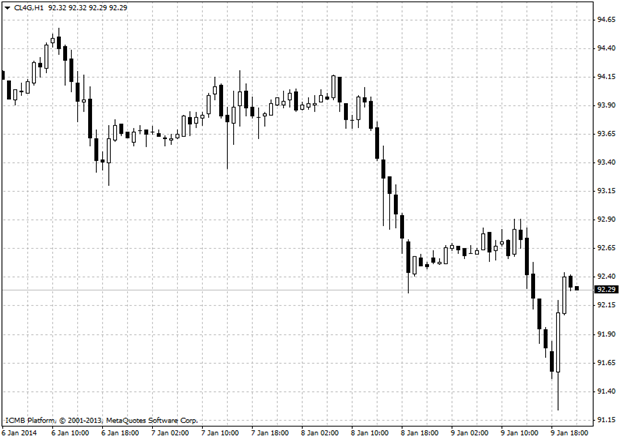

CL

Oil prices edged to 6-month lows on Thursday after Wednesday's U.S. inventory data continued to dampen spirits, while ongoing expectations for Libya to ramp up its output to normal levels also pressured prices lower. Wednesday's supply data continued to pressure prices lower on Thursday, especially figures on refined crude products. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories fell by 2.68 million barrels in the week ended Jan. 3, beating expectations for a decline of 849,000 barrels. Total U.S. crude oil inventories stood at 357.9 million barrels as of last week. The report also showed that total motor gasoline inventories increased by 6.24 million barrels, significantly higher than expectations for a gain of 2.28 million barrels. Meanwhile inventories of distillates, which include diesel fuel and heating oil, rose by 5.83 million barrels compared to market calls for a gain of 1.90 million. The hikes in refined oil products sent prices falling as did Libyan supply concerns. Oil prices have fallen in recent sessions on expectations for Libyan production to approach normal levels and add to global supply.

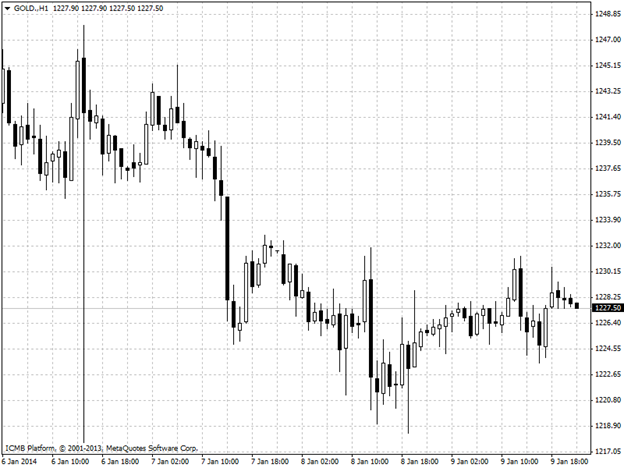

GOLD

Gold futures rose on Thursday after bargain hunters snapped up nicely-priced positions in the yellow metal, especially after uncertainty over Friday's jobs report softened the dollar, which trades inversely with the yellow metal. The Federal Reserve has said it will pay close attention to indicators when deciding the fate of its USD75 billion monthly bond-buying program — Fed bond purchases aim to prop up the economy by suppressing long-term borrowing costs, weakening the dollar as a side effect as long as they remain in effect, thus making gold an attractive hedge. By Thursday, however, the dollar cooled its gains as the rally ended ahead of the Friday release of official U.S. December jobs figures, which gave gold prices room to rise on demand from bottom fishers. Earlier Thursday, the Labor Department said the number of individuals filing for unemployment assistance in the U.S. last week fell by 15,000 to 330,000 from the previous week’s revised total of 345,000. Economists had expected jobless claims to decline by 10,000, though investors were largely eager to see the December jobs data by afternoon trading on Thursday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Friday’s Oil And Gold Analysis

Published 01/10/2014, 05:26 AM

Updated 04/25/2018, 04:40 AM

Friday’s Oil And Gold Analysis

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.