released at 8:30am. The market expects Personal Income to increase by 0.3% on a month-over-month basis versus an increase of 0.5% previous. Consumer Spending is expected to increase by 0.3% versus an increase of 0.2% previous.

- Consumer Sentiment for December will be released at 9:55am.The market expects 75.5 versus 75.1 previous.

- Consumer Credit for October will be released at 3:00pm. The market expects $15.0B versus $13.7B previous.

Upcoming International Events for Today:

- German Factory Orders for October will be released at 6:00am EST. The market expects a year-over-year increase of 3.6% versus an increase of 7.9% previous.

- Canadian Labour Force Survey for November will be released at 8:30am EST. The market expects an increase of 13,000 versus an increase of 13,200 previous. The Unemployment Rate is expected to tick higher to 7.0% versus 6.9% previous.

The Markets

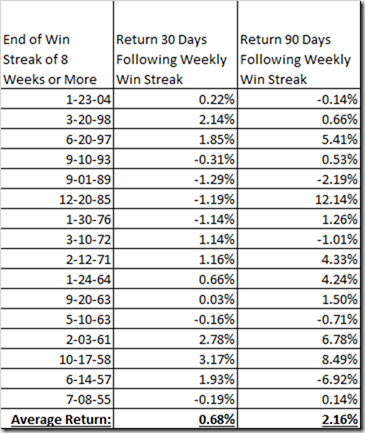

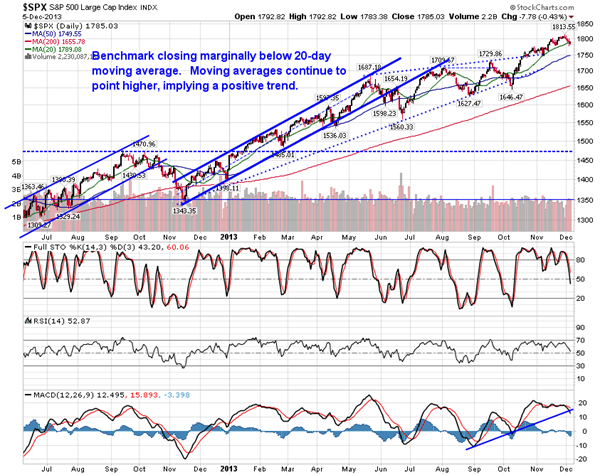

Stocks declined for a fifth straight session on Thursday, which saw the S&P 500 tie the longest consecutive daily decline of the year. The large cap benchmark is now at risk of positing the first negative week since the quarter began, capping off an 8 week win streak, the longest since January of 2004. A total of 16 win streaks accounting 8 weeks or more have been recorded over the last 60 years, and while each has eventually led into a negative short-term period, gains were the average both 30 days and 90 days following each event. The S&P 500 gained an average of 0.68% 30-days following a consecutive weekly win streak of 8 weeks or more; 2.16% was the average gain 90-days following. The two win streaks over the last 60 years that concluded in the fourth quarter went on to see gains of over 8% and 12% in the three month period to follow. The trend is your friend until it ends.

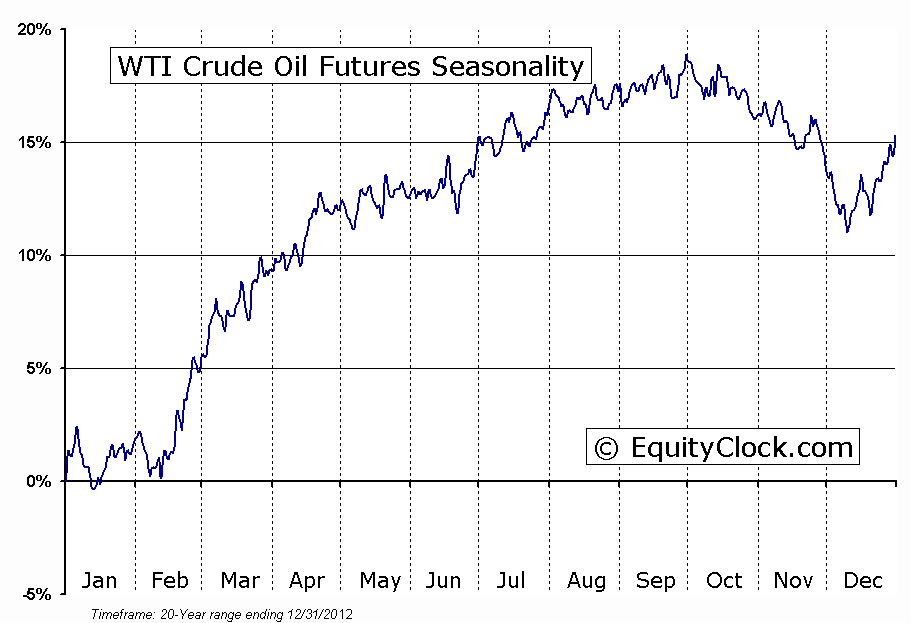

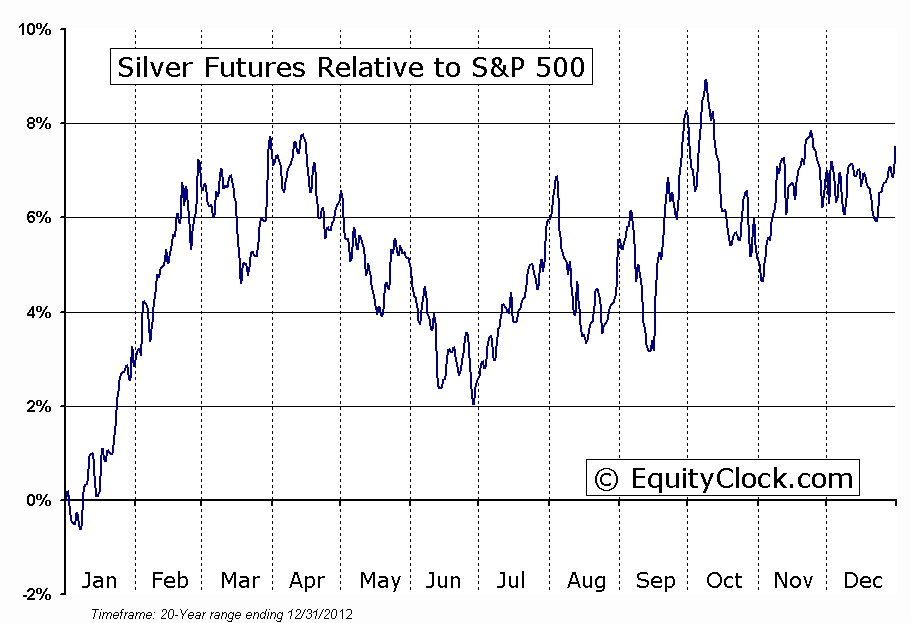

The commodity market is at an interesting juncture with positive seasonal tendencies directly ahead. The CRB commodity index has bounced over recent days, rebounding from a declining long-term trendline that stretches back to mid-2012. The benchmark had traded above this trendline in the summer of this year, suggesting a bottoming process may be in the works. Commodity prices, according to the index, recently became the most oversold since June of 2012, exhausting the downside pressures on the benchmark, leading to the rebound that continues to play out. Seasonal tendencies for Oil, Silver, Copper, Platinum, Palladium, Corn, Frozen Pork Bellies, and Gasoline turn positive into the new year, potentially acting as a tailwind for further gains to come.

The price of Crude Oil has now bounced from around a point of support at $91; the commodity is reaching towards a point of resistance around $98. Oil recently broke above its 20-day moving average, now the 50-day has become a key hurdle level. Seasonal tendencies for Oil turn positive mid-February.

Silver is also coming down to test a key point of support, presented by the June low around $18. The commodity remains constrained by a declining long-term trendline, however, should support hold at the summer lows, a launching pad into the period of seasonal strength that starts mid-December may be presented. Seasonal tendencies remain positive through February. Disinflationary pressures continue to restrain upside momentum in the commodity market, however, improving economic data, particularly in the area of manufacturing and production, could act as positive catalyst in the months ahead.

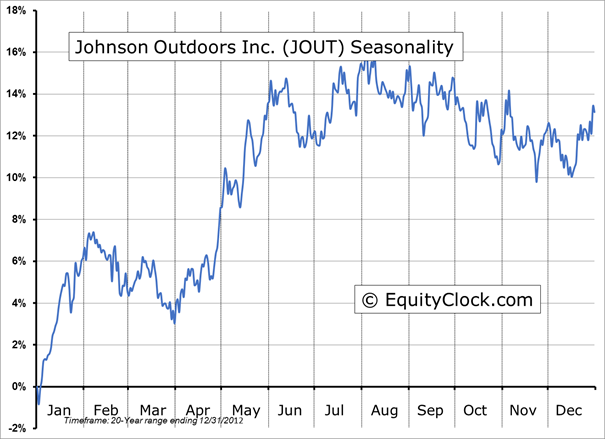

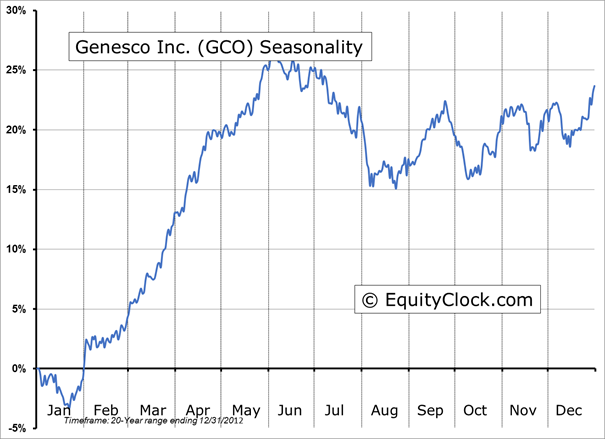

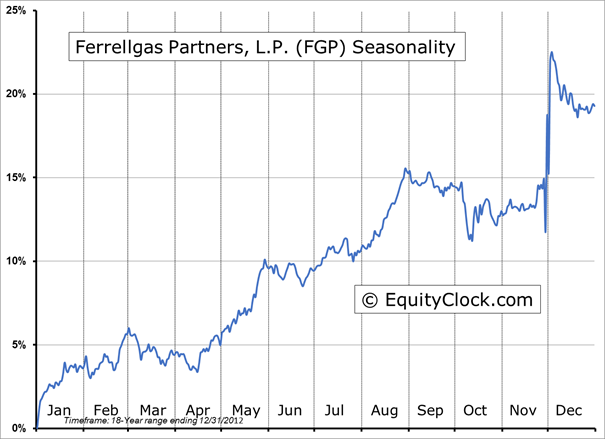

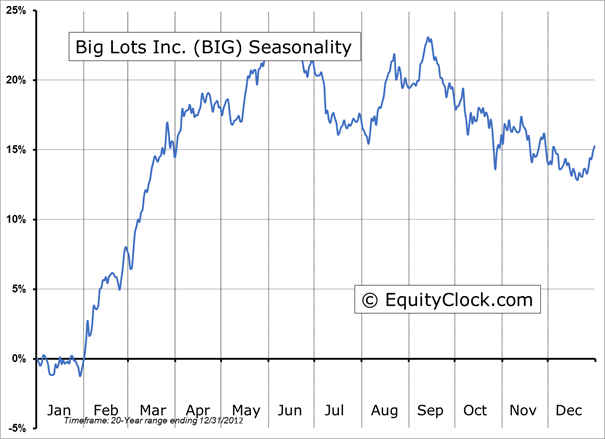

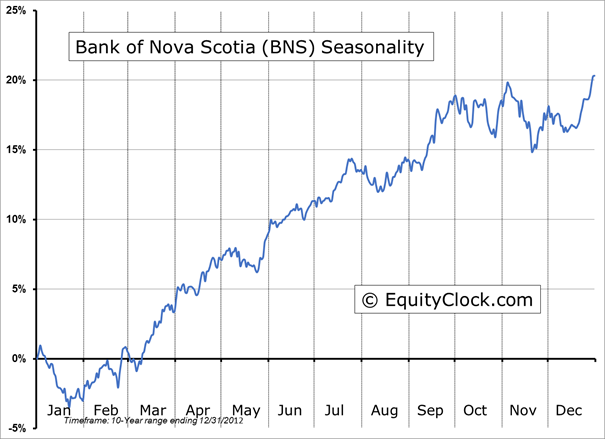

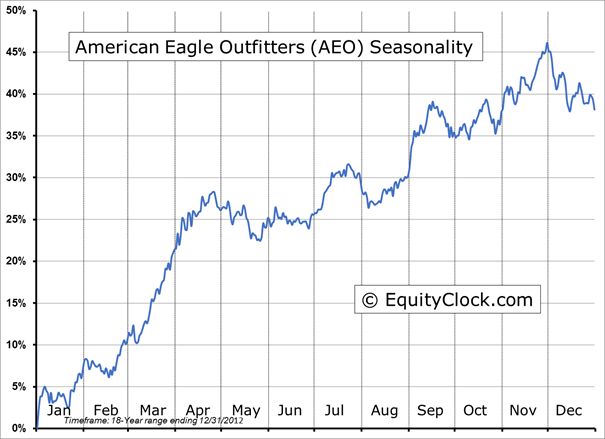

Seasonal charts of companies reporting earnings today:

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.77.

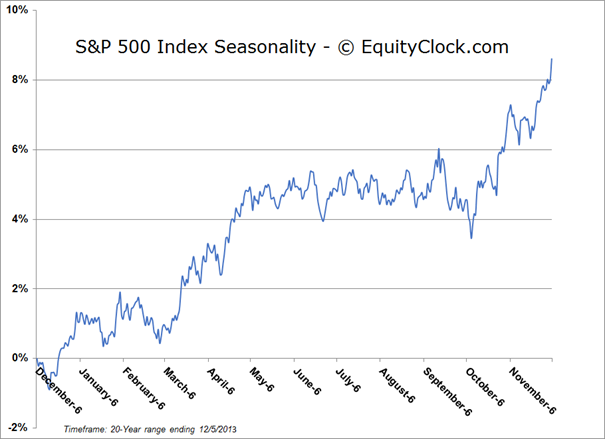

S&P 500 Index

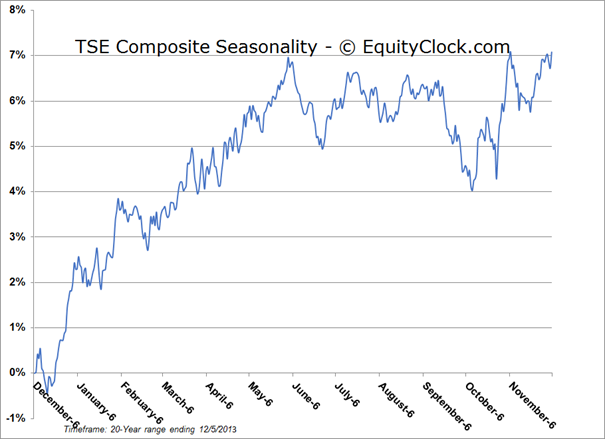

TSE Composite

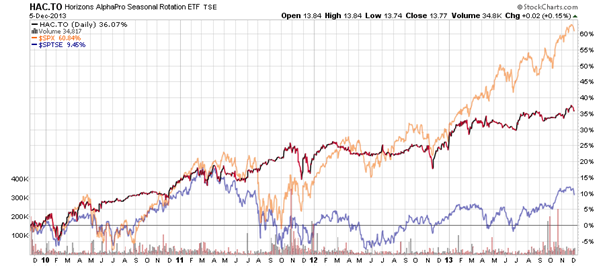

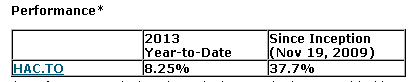

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $13.77 (up 0.15%)

- Closing NAV/Unit: $13.77 (down 0.24%)

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.