Pre-market update:

- Asian markets traded -0.7% lower.

- European markets are trading 0.1% higher.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): Consumer Sentiment (9:55), Farm Prices (3)

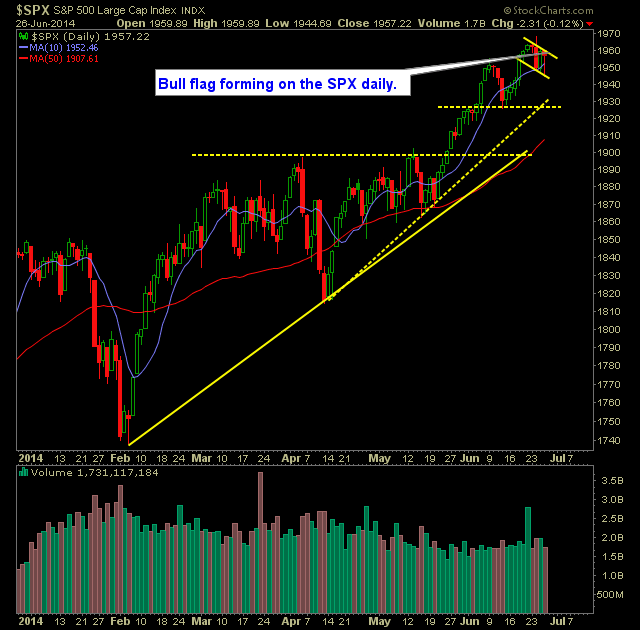

Technical Outlook (SPX):

- Strong recovery yesterday after the initial morning sell-off creating a long lower candle on the daily.

- After the initial sell-off, the dip-buyers once again showed that they are still in full control of this market.

- Concerns could impact the market negatively in the near term due to Fed speak about raising interest rates sooner than expected.

- Today's bounce occurred right at the 20-day moving average.

- Bull flag forming over the last four days on the SPX, which is a good sign of another big push higher being right around the corner.

- Volume continues to come in at average levels.

- VIX came off the intraday highs yesterday to only close 0.4% higher.

- I am looking for SPX to establish new all-time highs in the next 1-3 days.

- It has been over two months since SPX saw a move of more than 1% (4/16/14).

- The rising trend-line off of 4/14/14 currently sits at 1926.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Did not close out any positions yesterday.

- I added two new additional longs yesterday.

- Will look to add 1-2 new long positions today. May also look to take some gains in existing positions.

- Remain long FB at 66.63, YOKU at 22.02, DDD at 56.54, FSLR at 69.69.

- 60% Long / 40% Cash